[ad_1]

By Conor Gallagher

Between 1993 and 2011 the Division of Justice Antitrust Division issued a trio of coverage statements (two throughout the Clinton administration and one underneath Obama) concerning the sharing of knowledge within the healthcare trade. These guidelines supplied wiggle room across the Sherman Antitrust Act, which “units forth the fundamental antitrust prohibition towards contracts, combos, and conspiracies in restraint of commerce or commerce.”

And it wasn’t simply in healthcare. The foundations have been interpreted to use to all industries. To say it has been a catastrophe could be an understatement. Corporations more and more turned to information companies providing software program that “exchanges info” at lightning pace with opponents as a way to preserve wages low and costs excessive – successfully creating nationwide cartels.

Listed below are simply two current examples:

- Actual property funding behemoths are allegedly utilizing third-party software program algorithms to primarily act as one nationwide landlord cartel that coordinates pricing (i.e., preserving your hire sky excessive). The true property rental giants and the information-sharing firm that connects all of them are dealing with a collection of lawsuits, and the DOJ can also be investigating the businesses accused of colluding to maintain residences vacant and rents elevated. The elevated use of such info sharing has coincided with astronomical hire development and will increase within the variety of homeless People and deaths of the homeless.

- Final yr the DOJ fined a bunch of main poultry producers $84.8 million over a long-running conspiracy to alternate details about wages and advantages for poultry processing plant employees and collaborate with their opponents on compensation selections in violation of the Sherman Act. The DOJ additionally ordered an finish to the alternate of compensation info, banned the information agency (and its president) from information-sharing in any trade, and prohibited misleading conduct in direction of rooster growers that lowers their compensation. Neither the poultry teams nor the information consulting agency admitted legal responsibility.

The excellent news is that the DOJ is lastly admitting that these loopholes have been a mistake and has closed them. Right here is the Feb. 3 assertion from the DOJ:

After cautious evaluation and consideration, the division has decided that the withdrawal of the three statements is the most effective plan of action for selling competitors and transparency. Over the previous three a long time since this steerage was first launched, the healthcare panorama has modified considerably. Consequently, the statements are overly permissive on sure topics, akin to info sharing, and not serve their meant functions of offering encompassing steerage to the general public on related healthcare competitors points in at present’s setting. Withdrawal subsequently finest serves the curiosity of transparency with respect to the Antitrust Division’s enforcement coverage in healthcare markets. Latest enforcement actions and competitors advocacy in healthcare present steerage to the general public, and a case-by-case enforcement method will permit the Division to raised consider mergers and conduct in healthcare markets that will hurt competitors.

The impact might be swift as companies attempt to keep away from antitrust fits. From ArentFox Schiff LLP, a nationwide legislation and lobbying agency:

The withdrawal of the security zone and elevated scrutiny of knowledge exchanges sign that broader enforcement towards info sharing is coming. Corporations ought to seek the advice of with their antitrust counsel to re-evaluate their present information-sharing practices.

The foundations have been primarily based on junk economics and have been huge items to huge enterprise from the Clintons. In 1993, first woman Hillary Rodham Clinton and different officers introduced steps to make healthcare extra “out there” and “inexpensive” to all People.

The coverage statements supplied for antitrust “security zones” which created circumstances underneath which the DOJ and the FTC wouldn’t problem the next:

- Hospital mergers;

- Hospital joint ventures involving high-technology or different costly medical gear;

- Physicians’ provision of knowledge to purchasers of well being care providers;

- Hospital participation in exchanges of value and value info;

- Joint buying preparations amongst well being care suppliers;

- Doctor community joint ventures.

The foundations have been additional liberated in 1996 after which once more in 2011 underneath Obama’s Inexpensive Care Act and its Accountable Care Organizations provision.

Whereas all of those guidelines allowed for extra focus, which is well-known, the “alternate of value and value” provision additionally made it so even in non concentrated industries, companies might nonetheless wield monopoly pricing energy by exchanging info with “opponents” by way of middlemen. Right here was the loophole, in line with the DOJ’s now-withdrawn enforcement coverage:

Accordingly, as a way to qualify for this security zone, the gathering of knowledge to be supplied to purchasers should fulfill the next situations:

(1) the gathering is managed by a 3rd get together (e.g., a purchaser, authorities company, well being care guide, tutorial establishment, or commerce affiliation);

(2) though present fee-related info could also be present to purchasers, any info that’s shared amongst or is offered to the competing suppliers furnishing the information have to be greater than three months previous; and

(3) for any info that’s out there to the suppliers furnishing information, there are no less than 5 suppliers reporting information upon which every disseminated statistic is primarily based, no particular person supplier’s information could symbolize extra than 25 p.c on a weighted foundation of that statistic, and any info disseminated have to be sufficiently aggregated such that it might not permit recipients to establish the costs charged by any particular person supplier.

For the patron which means that whether or not you’re going to the grocery retailer or the physician or paying hire, it’s at all times like a visit round a consolidated monopoly board. One want look no additional than the collection of lawsuits and DOJ investigation towards actual property rental giants and the intermediary firm RealPage, which (allegedly) provided software program permitting landlords throughout the nation to collude on rental costs.

The way it’s alleged to work, or used to anyhow, is that when occupancy dropped, rents would additionally drop in order that properties could be full. Corporations would compete for extra “heads in beds” by way of decrease rental costs and sometimes intention for occupancy charges round 97-98 p.c. However the RealPage software program permits property homeowners to maintain costs excessive even in periods of excessive emptiness. The software program required customers (landlords) to take care of pricing at ranges its algorithm set, which regularly meant larger emptiness, however landlords discovered that they have been nonetheless making more cash.

Simply take a look at a number of the actual property goliaths named within the lawsuits who have been utilizing RealPage software program to maintain rents artificially excessive:

- Greystar: The nation’s largest property administration agency with almost 794,000 multifamily models and pupil beds underneath administration. In December, it was nominated for six(!) 2022 Personal Fairness Actual Property Awards.

- Trammell Crow Firm, headquartered in Dallas, is a subsidiary of CBRE Group, the world’s largest industrial actual property providers and funding agency.

- Lincoln Property Co. Manages or leases over 403 million sq. toes throughout the US.

- FPI Administration. At present manages simply over 155,000 models in 18 states.

- Avenue5 manages $22 billion in multifamily and single-family belongings nationwide.

- Fairness Residential, the fifth largest proprietor of residences in america, primarily in Southern California, San Francisco, Washington, D.C., New York Metropolis, Boston, Seattle, Denver, Atlanta, Dallas/Ft. Value, and Austin.

- Mid-America House Communities, which as of June 30, 2022, owns or has possession curiosity in 101,229 houses in 16 states all through the Southeast, Southwest, and Mid-Atlantic areas.

- Essex Property Belief (62,000 models). This absolutely built-in actual property funding belief (REIT) acquires, develops, redevelops, and manages multifamily house communities positioned in supply-constrained markets on the west coast.

- Thrive Group Administration (18,700 models in Washington and Oregon). Adorably refers to staff as “thrivers.”

- AvalonBay Communities, Inc. As of September 30, 2022, the Firm owned or held a direct or oblique possession curiosity in 293 house communities containing 88,405 house houses in 12 states and DC.

- Cushman & Wakefield, with a portfolio of 172,000 models.

- Safety Properties portfolio displays pursuits in 113 belongings encompassing almost 22,354 multifamily housing models.

No surprise Moody’s declares that the “US is now rent-burdened nationwide for the primary time.” Extra:

The nationwide common rent-to-income (RTI) reached 30% for the primary time in our 20+ years of monitoring historical past, up 1.5% from year-ago or 0.2% from Q3, preserving the expansion fee fixed all through the second half of final yr.

Rising mortgage charges triggered many households to be priced out from dwelling shopping for and would-be patrons to stay renters. House demand surged because of this and drove charges sky excessive. Because the disparity between hire development and earnings development widens, American’s wallets really feel monetary misery as wage development trails hire development.

Rents proceed to assist drive inflation with Tuesday’s Labor Division report exhibiting that People continued to be burdened by larger prices for rental housing. From Reuters:

The patron value index elevated 0.5% final month after gaining 0.1% in December, the Labor Division stated on Tuesday. A 0.7% rise in the price of shelter, which principally mirrored rents, accounted for almost half of the month-to-month enhance within the CPI.

In a Feb. 2 speech asserting the withdrawal, Principal Deputy Legal professional Normal Doha Mekki defined that the event of technological instruments akin to information aggregation, machine studying, and pricing algorithms have elevated the aggressive worth of historic info.In different phrases, it’s now (and has been for plenty of years) means too straightforward for corporations to make use of these security zones to repair wages and costs.

It’s an open query as to how a lot this algorithmic price-fixing software program might be contributing to inflation, however because the Kansas Metropolis Fed famous in January, “markups might account for greater than half of 2021 inflation.”

Mekki admitted as a lot on Feb. 2 at an antitrust convention in Miami:

A very formalistic method to info alternate dangers allowing – and even endorsing – frameworks that will result in larger costs, suppressed wages, or stifled innovation. A softening of competitors by way of tacit coordination, facilitated by info sharing, distorts free market competitors within the course of.

However the intense dangers which might be related to illegal info exchanges, a number of the Division’s older steerage paperwork set out so-called “security zones” for info exchanges – i.e. circumstances underneath which the Division would train its prosecutorial discretion to not problem corporations that exchanged competitively-sensitive info. The protection zones have been written at a time when info was shared in manila envelopes and thru fax machines. At this time, information is shared, analyzed, and utilized in ways in which could be unrecognizable a long time in the past. We should account for these modifications as we contemplate how finest to implement the antitrust legal guidelines.

The DOJ withdrawal of those guidelines is a serious change from the lax perspective for the previous 30 years. There are nonetheless unanswered questions, however the shift is obvious. From ArentFox Schiff LLP, a nationwide legislation and lobbying agency:

The withdrawal of the coverage statements forecasts higher DOJ scrutiny of knowledge sharing; nevertheless, it’s nonetheless clear that not all info sharing is illegitimate. Each the Supreme Courtroom and the DOJ have acknowledged that, in lots of situations, opponents must share info to attain legit pro-competitive targets. Nevertheless, exchanges of knowledge might violate the Sherman Act, which prohibits a “contract, mixture…or conspiracy” that unreasonably restrains commerce, if they permit competing sellers to collude or tacitly coordinate in an anti-competitive method, akin to by coordinating costs. Typically, courts will stability these two competing considerations. The Supreme Courtroom has protected info exchanges the place the information was publicly out there, was historic slightly than present or forward-looking, and/or was aggregated to make the knowledge nameless. It has additionally emphasised that sure exchanges of present value info and data exchanges in concentrated markets could obtain higher scrutiny.

The DOJ has not said whether or not it plans to interchange the coverage steerage. As well as, when assessing info exchanges, you will need to keep in mind that there was a transparent pattern towards elevated evaluation of knowledge sharing. For instance, the DOJ not too long ago fined three poultry producers $84.8 million over allegations that they improperly shared worker wage and profit info. Corporations ought to count on elevated scrutiny sooner or later.

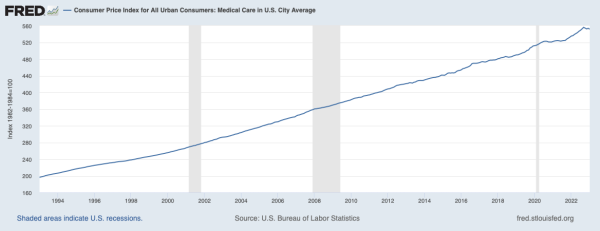

A lot for the romantic notion that the sharing of knowledge would result in higher care and decreased prices. In response to the DOJ, this was the said motive for the Clintons unveiling the “security zones”:

The coverage statements will assist alleviate uncertainty throughout the well being care trade making it simpler for mergers and joint ventures to happen, leading to decrease well being care prices.

How’d that work out?

Effectively, it took thirty years, however the DOJ has lastly admitted this particular scheme began underneath the Clintons was an enormous mistake, and it marks one other signal that enterprise as ordinary is perhaps altering at the FTC and DOJ.

5. Altering a broad coverage regime doesn’t occur in a single second. There are millions of switches to flip, and it requires a relentlessness and willingness to deal with each. That’s what we’re seeing in how Biden is addressing company energy. An virtually unnoticed shift.

— Matt Stoller (@matthewstoller) February 7, 2023

[ad_2]