[ad_1]

The Chinese language Folks’s Political Consultative Convention (CPPCC) and the Nationwide Folks’s Congress (NPC) – the so-called Two Classes – will kick off this weekend (beginning on Saturday, March 4 and Sunday, March 5, respectively). Through the one-week lengthy “Two Classes” occasion, the Authorities Work Report delivered by outgoing Premier Li Keqiang and the 2023 fiscal finances proposed by the Ministry of Finance might be mentioned and authorised by the NPC. As a result of this yr’s Two Classes coincide with the once-in-a-decade personnel reshuffling on the State Council in addition to all of the ministries beneath the State Council, they carry particular significance.

The TL/DR abstract of what to anticipate, comes from Bloomberg’s in-house China professional Tom Orlik who writes that the Congress/Convention will see an additional direct focus of financial and monetary energy beneath the CCP:

Whereas the idea amongst many China watchers is that the adjustments characterize an additional tilt away from markets that’s in the end unhealthy for development, current strikes to finish Covid Zero restrictions, increase assist for the property sector and search higher ties with the US counsel that buyers shouldn’t rush to conclusions. The potential optimistic approach of trying on the looming personnel and organizational adjustments is when Xi has a staff round him who he’s conversant in and who he trusts. Maybe there’s just a few extra space to get some good issues finished, to make some pragmatic selections.

For these much less pressed for time, here’s a extra detailed abstract on what to anticipate on the Two Classes, as excerpted from a current observe by Goldman analyst Hui Shan

Three issues to observe: development goal, fiscal finances, and personnel adjustments

On the primary day of the NPC (Sunday, March 5), the sitting premier Li Keqiang will ship his final Authorities Work Report (GWR) which is able to comprise the federal government’s numerous financial targets, most vital of which is the GDP development goal. Goldman’s baseline expectation is a comparatively conservative “round 5%” GDP development goal, though the financial institution forecasts precise GDP development to be 5.5% in 2023. Final yr’s miss on development goal (3.0% precise development vs. “round 5.5%” goal) might trigger policymakers to set a low bar to make sure success this yr as evidenced by provincial governments’ conservative targets for 2023. Traders at present anticipate a development goal within the 5-5.5% vary, and a considerably increased goal (e.g., 6%) introduced over the weekend may very well be market-moving.

The GWR will point out some fiscal plans comparable to official on-budget deficit (GS expects 3.2% vs. 2.8% final yr) and native authorities particular bond (LGSB) quota (GS expects RMB 4tn vs. RMB 3.65tn final yr). Nevertheless, the extra complete fiscal finances proposal is probably going launched later through the Two Classes. The projected tax income development might inform us concerning the authorities’s expectation on nominal GDP development, the deliberate switch from central to native governments might trace at policymakers’ concern on native governments’ fiscal circumstances and their dedication in controlling native authorities implicit debt, and the government-managed fund income (principally land gross sales income) might give us clues on policymakers’ view on the property sector momentum.

Through the Two Classes, adjustments to Get together and state organizations and reshuffling of State Council and ministerial personnel, which have been deliberate on the Second Plenum throughout February 26-28, might be revealed to the general public and authorised by the NPC. It has been reported within the media that the monetary regulatory authority could also be moved to a resurrected Central Monetary Work Fee (which was first established in 1998 within the aftermath of the Asia Monetary Disaster and abolished in 2003) led by Ding Xuexiang, a Politburo Standing Committee member. The present Monetary Stability and Growth Committee beneath the State Council and led by Liu He might stop to exist. And He Lifeng, a Politburo member, might exchange Guo Shuqing, a Central Committee member, to turn out to be the occasion secretary of the PBOC. If true, these adjustments point out an elevated significance of, and extra occasion management over, the monetary regulatory system.

Past these three key parameters, statements on sector-specific insurance policies could be vital to buyers as nicely. For instance, characterization of the property market, consumption boosting measures, and web rules are price monitoring. Such discussions could also be supplied within the GWR, press conferences with ministers in financial and monetary areas, and/or in official information reviews by Xinhua, Folks’s Day by day and CCTV. Moreover, statements within the GWR concerning Taiwan can also collect market consideration

The place we’re within the post-Covid restoration

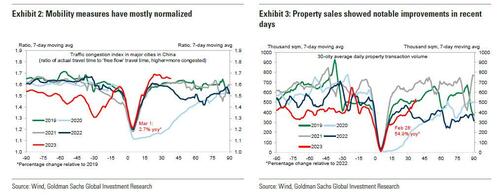

To gauge coverage stance to be unveiled at or after the Two Classes, one should first assess the place China is in its post-Covid financial restoration. Based mostly on GS monitoring of high-frequency information, mobility measures such because the 100-city visitors congestion index have principally normalized (Exhibit 2). Channel checks and anecdotal proof counsel that high-end client markets have been recovering rapidly. Within the property market, the 30-city each day property gross sales information confirmed notable enhancements in current days (Exhibit 3). Equally, the NBS 70-city property costs and the Beke’s 50-city present residence costs confirmed will increase within the newest readings. Nevertheless, it needs to be famous that high-frequency information within the property sector are likely to chubby giant top-tier cities the place fundamentals are extra supportive of a quicker restoration. Smaller lower-tier cities, in contrast, proceed to wrestle resulting from weak demographic and financial fundamentals in addition to dampened value expectations. For a lot of consumption classes, 2022 demand was dramatically beneath development and there’s nonetheless a protracted strategy to go for China’s post-Covid restoration, particularly for providers sectors, mass markets, migrant and younger employees.

4 coverage expectations

As mobility, consumption, and property have begun to point out clear indicators of recovering, the expansion acceleration that the market anticipate this yr is broadly on observe. Consequently, cyclical coverage in mixture needs to be much less stimulative this yr than final yr. Actually, the PBOC has allowed interbank market charges (e.g., DR007) to extend to the extent of coverage charges (e.g., 7-day OMO), an indication of coverage normalization after very free liquidity circumstances throughout and after the Shanghai lockdown final yr (Exhibit 4).1 Regardless of increased headline official on-budget deficit and LGSB quota that can possible be launched on the primary day of the NPC, Goldman expects the augmented fiscal deficit, a extra complete gauge of fiscal stance, to slim by 1.5% of GDP from 2022 to 2023.

However this isn’t to say that coverage will tighten in the identical abrupt and important method because it did in 2020H2. Exactly as a result of the withdrawal of coverage assist and the imposition and tightening measures have been an excessive amount of too quick again then, policymakers might be extra affected person this time round, particularly when the potential draw back danger from weaker exterior demand stays appreciable and confidence stays fragile. Although the February PMIs have been a lot stronger than anticipated and property costs in top-tier cities look like edging increased once more, a significant withdrawal of coverage assist is unlikely till a minimum of Q3 this yr.

Policymakers have been reiterating the message of enhancing home demand and boosting non-public consumption since final December’s Central Financial Work Convention (CEWC). Nevertheless, the chance of serious nationwide money handouts stays very low. Between finances constraints and cultural preferences, the federal government will proceed the previous method of utilizing infrastructure funding to stimulate the financial system when wanted. Consumption-boosting measures will possible keep inside the realm of tax subsidies for autos and residential home equipment, accelerated rental housing development, and small-scale native consumption coupons.

Though the exact coverage stance introduced at or after the Two Classes is troublesome to foretell, particularly with the once-in-a-decade reshuffling on the State Council and in numerous ministries, there ought to successfully be a “coverage put” for a minimum of 5% development this yr. With GDP development solely reaching 3% final yr and with 2023 marking the primary yr of the brand new premier’s 10-year time period, the federal government’s tolerance for beneath 5% GDP development this yr might be low.

Two key dangers, one exterior and one home

Essentially the most important draw back danger to China’s 2023 financial development is exports. Chinese language exports fell sharply in late 2022 (-9.9% yoy in December), in keeping with the expertise of different export-oriented economies comparable to South Korea and Taiwan and suggesting exterior demand has certainly been softening. Latest media reviews additionally highlighted empty containers at ports and dwindling abroad orders. Goldman’s baseline expectation is flat actual items exports this yr as its world staff initiatives no recession within the US or Europe over the subsequent 12 months. Nevertheless, if exports change into lots weaker than anticipated, policymakers may have to spice up financial/fiscal easing and infrastructure constructing once more. Given the extra restricted fiscal house after final yr’s efforts to stabilize the financial system, further infrastructure funding would possible be financed via coverage banks and industrial banks as an alternative of presidency debt.

Onshore conversations counsel enterprise and client confidence stays the principle danger to development domestically. With out confidence, the post-Covid restoration will not be sustainable as non-public corporations are reluctant to take a position and households are reluctant to spend. The current message from the Central Fee for Self-discipline Inspection in opposition to “monetary elites” and “hedonism and extravagance” has raised issues that anti-corruption marketing campaign might intensify this yr. Therefore, communications from the highest financial and monetary policymakers within the new authorities after the Two Classes might be significantly vital to observe.

There are definitely different dangers within the financial system. US-China relations have weighed on investor sentiment after the balloon incident, US Secretary of the State Antony Blinken suspending his journey to China, and media reviews of China contemplating supplying arms to Russia. We might even see extra detrimental headlines within the coming months. Nevertheless, it is a structural situation and the influence on financial development this yr nonetheless appears restricted up to now. Monetary dangers from small and rural banks and native authorities financing automobiles (LGFV) might re-emerge later this yr if NPLs are acknowledged and rates of interest rise after coverage normalization. However such dangers could be managed and the Zunyi LGFV bond restructuring in January was an instance. Dangers of coverage overtightening additionally seem low as a result of expertise of 2020/2021, and as mentioned earlier, policymakers might be extra affected person this yr.

Total, China’s post-Covid restoration has simply began with some encouraging indicators, setting the stage for Goldman’s forecast of 5.5% full-year GDP development (and 6.5% yoy in This fall) which is above consensus (Bloomberg consensus 5.2%). The federal government is more likely to stay affected person in withdrawing assist, and to face by to ease within the occasion that restoration disappoints or exports fall quick. After the sturdy February PMI print, the market might be specializing in onerous information comparable to January/February commerce (to be launched on March 7) and retail gross sales (to be launched on March 15). If these onerous information shock meaningfully to the upside, the risk-on market actions that includes stronger RMB and better fairness/charges/commodities will proceed.

Loading…

[ad_2]