[ad_1]

Weekly indicators from Lewis-Mertens-Inventory (NY Fed) Weekly Financial Indicators, and Baumeister, Leiva-Leon and Sims WECI and Woloszko (OECD) Weekly Tracker via 2/4/2023, launched in the present day, in contrast in opposition to month-to-month GDP.

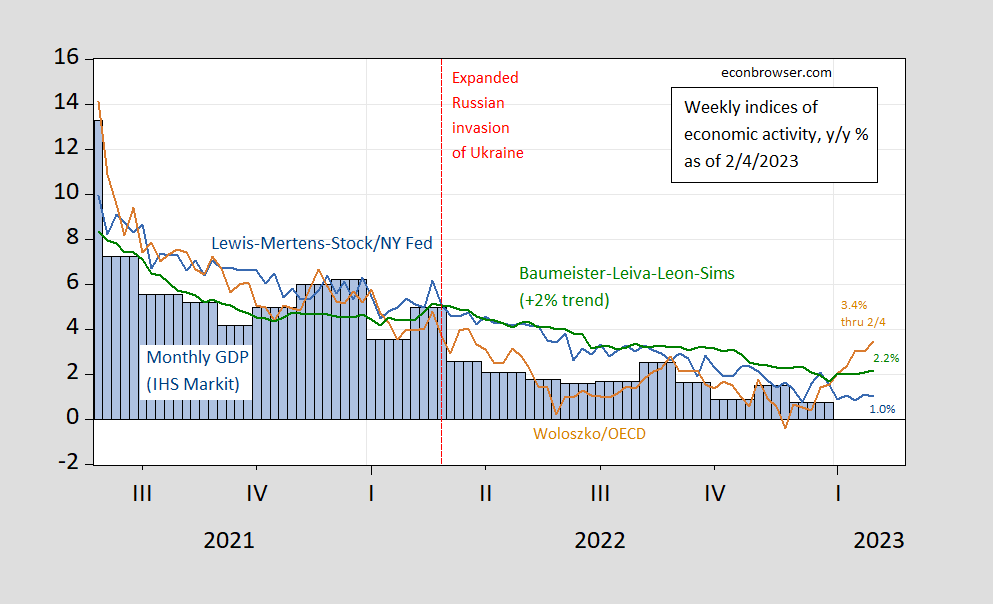

Determine 1: Lewis-Mertens-Inventory Weekly Financial Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Financial Situations Index for US plus 2% pattern (inexperienced), and IHS Markit month-to-month GDP (blue bars). Supply: NY Fed through FRED, OECD, WECI, IHS Markit/S&P World, and creator’s calculations.

There’s been a pointy rebound within the Weekly Tracker, which had dipped into detrimental for the week ending 11/26, now exceeding the WEI (1.0%) and WECI+2% (2.2%). The WEI studying for the week ending 2/4 of 1.0% is interpretable as a y/y quarter development of 1.0% if the 1.0% studying have been to persist for a complete quarter.The Baumeister et al. studying of 0.16% is interpreted as a 0.16% development fee in extra of long run pattern development fee. Common development of US GDP over the 2000-19 interval is about 2%, so this means a 2.16% development fee for the 12 months ending 2/4. The OECD Weekly Tracker studying of three.4% is interpretable as a y/y development fee of three.4% for 12 months ending 1/14. The 95% interval for the US weekly tracker is [1.9%, 4.9%].

[ad_2]