[ad_1]

Immediately, we’re lucky to current a visitor contribution written by Paweł Skrzypczyński, economist on the Nationwide Financial institution of Poland. The views expressed herein are these of the writer and shouldn’t be attributed to the Nationwide Financial institution of Poland.

We current an replace of the jobs-workers hole mentioned in earlier posts: [1], [2], [3].

Current BLS releases “The Employment Scenario – January 2023” and “Job Openings and Labor Turnover – December 2022” enable us to replace the jobs-workers hole and the enterprise cycle indicator primarily based on it. For January 2023 we assume that job openings degree declined to 10.7 mn from December 2022 degree of 11 mn, which might be in line what high-frequency information by Certainly suggests (https://www.hiringlab.org/information/).

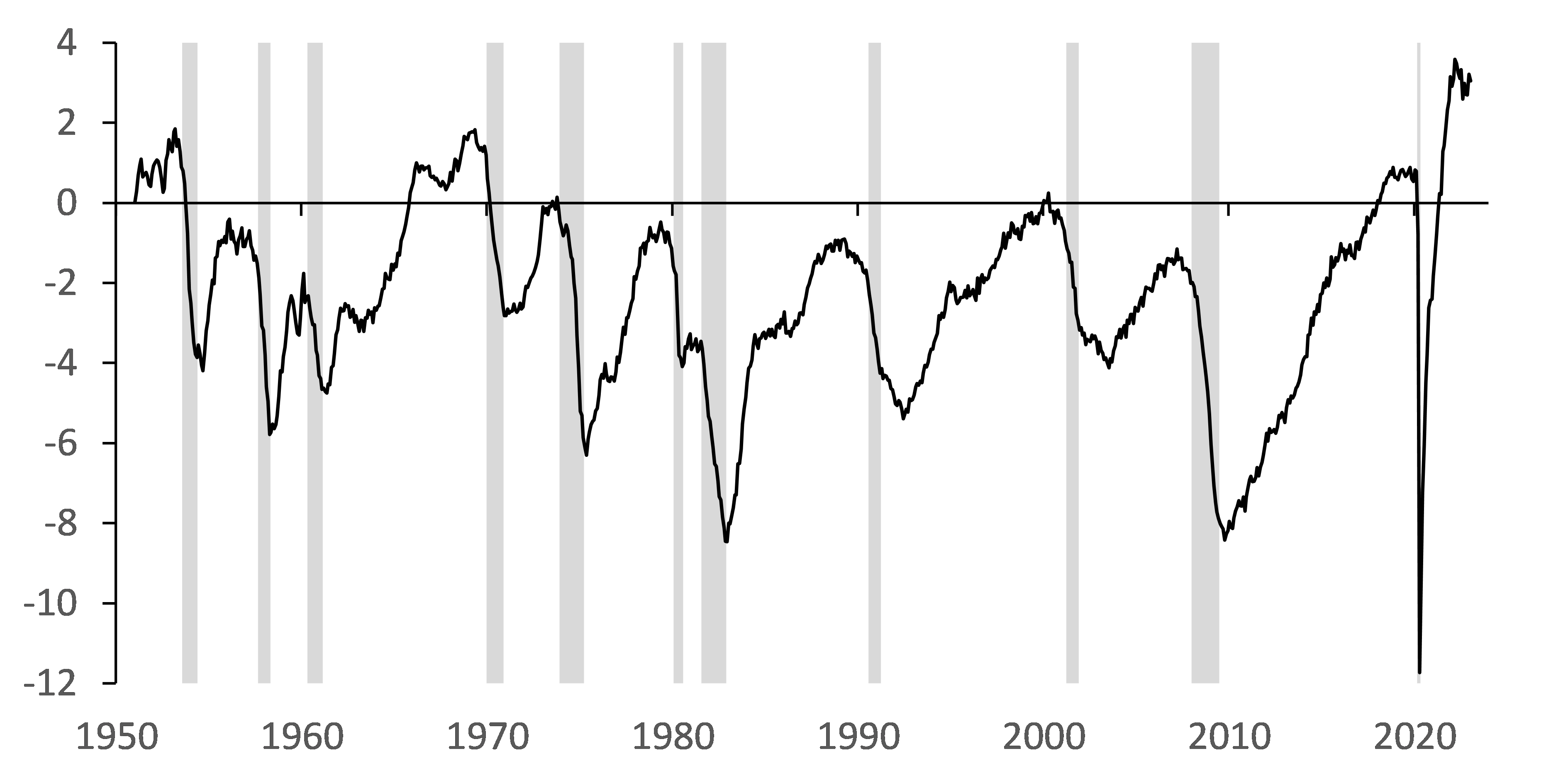

In January 2023 the jobs-workers hole was at 3.0% or 5.0 mn, down from December 2022 by 0.2 pp or 0.3 mn, nevertheless December 2022 m/m modifications of the hole had been 0.5 pp or 0.9 mn, respectively.

Determine 1. Jobs-Staff Hole (P.c)

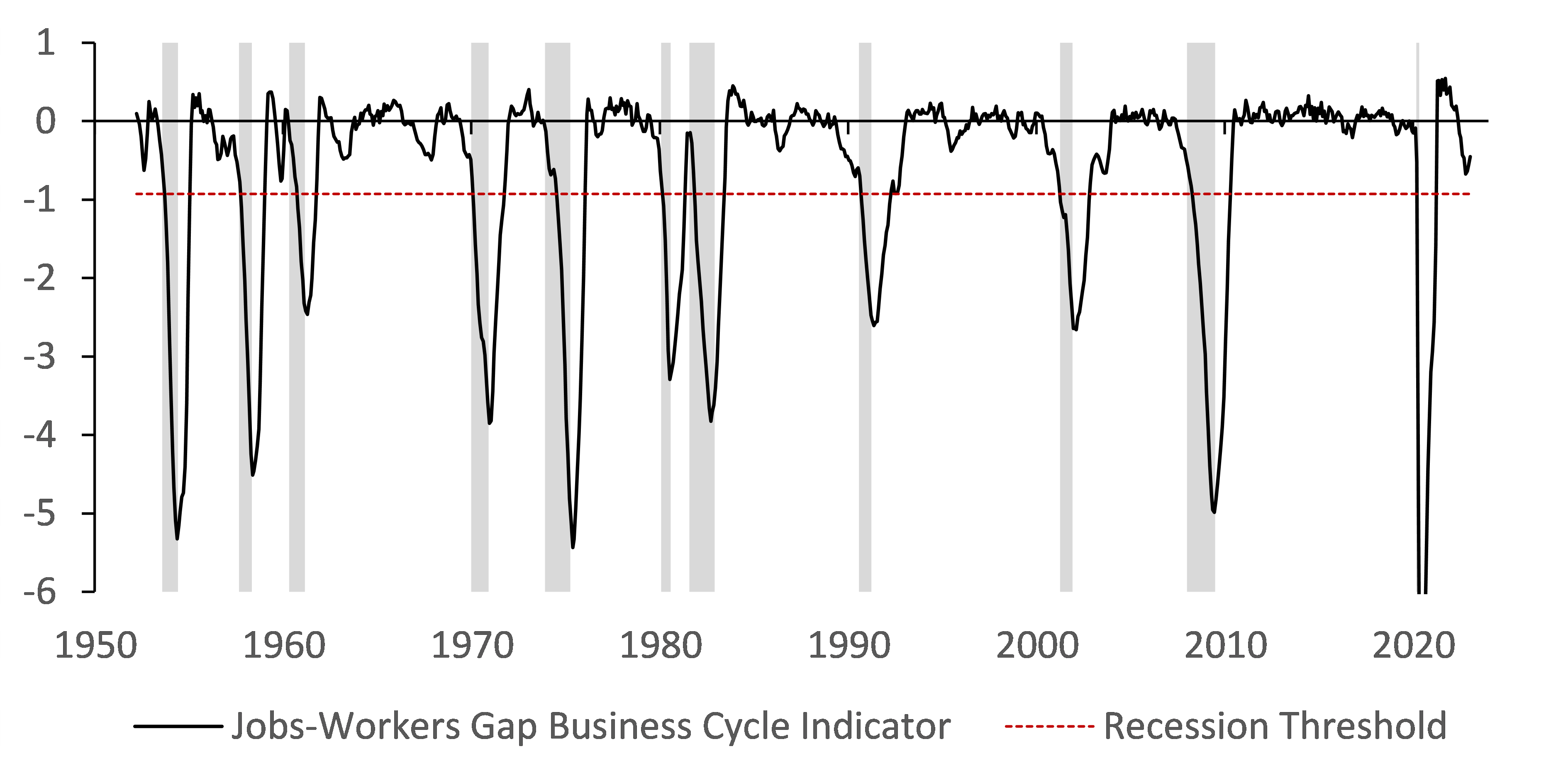

With this new information the jobs-workers hole enterprise cycle indicator (JWGBCI) elevated to -0.45 pp in January 2023 from -0.56 pp in December 2022 and -0.64 pp in November 2022, remaining above the recession threshold of -0.93 pp. Recall the indicator makes use of a smoothed hole, particularly we calculate the change of the three-month shifting common of the jobs-workers hole relative to its most throughout earlier twelve months.

Determine 2. Jobs-Staff Hole Enterprise Cycle Indicator (Proportion Factors)

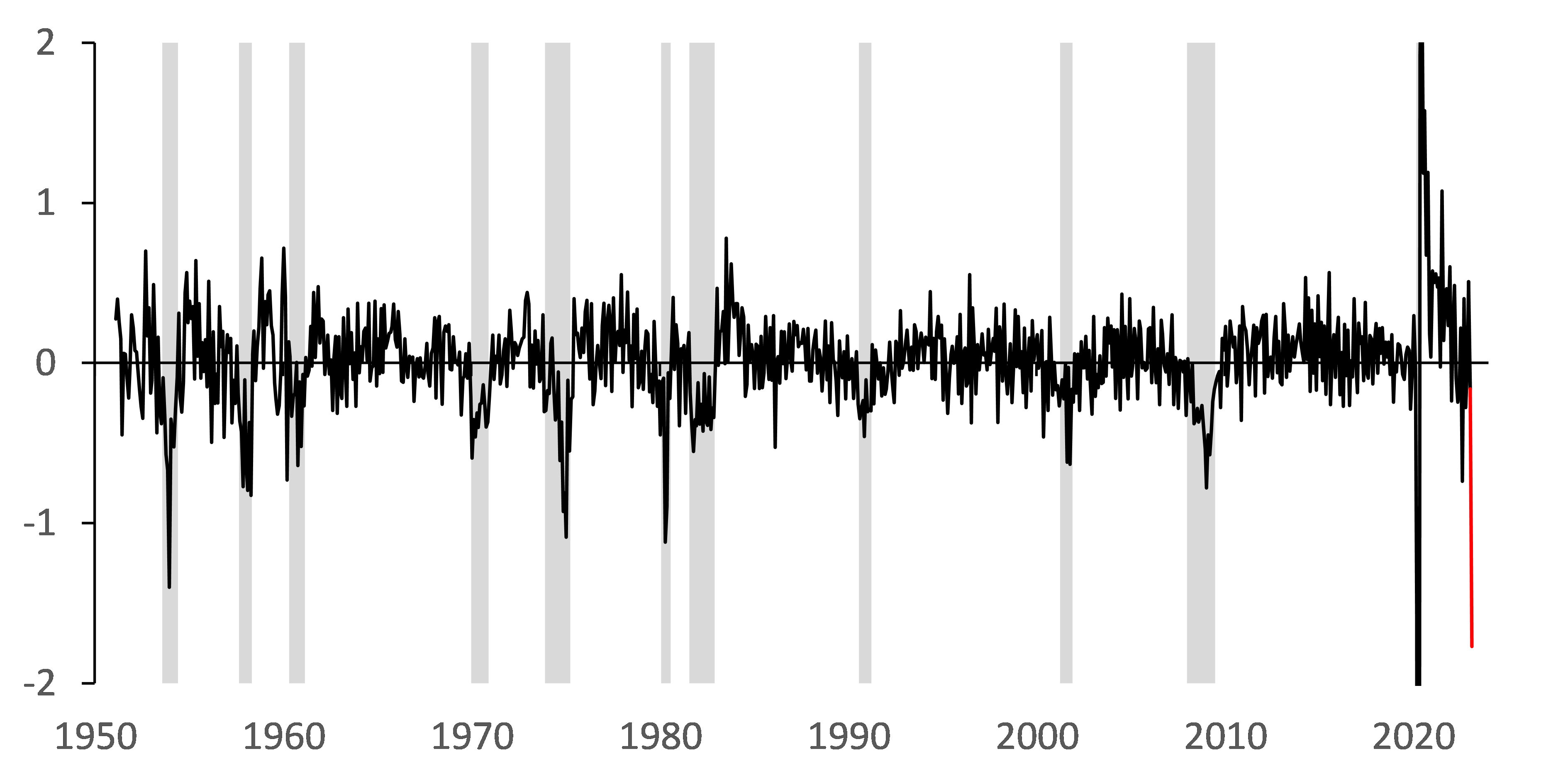

What magnitude of m/m change within the jobs-workers hole could be wanted in February 2023 to make a recession name? The roles-workers hole (not smoothed) would want to break down to 1.27% from 3.04% in January, that’s 1.77 pp which corresponds to three.7 customary deviations of historic volatility. Determine under presents this alteration (marked purple) in historic perspective. Such a giant change appears somewhat unlikely, as it could most certainly imply deep contraction of employment or job openings, or each in m/m phrases as of February.

Determine 3. Jobs-Staff Hole 1-Month Change (Proportion Factors)

Conclusion of this replace stays much like earlier ones. Current readings of the jobs-workers hole and the enterprise cycle indicator primarily based on it counsel that labor market stays tight and resilient to financial coverage tightening.

This put up written by Paweł Skrzypczyński.

[ad_2]