[ad_1]

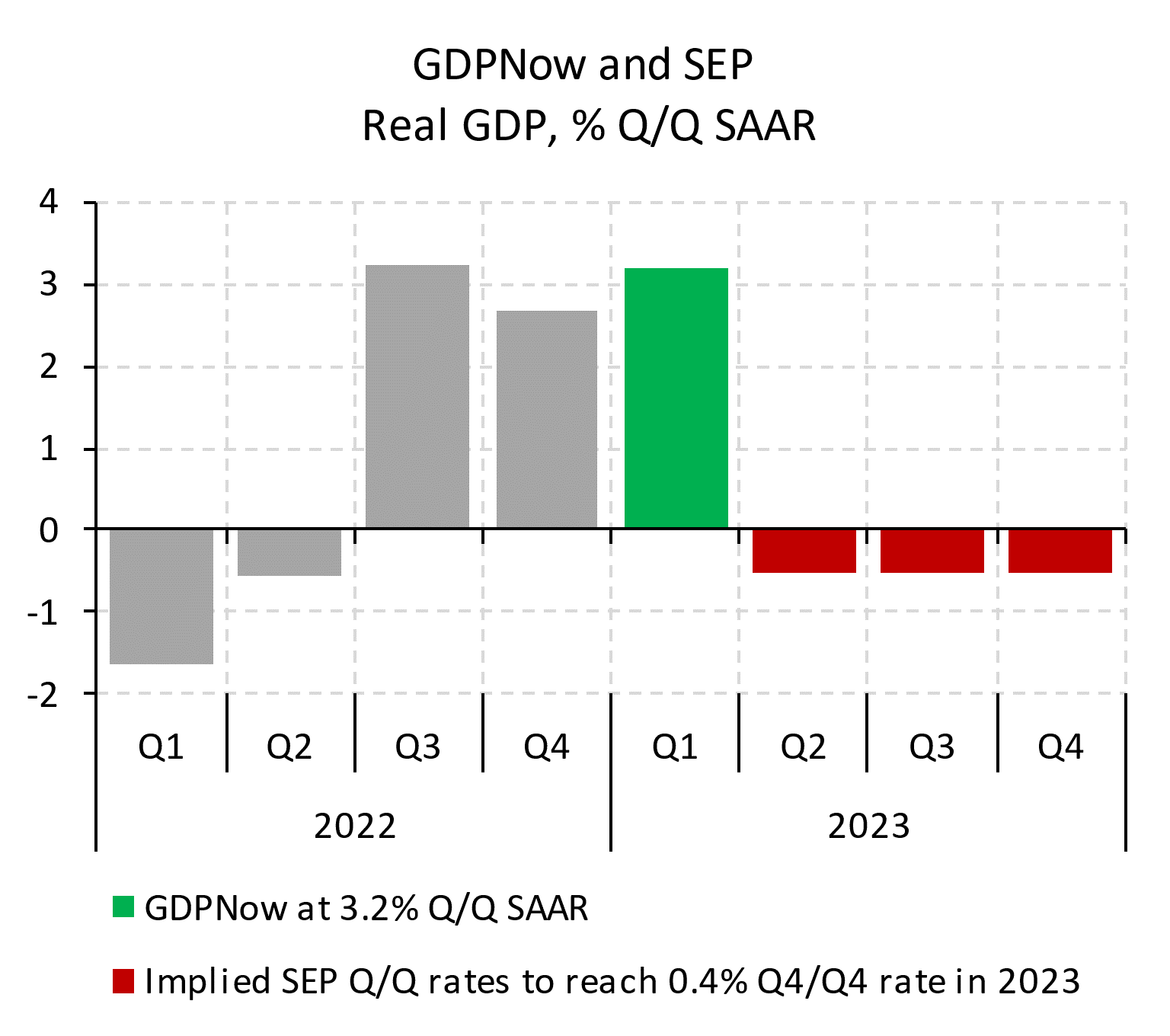

Right here’re some indicators on the weeky frequency for the actual economic system. Bloomberg notes that GDPNow (3/16) mixed with SEP median of 0.4% development charge for 2023 implies 3 quarters of adverse GDP development beginning in Q2. The most recent knowledge under relate to late in Q1.

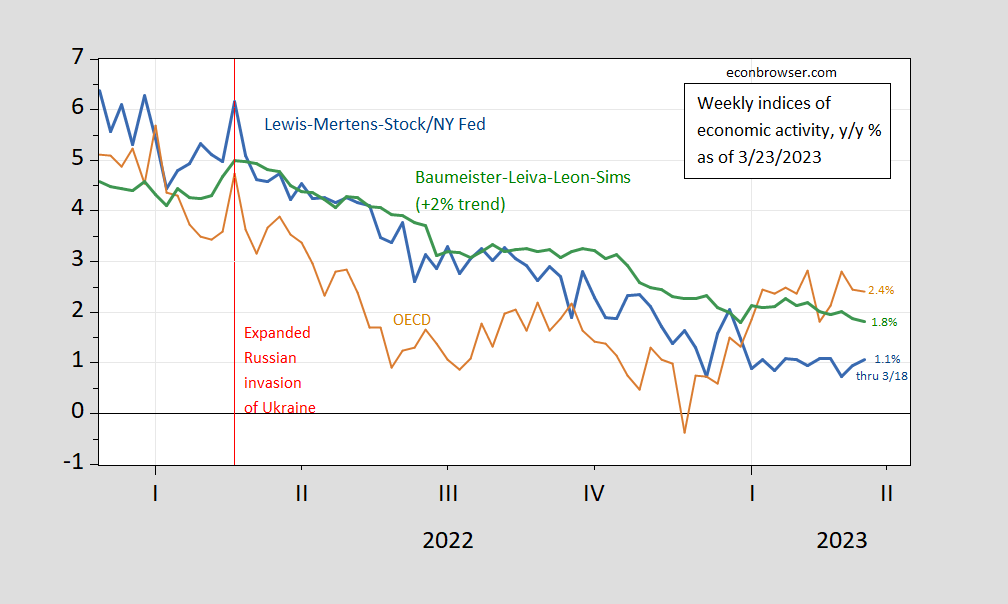

Determine 1: Lewis-Mertens-Inventory Weekly Financial Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Financial Situations Index for US plus 2% pattern (inexperienced). Supply: NY Fed by way of FRED, OECD, WECI, and writer’s calculations.

The Weekly Tracker continues to learn sturdy development, for the week ending 3/18, exceeding the WEI (1.1%) and WECI+2% (1.8%). The WEI studying for the week ending 3/18 of 1.1% is interpretable as a y/y quarter development of 1.1% if the 1.1% studying had been to persist for a complete quarter.The Baumeister et al. studying of -0.02% is interpreted as a -0.02% development charge in extra of long run pattern development charge. Common development of US GDP over the 2000-19 interval is about 2%, so this suggests a 1.8% development charge for the yr ending 3/18. The OECD Weekly Tracker studying of two.4% is interpretable as a y/y development charge of two.4% for yr ending 3/18.

Recall the WEI depends on correlations in ten sequence out there on the weekly frequency (e.g., unemployment claims, gas gross sales, retail gross sales), whereas the WECI depends on a blended frequency dynamic issue mannequin. The Weekly Tracker — at 2.4% — is a “massive knowledge” method that makes use of Google Tendencies and machine studying to trace GDP. As such, it doesn’t depend on precise financial indices per se.

Pawel Skrzypczynski does the work on what the GDPNow calculation plus median SEP implies:

Supply: Pawel Skrzypczynski. [corrected 3/24]

[ad_2]