[ad_1]

Authored by Simon White, Bloomberg macro strategist,

The outlook for credit score is more and more at odds with the tender(er)-landing situation that has been gaining credence. Credit score markets and retail shares are amongst property that look most susceptible to draw back.

US banks have reported tightening lending requirements throughout the board within the newest Fed Senior Mortgage Officer Survey launched yesterday.

Banks reported tightening their requirements on C&I loans to all sizes of corporations over the fourth quarter. Many banks additionally reported tightening mortgage covenants and collateralization necessities.

This newest survey confirmed the development that banks wish to lend much less and debtors wish to borrow much less. The chart under reveals this may proceed, as when banks tighten requirements, demand for loans falls.

The survey reported loan-standard tightening in business real-estate, residential real-estate and shopper loans, together with bank cards. Credit score-card lending has surged for the reason that pandemic making up for the shortfall in lower-income households who’ve probably used up most of their pandemic financial savings.

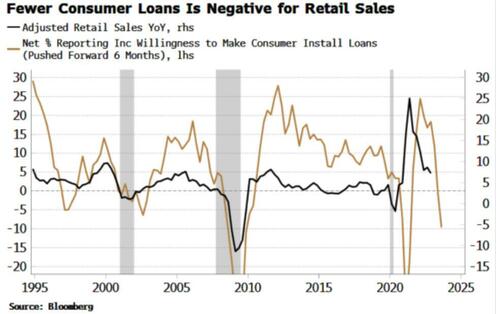

The tightening in shopper loans factors to continued weak spot in retail gross sales. This leaves the retail sector, probably the greatest performing this 12 months, wanting uncovered to correcting decrease.

Loading…

[ad_2]