[ad_1]

plastic_buddha

The S&P Supplies sector index closed the week +0.03%, and the Supplies Choose Sector SPDR ETF (XLB) +0.01%.

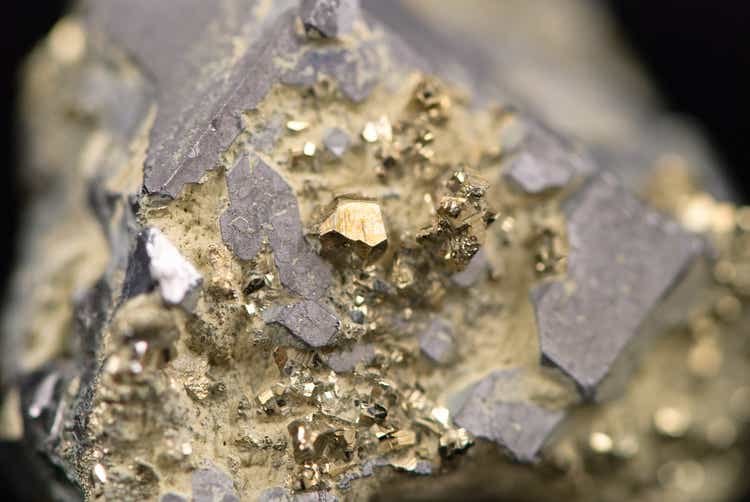

Gold costs slipped in Thursday’s buying and selling because the U.S. greenback rebounded and a few traders appeared to take income after costs touched a nine-month intraday excessive. It fell additional after a lot stronger than anticipated U.S. non-farm payrolls information raised fears that the Federal Reserve might hold mountaineering rates of interest.

April Comex gold (XAUUSD:CUR) -2.3% to $1,886.60/oz, poised for a sixth loss in seven classes, and March silver (XAGUSD:CUR) -4.3% to $22.59/oz.

Copper costs too fell probably the most in practically seven weeks Wednesday as demand considerations outweighed provide disruptions and bets that the top of China’s COVID restrictions will reignite development.

Entrance-month Comex copper (HG1:COM) for February supply closed -2.7% to $4.111/lb, its fifth loss previously seven classes and the most important drop since December 15. Three-month copper on the London Metallic Trade was down 2.4% for the week.

Check out this week’s high gainers amongst primary materials shares ($2B market cap or extra):

- Scotts Miracle-Gro (SMG) +23.7%; Shares jumped after topping expectations for FQ1 adjusted earnings and revenues.

- Quaker Chemical (KWR) +10.16%

- Worthington Industries (WOR) +12.02%

- Constellium (CSTM) +10.08%

- Lithium Americas (LAC) +9.80%

Listed here are the highest 5 losers amongst primary materials shares:

- Air Merchandise & Chemical substances (APD) -9.10%; Shares plunged to a virtually three-month low after posting disappointing earnings and Q2 EPS steerage.

- Gold Fields (GFI) -7.92%

- Agnico Eagle Mines (AEM) -7.45%

- Kinross Gold (KGC) -7.40%

- Vale (VALE) -7.13%

Different supplies ETFs to look at: iShares World Timber & Forestry ETF (WOOD), Supplies Choose Sector SPDR ETF, Vanguard Supplies ETF (VAW), iShares World Supplies ETF (MXI), SPDR S&P Metals and Mining ETF (XME), VanEck Vectors Gold Miners ETF (GDX), iShares MSCI World Gold Miners ETF (RING), World X Copper Miners ETF (COPX).

[ad_2]