[ad_1]

Jim Vondruska

Southwest Airways (NYSE:LUV) canceled greater than 16,700 flights throughout the busy December vacation journey interval as its software program could not hold tempo with brutal coast-to-coast winter climate.

The airline now plans to apologize earlier than a Senate panel on Thursday – over the meltdown that stranded vacationers round Christmas – and promise that there is not going to be a repeat.

“Let me be clear: We tousled. In hindsight, we didn’t have sufficient winter operational resilience,” stated COO Andrew Watterson in written testimony. ”We’re assured in our flight community and the schedules we have now printed on the market. The improve to the Crew software program will equip us to raised deal with restoration from a mass cancellation occasion.”

Southwest (LUV) has additionally employed consulting agency Oliver Wyman to assessment the meltdown, and expects the leads to the approaching weeks.

The debacle prompted a $800M pretax hit final quarter that led to a $220M loss. Southwest (LUV) has moreover stated it may lose $300M-$350M in income at first of the 12 months tied to the December disruptions.

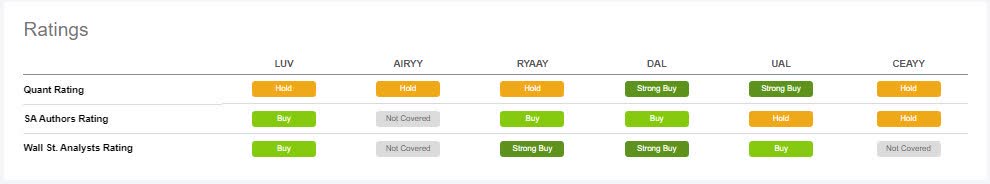

Wall Road analysts assign a Purchase score to LUV inventory, whereas an SA Quant evaluation provides it a Maintain score – with highest issue grades given to development. Here is a comparative score of the corporate in opposition to its friends:

Additional studying from SA contributors: ‘Is Southwest Airways A Good Funding After Its Epic Vacation Meltdown?‘

[ad_2]