[ad_1]

Authored by Simon White, Bloomberg macro strategist,

Retail shares are uncovered to tighter credit score and shoppers going through rising non-discretionary prices. Their anticipated underperfomance additionally makes them a candidate as a portfolio hedge for an more and more doubtless equity-market correction.

(Nominal) retail gross sales had been launched this week, with January displaying an enchancment on December’s information. Nonetheless, this could not detract from the sturdy downward pattern main indicators anticipate for retail consumption.

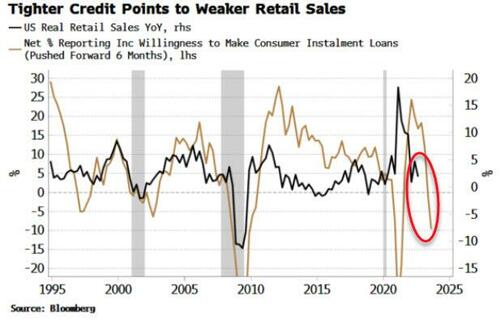

Because the Fed’s charge hikes more and more chunk, credit score situations are tightening. A key demand assist for consumption comes from shopper credit score. However banks are tightening lending situations throughout the board, from firm loans to shopper credit score. Fewer banks are keen to make shopper loans, which factors to a lot weaker retail gross sales by means of this 12 months.

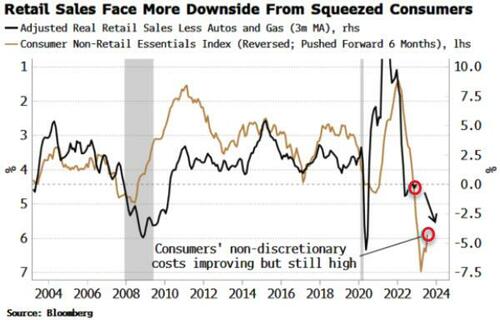

Shoppers are additionally having to tighten their belts. Inflation has ensured the price of just about all items and providers has risen over the previous two years. Wages usually are not conserving tempo with value rises, and sure important outlays, corresponding to lease and mortgage funds, can’t be readily minimize.

Subsequently discretionary consumption, which retail gross sales primarily captures, suffers.

My self-explanatory (however not catchily titled) Shopper Non-Retail Necessities Index exhibits that retail gross sales are going to face continued headwinds this 12 months from shopper retrenchment.

The index is a bit of off its highs (brown line within the chart above; NB it’s reversed), however the prices of important providers stays very excessive, and it will proceed to pressure shoppers to prioritize their spending.

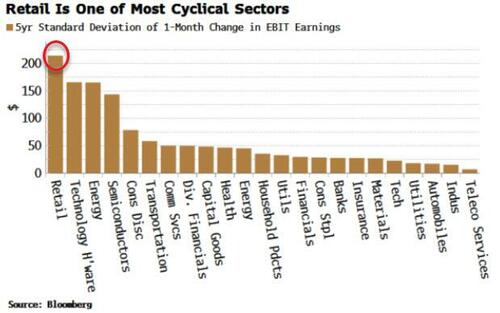

This leaves retail shares uncovered. Retail is likely one of the most cyclical sectors, and as progress continues to weaken (as a number of main indicators level in the direction of), the sector will face growing resistance.

After being the most effective sectors year-to-date to date, retail is prone to quickly start underperforming because it turns into obvious discretionary consumption will weaken extra.

Loading…

[ad_2]