[ad_1]

For a lot of, competing within the Olympics is the head of sporting achievement, and getting there takes years of sweat, toil and sacrifice. Nevertheless, it’s little one’s play in comparison with going through off within the inventory market. That is at the least the opinion of Ray Dalio, the billionaire founding father of the world’s largest hedge fund, Bridgewater Associates.

In a latest interview, Dalio has likened the inventory market to poker, the place “someone’s going to take cash away from someone else.” Not solely that, however portfolios are additionally just like casinos, the place you win some and lose some.

Dalio has completed a number of profitable on the inventory market recreation and though he may not be co-chief funding officer on the agency having left his position final October, he has stored a spot on Bridgewater’s board.

In the meantime, the hedge fund has been rolling the cube on a pair of shares, believing the chances are stacked of their favor. Wall Road’s analysts evidently assume so, too; in line with the TipRanks database, each are rated as Sturdy Buys by the analyst consensus. Let’s see what makes them good additions to the portfolio proper now.

Planet Labs PBC (PL)

The primary inventory Bridgewater has been loading up on is Planet Labs, an organization whose goal is to revolutionize area imaging. That’s, it was established with the goal of offering world satellite tv for pc imagery and geospatial options. Planet Labs develops and manages the most important statement fleet of imaging satellites – greater than 200 satellite tv for pc cameras are in orbit – and collects information from greater than 3 million photographs on daily basis. The corporate presents improved analytics, imagery, and software program for functions in agriculture, authorities, safety, and lots of different fields.

Planet Labs is comparatively new to the inventory market, having gone public on the finish of 2021 by way of the SPAC route. In its newest quarterly report, for 3Q22, the corporate dialed in document income of $49.7 million, amounting to a 56.8% year-over-year improve and beating the Road’s name by $2.51 million. There was a beat on the bottom-line too, with adj. EPS of -$0.08 trumping the -$0.11 forecast. For This autumn, the corporate anticipates income within the vary between $50 million to $54 million, on the midpoint representing roughly a 40% year-over-year improve.

Bridgewater should sees massive potential right here. Throughout This autumn, the hedge fund opened a brand new place in Planet Labs, with the acquisition of 1,499,078 shares. These at the moment are value about $7 million.

Wedbush analyst Daniel Ives can be a fan and past offering imagery, thinks further worth lies elsewhere.

“Administration is seeking to place the corporate to additionally present information and successfully be a back-end provider for corporations needing satellite tv for pc imaging information,” the 5-star analyst defined. “With this enterprise mannequin, corporations can successfully companion with Planet and even launch on prime of Planet’s information as a person entity, creating an enormous scaling alternative for the title as Planet owns the info. Trying ahead, we see an ideal alternative for Planet to capitalize on this large addressable market as the necessity for exact satellite tv for pc imaging accelerates.”

To this finish, Ives charges PL an Outperform (i.e. Purchase), alongside an $8 value goal, suggesting shares will climb ~71% greater within the 12 months forward. (To look at Ives’ monitor document, click on right here)

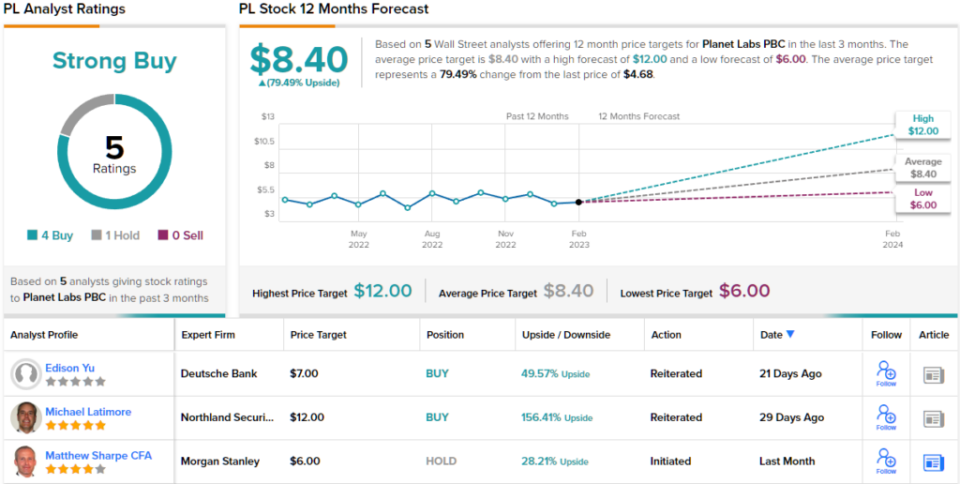

What does the remainder of the Road must say? 4 Buys and 1 Maintain have been issued over the previous three months. Due to this fact, PL will get a Sturdy Purchase consensus score. Based mostly on the $8.40 common value goal, shares might rise ~79% within the subsequent 12 months. (See PL inventory forecast)

Schlumberger Restricted (SLB)

The following inventory we’re is Schlumberger, an enormous participant in oilfield companies. Actually, it’s the greatest offshore drilling firm on this planet, offering oilfield tools and companies for the worldwide oil & fuel business. Situated in over 120 nations, Schlumberger’s companies embody information processing, oil nicely testing, web site appraisal, drilling and lifting operations. Moreover, the corporate presents administration and consulting companies.

Schlumberger reported its monetary outcomes for 4Q22 in January, and the outcomes had been spectacular. Income grew by 26.5% year-over-year to $7.9 billion, whereas beating the Road’s name by $110 million. Adj. EPS of $0.71 was up by 76% from the identical interval a 12 months in the past and likewise fared higher than the $0.68 anticipated by the analysts. This autumn money circulate from operations reached $1.6 billion whereas the corporate generated roughly $900 million in free money circulate.

After all, power shares had been of the few to profit throughout final 12 months’s bear and so did Schlumberger, gaining 78% over the course of the 12 months. Bridgewater evidently thinks there’s extra room to run. In This autumn, the hedge fund purchased 272,080 shares, rising the stake by 74%. In complete, the fund now holds 644,781 SLB shares, presently value greater than $33.7 million.

Additionally portray an upbeat image is Barclays analyst David Anderson, who considers SLB a ‘Prime Decide.’

“With one other spectacular quarter, SLB as soon as once more introduced a compelling funding case to buyers – not just for its personal inventory, however for the complete Power Providers sector. By each measure, 2022 was certainly one of SLB’s best years in a decade, however with the cycle coming into a brand new progress section, visibility on progress and margin growth now extends past 2025 (doubtlessly nicely past,” Anderson famous.

“At this level,” the analyst added, “it’s exhausting to search out fault in both the story or the outlook, particularly with the Center East and offshore cycles enjoying into SLB’s strengths. And with the one actual bear case for SLB (aside from being nicely owned) being valuation, the elevated visibility on the length of the cycle gives one other leg of upside potential to the inventory.”

In keeping with this view of SLB’s strengths, Anderson charges the inventory as Obese (i.e. Purchase), with a $74 value goal implying a 12-month upside of ~41%. (To look at Anderson’s monitor document, click on right here)

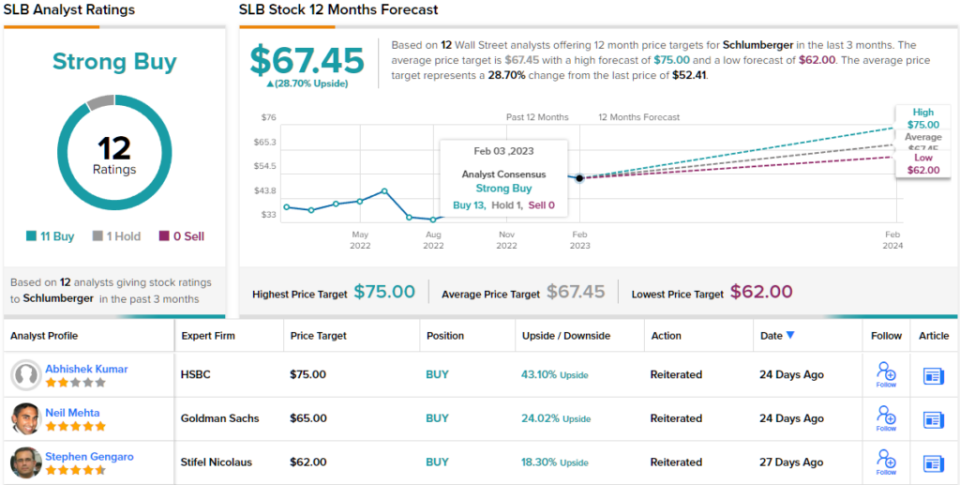

Most on the Road concur; barring one skeptic, all 11 different latest analyst evaluations are constructive, making the consensus view right here a Sturdy Purchase. At $67.45, the typical goal implies buyers will probably be sitting on returns of ~29% a 12 months from now. As a bonus, the corporate pays common dividends that presently yield 1.87%. (See Schlumberger inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is rather vital to do your individual evaluation earlier than making any funding.

[ad_2]