[ad_1]

Marc Benioff, co-founder and CEO of Salesforce, speaks on the World Financial Discussion board in Davos, Switzerland, on Jan. 18, 2023.

Stefan Wermuth | Bloomberg | Getty Pictures

Salesforce shares soared 16% in prolonged buying and selling on Wednesday after the cloud software program maker beat Wall Road estimates on revenue and issued a better-than-expected forecast.

Here is how the corporate did:

- Earnings: $1.68 per share, adjusted, vs. $1.36 per share as anticipated by analysts, in line with Refinitiv.

- Income: $8.38 billion, vs. $7.99 billion as anticipated by analysts, in line with Refinitiv.

Salesforce’s income grew 14% yr over yr within the fiscal fourth quarter, which ended on Jan. 31, per the earlier quarter, in line with a assertion. The corporate reported a lack of $98 million, in contrast with a lack of $28 million within the year-ago quarter.

In January Marc Benioff, Salesforce’s co-founder and CEO, mentioned the corporate would lower 10% of its workforce, representing over 7,000 folks, and that restructuring technique led to $828 million in prices throughout the quarter.

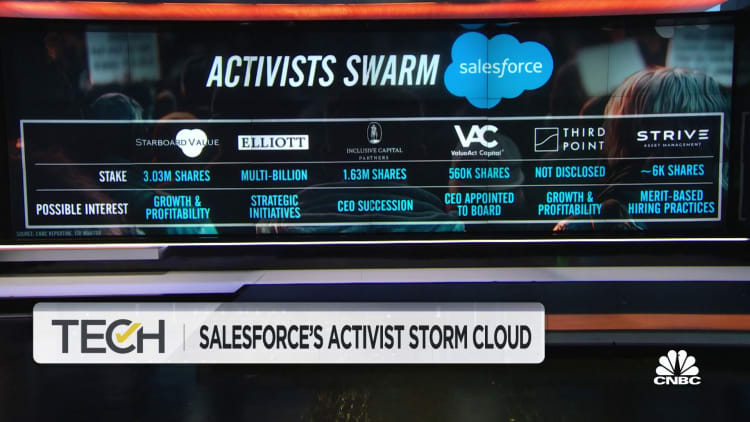

Profitability has change into a better precedence at Salesforce, which in current months has been getting pressured by an inflow of activist buyers, together with Third Level, Elliott Administration and Starboard Worth. The corporate introduced the addition of ValueAct Capital CEO Mason Morfit to its board. On the finish of the quarter Bret Taylor, who ran Salesforce as co-CEO alongside Benioff, stepped down.

The adjusted working margin, at 29.2%, was wider than the 25% aim for the fiscal 2026 fiscal yr that executives had laid out at its investor day in September.

“Six months in the past in September at our Dreamforce Investor Day we shared with you our complete transformation plan, the brand new day for worthwhile development,” Benioff mentioned on a convention name with analysts. “However issues have modified as we entered our fourth quarter. We acknowledged that we wanted to radically speed up the transformation plan timeframe. We would have liked to press the hyper-space button and produce the two-year targets ahead shortly and exceed them now.”

Benioff mentioned Salesforce is working with Bain on a overview of the enterprise.

For the fiscal first quarter, the corporate known as for adjusted earnings within the vary of $1.60 to $1.61 per share and income of $8.16 billion to $8.18 billion. Analysts surveyed by Refinitiv had been in search of $1.32 in adjusted earnings per share and $8.05 billion in income.

Salesforce sees adjusted earnings per share for the complete 2024 fiscal yr of $7.12 to $7.14 and income of $34.5 billion to $34.7 billion. Analysts polled by Refinitiv had anticipated $5.84 in adjusted earnings per share and $34.03 billion in income. It known as for a 27% adjusted working margin within the 2024 fiscal yr.

The corporate mentioned it was increasing its share buyback program to $20 billion after asserting its first repurchasing dedication, with as much as $10 billion allotted for that objective, in August.

Salesforce shares have risen 26% to this point this yr, excluding Wednesday’s after-hours transfer, outperforming the S&P 500 index, which has gained 3% over the identical interval.

Executives will focus on the outcomes with analysts on a convention name beginning at 5 p.m. ET.

That is breaking information. Please verify again for updates.

[ad_2]