[ad_1]

CASH REMITTANCES hit a retwine excessive in 2022, as abroad Filipino employees (OFWs) despatched extra money to their households who’re combating hovering costs.

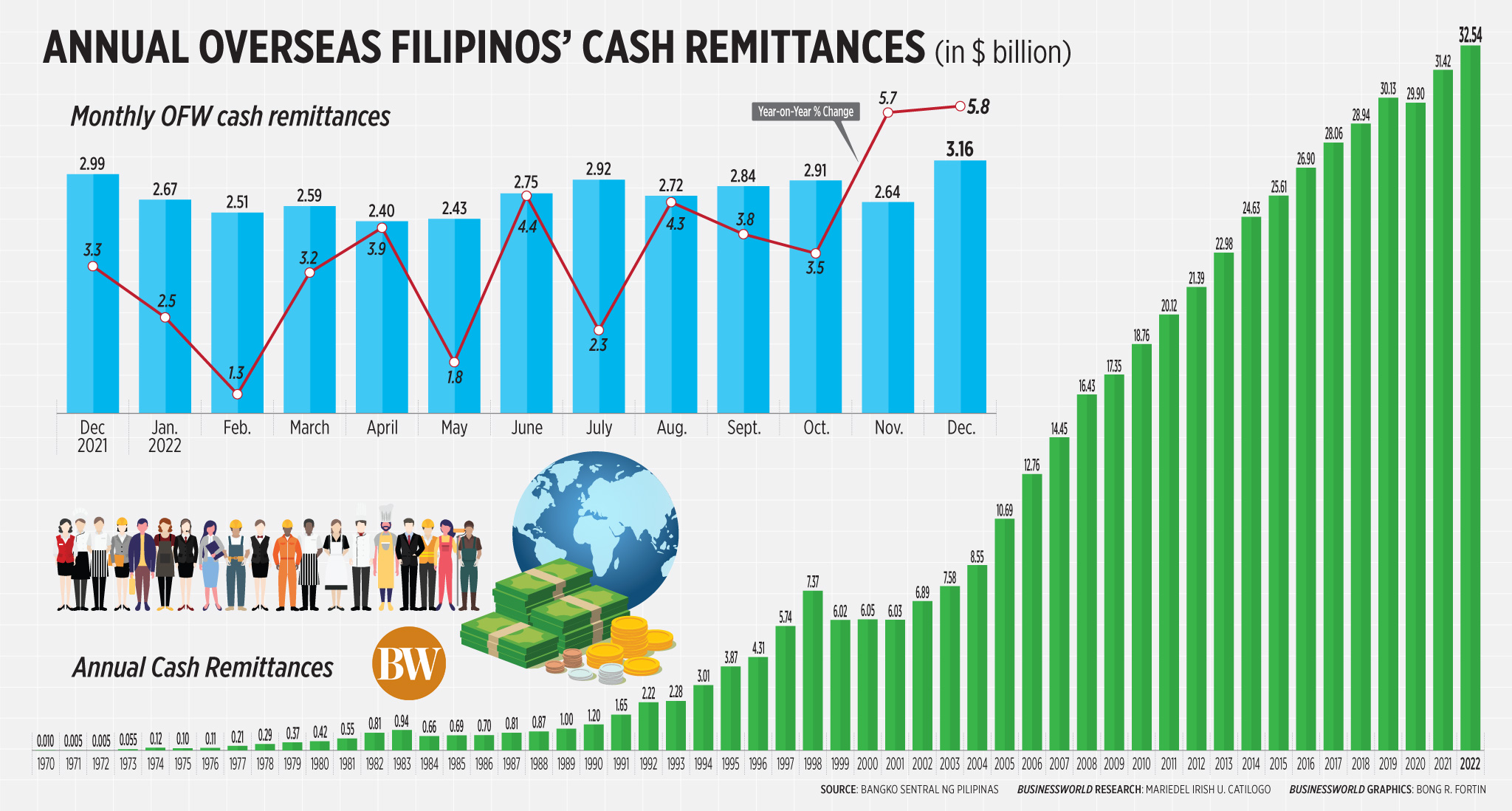

Cash despatched by OFWs by means of banks jumped by 3.6% to $32.54 billion final 12 months, in line with information launched by the Bangko Sentral ng Pilipinas (BSP) on Wednesday. It exceeded the earlier report of $31.42 billion in 2021.

Nonetheless, the three.6% annual remittance improve fell in need of the BSP’s 4% projection. It was additionally slower than the 5.1% enlargement in 2021.

In December alone, money remittances jumped by 5.8% to a report $3.16 billion, from $2.99 billion a 12 months earlier. The expansion in remittances for December was additionally the quickest because the 7% seen in June 2021.

“The enlargement in money remittances in December 2022 was as a result of progress in receipts from land- and sea-based employees,” the BSP mentioned.

Land-based OFWs despatched $2.514 billion in December, up by 5.8% in the identical month final 12 months. Remittances from sea-based employees grew by 5.6% to $644.91 million from a 12 months in the past.

Remittances normally surge in December as OFWs sometimes ship extra money to their relations through the holidays, Union Financial institution of the Philippines, Inc. (UnionBank) Chief Economist Ruben Carlo O. Asuncion mentioned in a Viber message.

“(This was) Christmas exuberance… Our OFWs have been in all probability simply within the temper to spend and spend a lot. This December has been probably the most ‘open’ one within the final three years,” Mr. Asuncion mentioned.

The Philippine economic system grew by 7.2% within the fourth quarter, as family consumption rose amid Filipinos’ “revenge spending” through the holidays. This introduced full-year financial progress to 7.6% in 2022, the quickest since 1976.

China Banking Corp. Chief Economist Domini S. Velasquez mentioned elevated inflation might have additionally prompted OFWs to ship extra money to assist their households.

“Pull elements reminiscent of excessive inflation and larger mobility within the house nation (Philippines) inspired extra remittances,” Ms. Velasquez mentioned.

Inflation accelerated to a 14-year excessive of 8.1% in December, bringing full-year inflation to five.8% in 2022 amid hovering meals costs.

Ms. Velasquez mentioned the weaker peso in the previous few months of 2022 “may have additionally helped” increase remittances.

The peso closed at P55.755 on Dec. 29, 2022, down 8.5% or P4.755 from its P51-per-dollar shut on Dec. 31, 2021.

“Higher financial efficiency in host economies led to jobs and revenue for abroad Filipinos — notably the US, Asia, and Center East proceed to put up brisk financial actions,” Ms. Velasquez mentioned.

Based on the BSP, progress in inflows from economies reminiscent of america (US), Saudi Arabia, Singapore, Qatar, and United Kingdom (UK) contributed largely to the rise in remittances in 2022.

The US (41.2%) was the largest supply of remittances in 2022, adopted by Singapore (7%), Saudi Arabia (6%), Japan (5.1%), the UK (4.7%), the United Arab Emirates (4.2%), Canada (3.6%), Qatar (2.8%), Taiwan (2.7%), and Republic of Korea (2.5%).

These international locations altogether account for greater than three-fourths (79.8%) of money remittances through the 12 months.

In the meantime, private remittances that embrace inflows in form grew 5.7% to $3.49 billion in December from $3.30 billion within the 12 months prior. This introduced the full-year figure 3.6% greater to a report $36.14 billion.

“The sturdy inward remittances reflected the rising demand for international employees amid the reopening of economies. The total-year 2022 degree accounted for 8.9% and eight.4% of the nation’s gross home product (GDP) and gross nationwide revenue (GNI), respectively,” the BSP mentioned.

UnionBank’s Mr. Asuncion expects remittance progress to sluggish this 12 months as a result of looming international financial slowdown.

“Our forecast for this 12 months is a progress of two.6%. Will probably be softer however nonetheless respectable,” he mentioned.

In the meantime, China Financial institution’s Ms. Velasquez is hopeful remittances will stay sturdy regardless of a worldwide recession.

“Subsequent 12 months, we predict that regardless of a worldwide slowdown, remittances will stay sturdy with mushy touchdown/solely a shallow recession is predicted from the US — the largest sending nation; higher outlook for Asia, with China’s reopening; and continued deployment to the Center East, Asia, and a few European international locations,” she mentioned.

The BSP expects remittances to develop by 4% this 12 months. — Keisha B. Ta-asan

[ad_2]