[ad_1]

US financial institution shares had been larger by noon buying and selling on Monday as traders appeared previous the measures to shore up the banking system to deal with the Federal Reserve’s upcoming determination on US rates of interest.

The KBW Nasdaq Financial institution index rose 2.8 per cent, with heavyweights corresponding to JPMorgan Chase and Citigroup up 1.9 per cent and 1.7 per cent respectively. Nonetheless, First Republic, the lender on the centre of final week’s issues, was down 14.6 per cent.

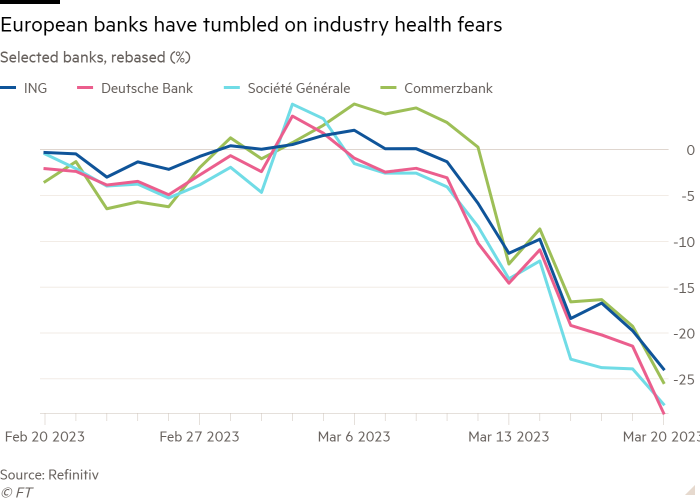

The beneficial properties had been mirrored in Europe, the place the Euro Stoxx Banks index rose 2.9 per cent, as most of the area’s largest names recovered from early declines. UBS erased losses of greater than 14 per cent as traders weighed its takeover of Credit score Suisse, to commerce as a lot as 2.3 per cent larger.

Nonetheless, Société Générale was down 0.7 per cent and shares in Credit score Suisse dropped 51.5 per cent as its shareholders confronted a heavy writedown in worth from the UBS takeover.

However the wider benchmark indices moved larger. The blue-chip S&P 500 rose 1 per cent and the tech-heavy Nasdaq gained 0.3 per cent. In Europe, the Stoxx 600 index rose 1.2 per cent whereas the FTSE 100 was up 1.2 per cent and the Cac 40 in Paris added 1.6 per cent.

“The [Credit Suisse/UBS] deal on the margin diminished the systemic threat of banks failing,” stated Emmanuel Cau, head of European fairness technique at Barclays. He added that there was “little conviction out there . . . it’s a bounce attributable to threat to the banking sector and the financial system being diminished”.

Traders’ focus is on the Fed’s assembly on Tuesday and Wednesday, through which its newest rate of interest determination will probably be determined. Traders are pricing in a 55 per cent probability of a 0.25 share level rise, and a forty five per cent probability of no change.

“A lot will rely upon whether or not a modicum of stability returns to monetary markets, particularly for regional banks,” stated analysts at ING. “In a super world, the Fed would separate financial coverage (inflation requiring extra hikes) and monetary stability (liquidity provision to banks). In apply, a hike may irritate monetary stability issues.”

Goldman Sachs stated it anticipated the outbreak of stress within the banking sector to constrain central banks’ plans to maintain elevating charges of their long-running battle with inflation.

The funding financial institution trimmed its eurozone financial progress forecast by 0.3 share factors and stated it anticipated the European Central Financial institution to boost charges by 1 / 4 of some extent in Might. It beforehand anticipated a half level. It additionally now not anticipated the Financial institution of England to boost charges in Might.

One ingredient of the rapid-fire takeover of Credit score Suisse that’s fuelling jitters amongst debt traders is the deal’s wipeout of $17bn of the financial institution’s bonds. Swiss regulator Finma demanded on Sunday that SFr16bn ($17bn) of Credit score Suisse’s extra tier 1 (AT1) bonds, a kind of financial institution debt designed to take losses throughout a disaster, be written right down to zero as a part of the rescue cope with UBS. The Swiss transfer forged doubt on the hierarchy of claims within the occasion of a banking failure. It was the most important writedown thus far of AT1 debt.

“There are two classes from the Credit score Suisse story,” stated Charles-Henry Monchau, chief funding officer at Syz Financial institution. “Once you’re a minority shareholder of a systemic financial institution, your voice doesn’t rely in any respect. And also you thought AT1 bonds had been senior to fairness — you had been incorrect. It’s a giant stress available on the market.”

There have been heavy declines in Asia, together with a 7.1 per cent fall in HSBC shares in Hong Kong. “It’s a wake-up name to traders that AT1 bonds carry actual dangers of being written off in excessive situations, which can also be the aim of getting such bonds,” stated Gary Ng, senior economist at Natixis in Hong Kong. “The transfer will in all probability set off some sell-offs and threat rebalancing from bond traders and wealth administration product holders.”

He added: “That is an evaluation that lots of people are doing as we speak — establishments, banks and personal financial institution purchasers that each one maintain this.”

The yield on the 10-year US Treasury be aware rose 0.07 share factors to three.47 per cent. The yield on the two-year be aware was up 0.1 share factors to three.98 per cent.

The yield on 10-year German Bunds was down 0.2 share factors at 2.11 per cent, and the yield on the two-year be aware fell 0.9 share factors to 2.34 per cent.

Asian shares fell. Japan’s Topix shed 1.5 per cent, whereas South Korea’s Kospi dropped 0.8 per cent and Hong Kong’s Cling Seng index declined 2.7 per cent.

Brent crude, the worldwide benchmark, and WTI, the US equal, fell 0.4 and 0.6 per cent respectively, to their lowest value since December 2021.

Extra reporting by Primrose Riordan in Hong Kong

[ad_2]