[ad_1]

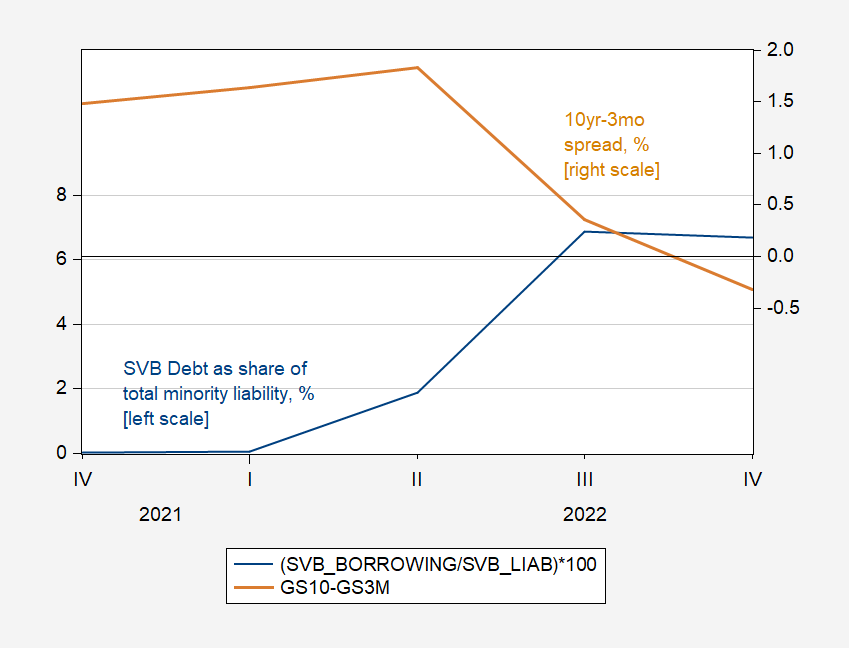

SVB was a collapse ready to occur. One indicator is the growing reliance on debt acquired on the capital markets (versus deposits).

From WSJ:

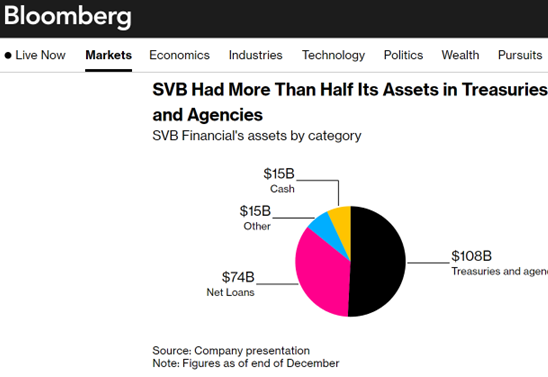

SVB’s year-end steadiness sheet additionally confirmed $91.3 billion of securities that it categorized as “held to maturity.” That label permits SVB to exclude paper losses on these holdings from each its earnings and fairness.

In a footnote to its newest monetary statements, SVB stated the fair-market worth of these held-to-maturity securities was $76.2 billion, or $15.1 billion under their balance-sheet worth. The fair-value hole at year-end was virtually as massive as SVB’s $16.3 billion of complete fairness.

Right here’s an image of belongings from Bloomberg:

Supply: Bloomberg, 3/10/2023.

It’s type of humorous to think about credit score danger related to Treasurys, however one could make a capital loss (versus loss attributable to default) if costs change loads, as they’ve for Treasurys within the wake of QT and rises within the Fed funds fee.

Therefore, SVB skilled a basic financial institution run within the face of solvency issues, on condition that deposits exceeded the insured quantity. Within the run-up to the disaster, the financial institution elevated its reliance on debt acquired within the capital market (versus deposits which might’ve required larger rates of interest). On this sense, incurring extra debt must be considered as a sign, moderately than a causal issue.

Determine 1: Finish of quarter debt as share of complete web minority legal responsibility, % (blue, left scale), and ten year-three month Treasury unfold, % (tan, proper scale). Supply: YahooFinance, Treasury through FRED, and creator’s calculations.

[ad_2]