[ad_1]

Olivier Blanchard and Larry Summers had an fascinating change about rates of interest and secular stagnation, and goal inflation charges at this time, at PIIE. Blanchard talked about the evolution of r vs. g as a key situation in enthusiastic about secular stagnation, and this spurred me to have a look at the info.

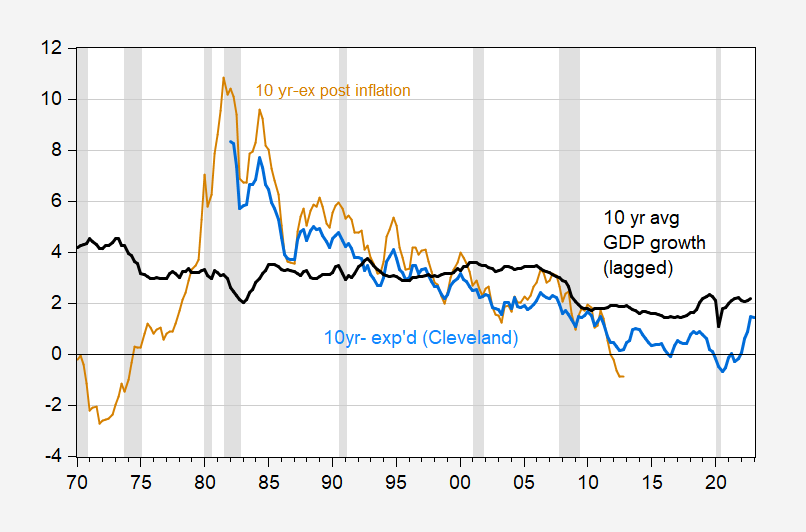

First, actual 10 yr Treasury charges adjusting for anticipated inflation, vs. 10 yr development charges over the earlier ten years.

FIgure 1: Ten yr Treasury yield adjusted by ex submit inflation (tan), by Cleveland Fed anticipated inflation (blue), and common development price of GDP over the earlier ten years (black). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, Cleveland Fed, BEA, NBER, and writer’s calculations.

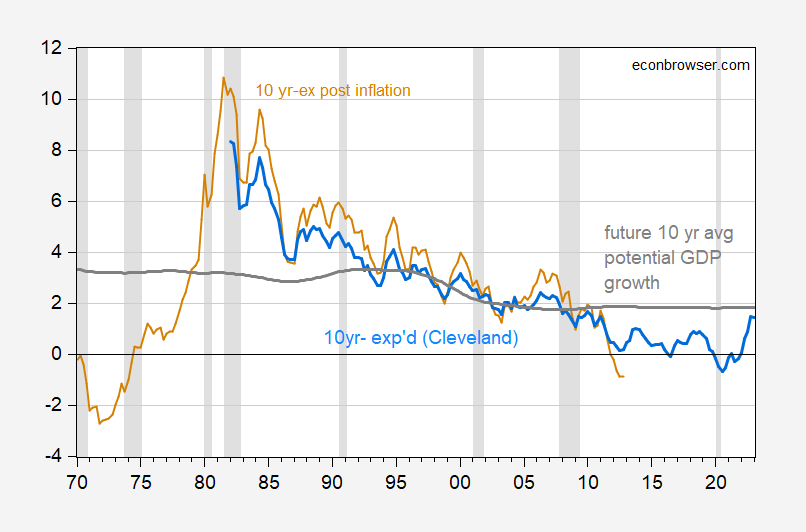

In actual fact, one could be higher considering of the true rate of interest vs. the expansion price over the related interval. We may calculate and use the ex submit development price of GDP (ending with the commentary in 2012Q4), however as a substitute I exploit CBO’s estimate of potential development.

FIgure 2: Ten yr Treasury yield adjusted by ex submit inflation (tan), by Cleveland Fed anticipated inflation (blue), and common development price of potential GDP over the following ten years (grey). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury through FRED, Cleveland Fed, CBO, NBER, and writer’s calculations.

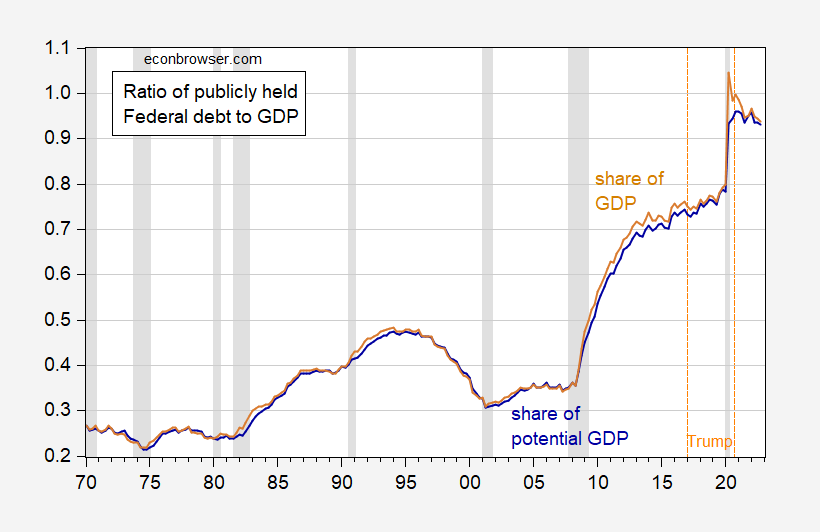

g > r for the previous decade, together with 2020-21. Proper now the 2 have converged, however given the evolution of those two charges over the current previous, we are able to see why the debt to GDP ratio has not exploded, submit-Trump, regardless of massive (in greenback phrases) deficits.

FIgure 3: Federal debt held by public as a share of GDP (tan), as share of potential GDP (darkish blue). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury, BEA through FRED, CBO, NBER, and writer’s calculations.

To recap, Debt-to-GDP dynamics are described by this expression.

(1) dt-dt-1 = [(rt-gt)/(1+gt)]× dt-1 – pt

The place d is the debt to GDP ratio, r is the true (inflation adjusted) rate of interest, g is the expansion price of actual GDP, and p is the first (noninterest) surplus to GDP ratio. In phrases, the debt to GDP ratio rises when the true curiosity rate-growth price hole is sufficiently constructive, or the first deficit is sufficiently massive.

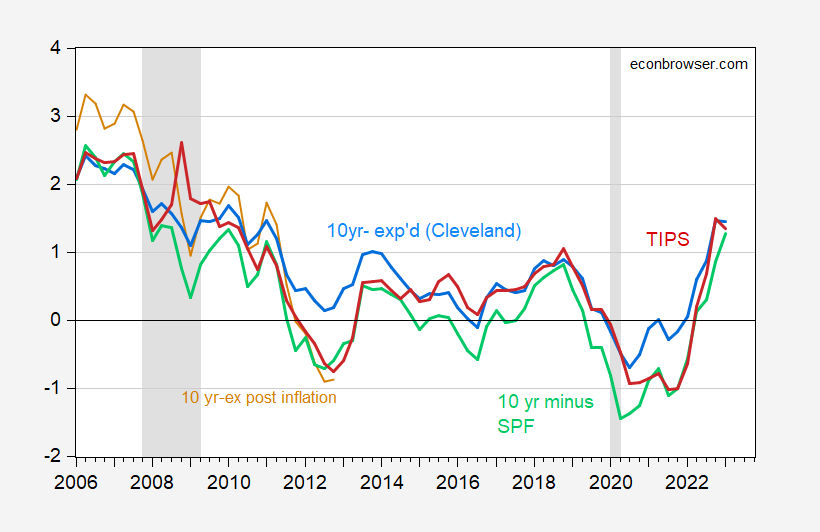

Notice that totally different measures of anticipated inflation yield related measures of the true 10 yr price as of the primary two months of 2023Q1.

FIgure 4: Ten yr Treasury yield adjusted by ex submit inflation over subsequent ten years (tan), by Cleveland Fed anticipated ten yr inflation (blue), by SPF median anticipated ten yr inflation (inexperienced), and TIPS ten yr yield (purple). NBER outlined peak-to-trough recession dates shaded grey. 2023Q1 commentary is for first two months. Supply: Treasury through FRED, Cleveland Fed, BEA, NBER, and writer’s calculations.

Clearly if actual charges additional rise, or development prospects diminish, then the debt dynamics don’t work to our benefit.

CBO’s newest projection places the ten yr price at 3.8% within the out years, and CPI inflation at 2.3%. Assuming the y/y inflation projected for 2028-2033 is the anticipated inflation price for the ten years forward, this implies the projected actual 10 yr rate of interest is 1.5%. The corresponding projected actual development price is 1.8%.

[ad_2]