[ad_1]

There was plenty of headscratching throughout Wall Road yesterday when precisely at 10:40am ET S&P futures swooned, with no elementary information to catalyze the transfer. After which, 80 minutes later, the promoting instantly stopped and reversed as shares staged a outstanding restoration with the S&P closing virtually unchanged from its opening worth.

A weird U-turn which left many asking what occurred? We now have the reply, and sure – as many speculated, 0DTE was concerned, solely this time in (report) dimension.

As Goldman flows guru Scott Rubner writes this morning, there was a serious growth in 0DTEs, that he wanted to flag forward of his common weekly commentary:

“Yesterdays was a fairly “boring Thursday” after all the macro occasions / information releases, after which…”

-

26,000 2/23/23 4000 strike Put choices (Bloomberg code IMDWG3P4 4000 Index) on S&P 500 e-mini futures traded yesterday morning (10:40am) in block type. This was properly after all the information releases and macro occasions for the remainder of the day, and when spoos have been buying and selling comfortably above 4,000.

-

The strike notional was $5.2 Billion, and the premium paid $5.5M. There was $2B price of delta promoting because of the hedge, 40% delta.

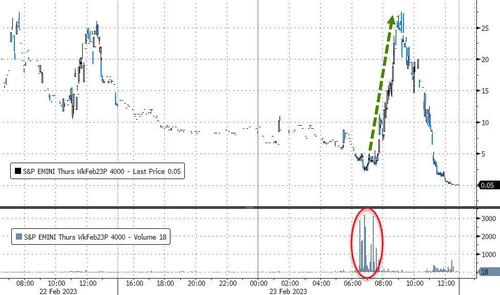

Figuring out properly the impression this commerce would have on the in any other case illiquid market, this feature shortly picked up delta for the remainder of the morning – simply as purchaser supposed – and elevated seller promoting, within the course of sending the value of the put 5x from $5 to $25 in two hours as spoos (proven in blue/inverted beneath) tumbled from 4030 to session lows slightly below 3980 by 12pm ET.

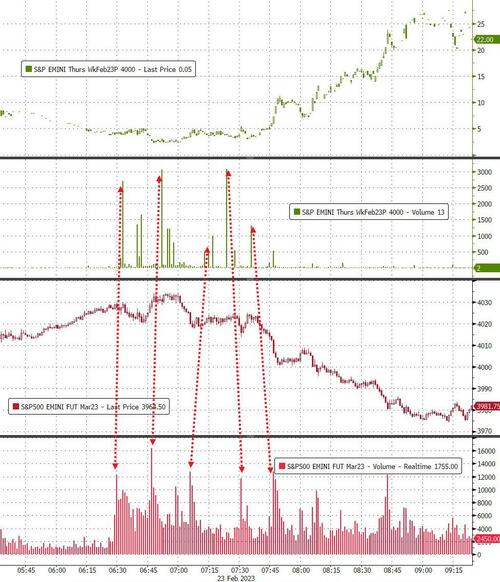

And one other option to visualize the impression of the commerce: linking quantity spikes in eminis to the 0DTE put:

Now the attention-grabbing half. Equities reversed simply after midday and this feature shortly misplaced delta on the quick rally increased, leading to masking the preliminary brief hedge as we rallied again into the shut. As Rubner calculates, “prime ebook liquidity on ES1 futures is $10M. So round lunchtime, sellers bought $2B to later cowl $2B by the tip of the day.“

To this we are going to add that it seems that the put purchaser did not unwind/cowl it when it 5x in worth, however somewhat let it bleed out, with sizable trades hitting solely after 2pm. This leads us to consider that the aim of the commerce was to not make a fast buck within the 0DTE however the manipulate the whole market first decrease, after which increased, permitting the unknown dealer to spend $5.5 Million on probably the most extremely levered, liquid, and risky short-dated choice in an effort to manipulate trillions in market cap.

Going again to Rubner, the Goldman dealer notes that “this commerce has an institutional footprint, and was too massive for “retail merchants”. The was possible an institutional investor shopping for a identical day put choice, which expired in ~5 hours. This was a dimension commerce.”

As defined within the paragraph we agree, though the rationale behind the commerce stays unclear.

What is obvious is that, as Rubner summarizes, “that is the biggest 0DTE block commerce that I’ve ever seen. I have to run the info, however this can be the biggest block 0DTE ever (or not less than prime 5). I monitor this each single day, and I’ve to confess that I used to be shocked watching the brief gamma hedging impression available on the market.”

Translation: spend $5.5 million in premium, transfer trillions in danger belongings in a route of your selecting.

As Rubner concludes, the highest incoming investor questions following this commerce:

-

“Do you suppose institutional buyers will start utilizing 0DTE’s in dimension to hedge particular day by day macro occasions”? My reply is sure.

-

“Can the market deal with institutional (not retail) stream in 0DTE’s market impression if this turns into, a factor”? My reply is not any.

If Rubner is true, and we consider he’s, we’re about to see a lot of market chaos and Powell might lastly see his want of a market crash come true…

Extra within the full notice out there to professional subscribers.

Loading…

[ad_2]