[ad_1]

By Nour Al Ali, Bloomberg Markets Dwell reporter and strategist

Whereas there are numerous causes to be bullish on oil, a contrarian view indicators costs could fall in coming months as long as actual rates of interest preserve rising.

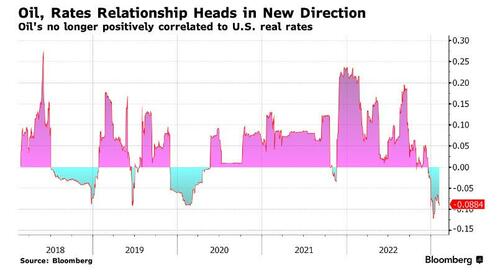

The breakdown within the relationship between crude and actual rates of interest could lead to a lower in oil costs. Check out the correlation between WTI contracts and US 10-year actual charges (ie the 10-year yield adjusted for inflation), measured on a 120-day foundation. The connection between the 2 belongings has weakened after it was constructive final yr, when vitality was the primary driver of inflation and central banks stored elevating charges in an effort to manage worth pressures.

Traders at the moment are involved about larger charges impacting demand for vitality, resulting in a provide surplus that might doubtlessly go away extra oil on the market than consumers need. Whereas there’s a rising refrain that believes the Fed will pivot, policymakers have stored up their hawkish requires additional fee will increase regardless of a latest moderation in inflation. It’s because inflationary pressures have change into extra ingrained in every day life and are not solely pushed by short-term components.

There are many different components which are influencing oil costs, primarily OPEC+’s management over provides to take care of market stability, and a rise in anticipated demand out of China. Though merchants have already taken these bullish components into consideration, the chance stays that rising oil costs could also be susceptible to rising rates of interest. The “don’t struggle the Fed” idea could change into more and more related on this sector of the market.

Loading…

[ad_2]