[ad_1]

Estimates differ for the worth tag of the UK authorities curiosity funds in 2023. The one widespread thread is that they’re large, each by historic requirements and as compared with different international locations.

This partially is as a result of the UK public debt consists of an unusually giant share of bonds which are linked to inflation, a selection that proved to be quite costly at occasions of quick worth development. The result’s that the UK’s authorities curiosity funds are set to rise to 4.2 per cent of GDP this yr, about double the typical within the 20 years to 2022, and greater than double that of France, in keeping with the OECD. That is regardless of the UK has a a lot smaller public debt than France, at 87 and 112 per cent of GDP respectively.

The European Fee expects that UK curiosity funds will rise to three.2 per cent of GDP this yr, 1.3 proportion factors greater than in 2020, whereas the determine is broadly unchanged for the eurozone. UK debt prices rose to three.8 per cent of GDP in 2022 up almost 2 proportion factors in comparison with 2020 and the identical stage of Italy, in keeping with the score company S&P World. For the file, Italy’s public debt is big, at 147 per cent of GDP.

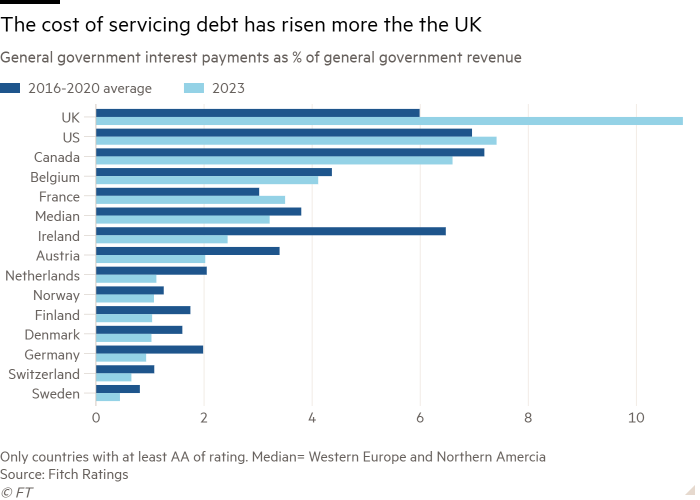

For the score company Fitch, UK curiosity funds amounted to over 10 per cent of presidency revenues in each 2022 and 2023. That is almost double its 2016-2020 common and by far the best determine for another nation with rated at the very least double AA. It’s solely 3.5 per cent for France.

Declining inflation is actually excellent news, however Fitch estimates that UK curiosity funds will nonetheless quantity to eight.7 per cent of revenues in 2024, in contrast with 2.3 per cent for AA-rated friends.

“We count on curiosity funds to stay elevated over the medium given increased authorities borrowing and the danger of extra persistent inflation,” mentioned Evan Wohlmann, Moody’s UK sovereign analyst.

How the UK discovered itself to this gap is not any thriller.

It began again within the Nineteen Eighties, when Britain was a pioneer of index-linked bonds, however the harm occurred 20 years later. The UK’s debt inventory that’s inflation linked has nearly quadrupled, from 6 per cent of GDP in 2000-01 to 22 per cent immediately. Spending rises by £6bn consequently for each proportion level enhance in retail worth index inflation, quite than £2bn if index-linked debt have been nonetheless at its 2000-01 ranges, in keeping with the OBR.

Germany and Spain maintain lower than 5 per cent in index-linked debt. Jonathan Camfield, accomplice on the pension advisor Lane Clark & Peacock mentioned that “in vital half, this displays the distinctive nature of the UK outlined profit pensions market.” He mentioned that no different nation has a big personal sector pensions market that requires firms to ensure pension schemes and requires inflation will increase on pensions.

Which means “index-linked authorities debt will at all times be the popular safe asset of selection for UK pension schemes. Different western governments shouldn’t have related demand from their native pension or insurance coverage markets,” he added.

Different elements are additionally at play, together with an total bigger debt inventory and the maturity of the debt inventory that has shortened. The latter “means rate of interest adjustments feed via into our debt inventory rapidly,” mentioned Cara Pacitti, senior economist on the Decision Basis, a think-tank. That features over £800bn in gilts held by the Financial institution of England on which the federal government successfully pays out curiosity at Financial institution charge.

Additional studying:

A shock looms for governments over inflation-linked bonds (FT)

Linkers in a chilly local weather — FTAV (2010)

[ad_2]