[ad_1]

One main query posed by latest occasions is whether or not the problems SVB confronted would’ve been caught had EGRRCPA not been handed (which raised the brink for what qualifies as a SIFI). Invoice Nelson on the Financial institution Coverage Institute has an illuminating put up arguing that the liquidity protection ratio (LCR), which might have utilized to SVB had it been labeled an SIFI, wouldn’t have been triggered. Folks like former Senator Toomey (a cosponsor of the 2018 act) have asserted that the LCR wouldn’t have caught SVB. Right here’s the logic I feel he, and others, is counting on.

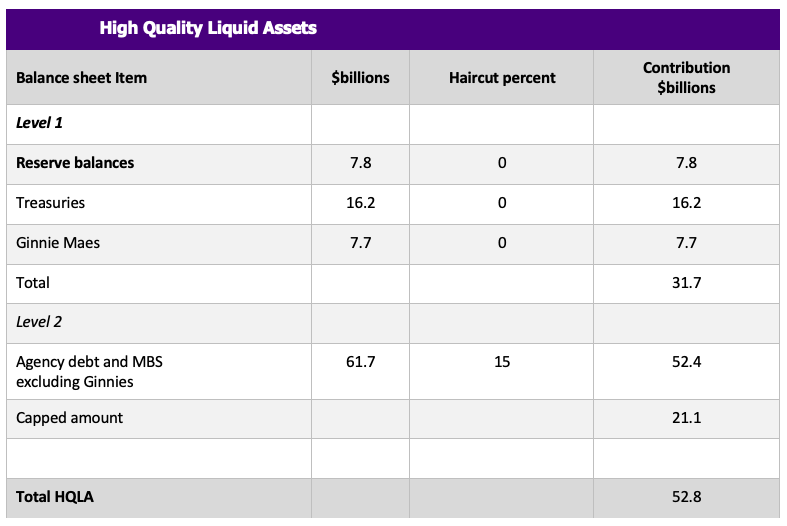

The LCR for the most important establishments is designed to cowl 30 days of stress. For smaller and fewer advanced establishments, the LCR’s stress assumptions are relaxed by multiplying projected web money outflows by 70 p.c. Absent S. 2155, SVB would have been topic to this diminished LCR requirement. To estimate SVB’s LCR, it’s essential to estimate the 2 parts, [High Quality Liquid Assets] HQLA and web money outflows. All information are as of Dec. 31, 2022, and are from SVB’s 10-Okay and name report. The outcomes are summarized in desk 1.

Excessive-quality liquid property encompass reserve balances (deposits at a Federal Reserve Financial institution), Treasuries, company debt and company MBS, and some different issues. The securities are marked to market. Reserve balances, Treasury securities and Ginnie Maes (that are absolutely assured by the U.S. authorities) are included in degree 1 HQLA, which have to be a minimum of 60 p.c of HQLA. Company debt and company MBS are included in degree 2a and are topic to a 15 p.c haircut. SVB had $7.8 billion in reserve balances, $16.2 billion in Treasury securities at honest worth and $7.7 billion in Ginnie Maes at honest worth, so $31.7 billion in degree 1 HQLA. SVB had $61.7 billion in company debt and company MBS (excluding Ginnie Maes) at honest worth; after the 15 p.c haircut, that’s $52.4 billion in degree 2 HQLA. As a result of degree 1 HQLA should equal a minimum of 60 p.c of HQLA, SVB’s holdings of degree 2a HQLA are capped at $21.1 billion. In sum, SVB would have had $52.8 billion in HQLA for LCR functions.

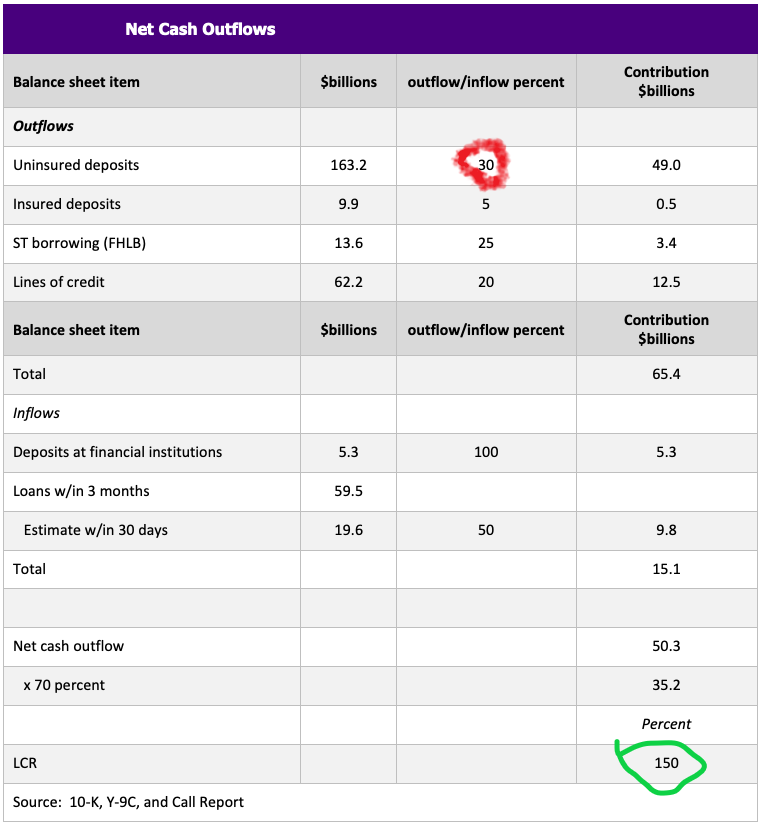

Web money outflows are extra difficult. They’re calculated by making use of pre-specified elements to numerous steadiness sheet and off-balance-sheet objects. The elements are chosen to copy the state of affairs through the GFC, with important idiosyncratic and market-wide stress. In lots of instances, the exact issue to use depends upon data that isn’t contained within the 10-Okay. An extra restriction within the LCR is that projected inflows can not exceed 75 p.c of projected outflows. As famous, for a financial institution of SVB’s dimension and different traits, web money outflows are then multiplied by 70 p.c.

First, outflows. SVB has $173.1 billion in deposits, of which $161.5 have been home. Of home deposits, $151.6 billion have been uninsured, indicating $9.9 billion have been insured. We subsequently estimate that $163.2 billion of complete deposits have been uninsured (complete – home insured). The outflow price on uninsured deposits of retail and nonfinancial enterprise prospects varies between 10 and 40 p.c relying on the traits of the depositor and deposit, with the decrease outflow price utilized to retail prospects together with these small companies which might be handled like retail prospects. The outflow price on uninsured deposits of monetary enterprise prospects varies between 25 p.c for operational deposits and 100% for non-operational deposits. If we assume a 30 p.c outflow price, that’s a $49.0 billion outflow.[1] The outflow charges on insured deposits are 3-40 p.c, the place 3 p.c is for a secure retail deposit. Assuming an outflow price of 5 p.c ends in a $0.5 billion outflow. SVB had $13.6 billion in short-term borrowings, that are nearly solely FHLB advances. The rollover price on FHLB advances is 75 p.c so the outflow from the short-term borrowing is $3.4 billion. SVB had $62.2 billion in strains of credit score and letters of credit score. The drawdown price assumption on strains of credit score is between 0-30 p.c relying on the kind and the counterparty. If the drawdown price is 20 p.c, the outflow could be $12.5 billion. Whole estimated outflows are $65.4 billion.

Second, inflows. SVB had $5.3 billion in deposits at different monetary establishments, all of that are assumed to be an influx. It had $73.6 billion in loans of which $59.4 billion mature inside three months. Half of scheduled repayments on most loans are handled as an influx. If we assume, conservatively, that one third of the loans that mature inside three months mature inside one month, the influx could be $9.8 billion. Whole estimated inflows are $15.1 billion.

Estimated web money inflows is $50.3 billion, or $35.2 billion after multiplying by 70 p.c.

SVB’s LCR would subsequently have been 150 p.c ($52.8 billion/$35.2 billion) on Dec. 31, 2022. The requirement is that the LCR be equal to or above 100%.

Desk 1 within the article cleary lays out the straightforward math.

Divide Whole HQLA by estimated web outflow results in the LCR of 150% (circled in inexperienced under).

The LCR = 150% depends upon a outflows of 30% on uninsured deposits.

Given the rapidity with which SVB misplaced uninsured deposits, I questioned in regards to the assumption of solely a 30% outflow price on the sum of operational and nonoperational deposits. Taking all the opposite assumptions Mr. Nelson used, I various the 30% outflow price to seek for what would yield a LCR lower than 100%. The reply is 46%.

In at some point (Thursday final week), depositors took out $42 billion based on journalistic accounts, so in a single day, 24% of deposits left. I don’t know what the regulators would’ve assumed of their stress checks, however in any case I’m undecided 30% would’ve been the proper quantity.

So, in my guide (bearing in mind I’m not a regulator, and don’t have any such expertise), it’s not clear-cut that having SVB listed as a SIFI wouldn’t have a minimum of made supervisors take a look at SVB a bit more durable. By the best way, having 76% of complete debt as being held to maturity (i.e., 2.2% securities out there on the market) signifies that the standard LCR based mostly on a calculation based mostly on all top quality liquid property would have wanted a footnote.

By the best way, none of that is to disclaim the truth that concentrating property in Treasurys and company debt with out hedging rate of interest danger appears to have been a dumb concept, given the telegraphing of rising price.

[ad_2]