[ad_1]

Yves right here. Finance folks will instantly acknowledge that exterior of loan-sharking, lenders displaying income on defaulted loans is remarkable. But my goodness, Uncle Sam is doing an excellent job of kneecapping pupil debtors who’ve hassle repaying. As this put up explains, that is predatory lending in motion.

Initially revealed at Indignant Bear

I’ve recognized Alan Collinge of Pupil Mortgage Justice for a number of years now. He has been prompting some sort of aid for individuals who won’t ever be capable to payback these loans or are in default.

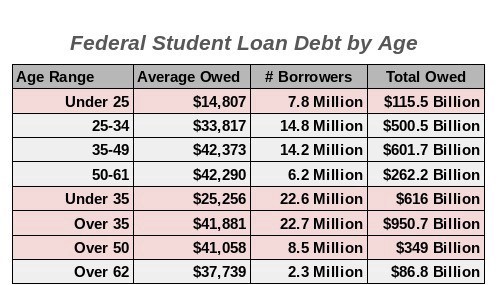

The knowledge within the chart above is from EOY 2020 and the Federal Pupil Mortgage Portfolio, Federal Pupil Assist, “Portfolio by Age” The Normal Hyperlink and which Chart (hyperlink) the info is taken from to again up my numbers can be above.

For the over 62 tack on one other $20 billion for EOY 2022. 300- thousand extra individuals are on this class. The typical period of time to pay again was 15 -17 years at $250/month. From over 50 and above, these money owed won’t ever be paid 100%.

A lot of that is Joe Biden’s fault from his opposing Pupil Mortgage aid since 1990.

“The Authorities makes a Revenue on Defaulted Pupil Loans,” Pupil Mortgage Justice Org., Alan Collinge

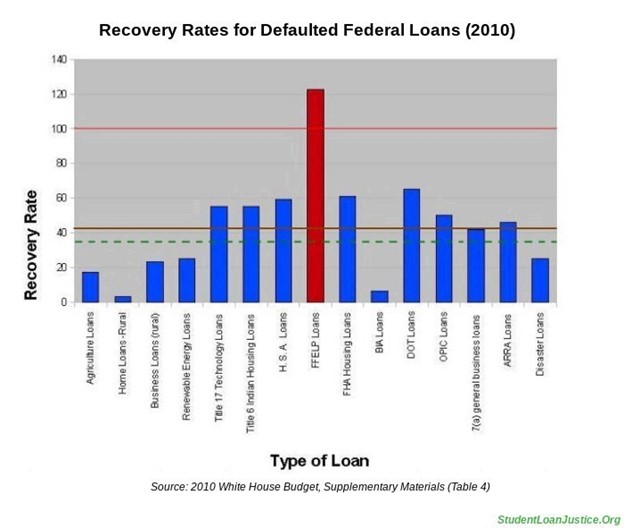

In 2010, we discovered the federal authorities was making a revenue, not a loss, on defaulted pupil loans. This can be a declare no different lender for every other sort of mortgage (together with governmental loans) could make. Newer White Home Funds information reveals that that is nonetheless true right this moment The profitability of pupil mortgage defaults is actually far higher right this moment than in 2010. Making a revenue on defaulted loans is a defining attribute of a predatory lending system. Residents in every single place must be involved.

The 2010 White Home Funds reported a restoration charge on defaulted FFELP (federally assured) loans of 122%. All different loans the federal government made or insured that yr had a median restoration charge of about 34%. No different mortgage varieties exceeded a 100% restoration charge, and even got here shut. On the time, the massive majority of all federal pupil loans have been of this class, the place the federal government doesn’t make, however reasonably assure.

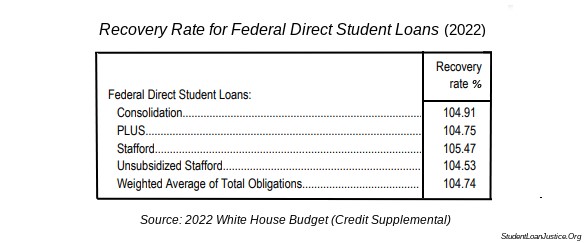

Newer White Home Funds Knowledge (2022), reveals that this pattern has continued for the Direct Mortgage Program (the place the federal government makes and holds the loans, reasonably than simply assure them), with a median restoration charge of over 100%. Much like the 2010 information, pupil loans have been the one sort of mortgage that may very well be discovered within the federal portfolio for which the restoration charge exceeded 100%.

Restoration Fee for Defaulted, Direct Pupil Loans, 2022

Importantly: Not like the older, FFELP (federally assured) loans, Direct Mortgage recoveries are way more worthwhile than FFELP loans as a result of the curiosity is constructed into Direct Loans.

For defaulted FFELP loans, the federal government, makes no curiosity on the mortgage previous to default. The declare quantities to the complete steadiness of the mortgage on the time of default, which incorporates each unpaid principal and curiosity.

For Direct Loans the federal government paid a a lot smaller principal when the mortgage was initially made. Whereas the worth of the mortgage on the time of default sometimes consists of a considerable amount of curiosity and accrues to the federal government reasonably than a personal lender. The restoration charge for each is calculated by evaluating the quantity recovered to the steadiness of the mortgage on the time of default.

So whereas the restoration charge for Direct loans are decrease than that for defaulted FFELP loans, the profitability of those recoveries is inherently far, far higher. There isn’t a different lending system in existence on this nation the place the lender can declare to be making a revenue on defaults.

Pupil Mortgage Portfolio Accumulate Curiosity from Default

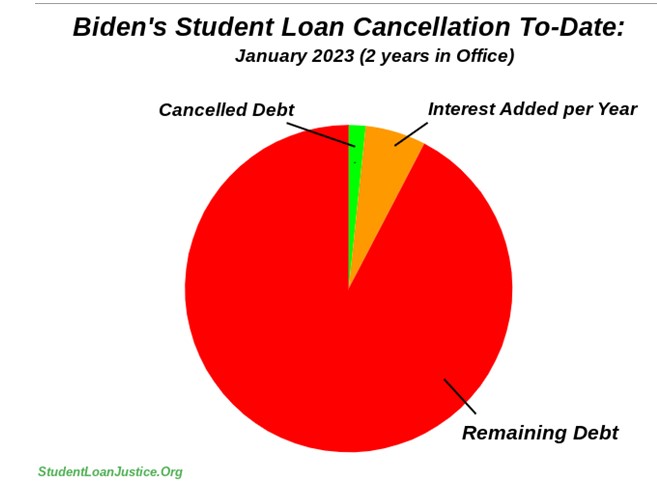

A mortgage portfolio which accrues practically $100 billion in annual curiosity, the place loans in default are literally worthwhile and only a few loans are being cancelled as is the case with the federal pupil mortgage program. It’s actually inconceivable to lose cash on these loans. This system can solely be being profitable from the defaults and a variety of it. All of this revenue for loans, President Lyndon Johnson mentioned can be “freed from curiosity” when he signed the Greater Training Act into regulation in 1965.

Default income depicted . . . .

What’s most annoying: The default charge for folks leaving faculty in 2004 is estimated to be 40%, and is probably going a low determine for the reason that estimates have been primarily based on voluntary surveys. Many debtors in default are inherently unlikely to fill out. The category of ’04, nonetheless, was solely borrowing a couple of third of what college students are borrowing right this moment. Furthermore, even earlier than the pandemic, 85% of all federal pupil mortgage debtors have been underwater (ie not paying, or paying however with an rising steadiness) on their loans, and practically 60% weren’t making funds.

With 3 years of practically common non-payment as a result of pandemic, this non-payment charge will escalate when compensation is once more demanded from the debtors. It isn’t in any respect unreasonable to count on that 70% or extra of those debtors will wind up in default on their federal loans when the system is turned again on. The scholar mortgage default is many multiples of the sub-prime residence mortgage default charge of 20% compared. So, by all rational metrics, this lending system is in catastrophic failure.

Seventy P.c of Debtors can be in Default

We consider it to be in no way unreasonable to count on that 70% or extra of debtors will wind up in default on their federal loans when the lending system is turned again on.

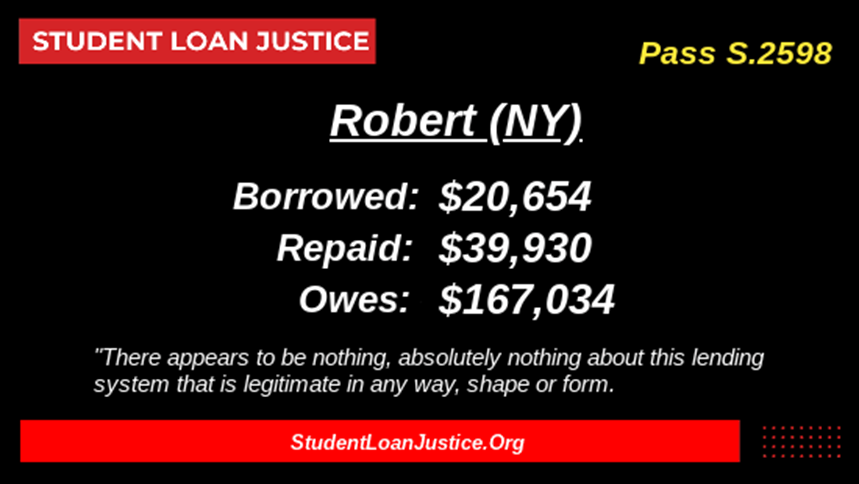

Unprecedented, and unwarranted of each chapter rights, and statutes of limitations lie on the core of the coed mortgage drawback. Within the absence of those protections, the lending aspect (as much as and together with the Division of Training) can- and does use this energy to extract huge sums of wealth ruining the lives of debtors, (one instance beneath). The human price of the predatory lending system has been large. The hurt that’s poised to be exacted on the citizenry is incalculable.

One instance of the individuals who have been harmed by these loans:

This can’t and shouldn’t proceed. At a minimal, constitutional chapter rights have to be returned to those loans. The catastrophic proportions of this failure, nonetheless, are such that it in all probability can be greatest to easily cancel the loans, finish the lending system, and exchange it with a extra rational, rationally priced, and honest larger training funding plan.

In case you agree, please signal this petition.

[ad_2]