[ad_1]

By Revin Mikhael D. Ochave, Reporter

THE PHILIPPINE ECONOMY is now thought of “principally unfree” because it dropped 9 spots within the newest financial freedom rating by US-based assume tank The Heritage Basis.

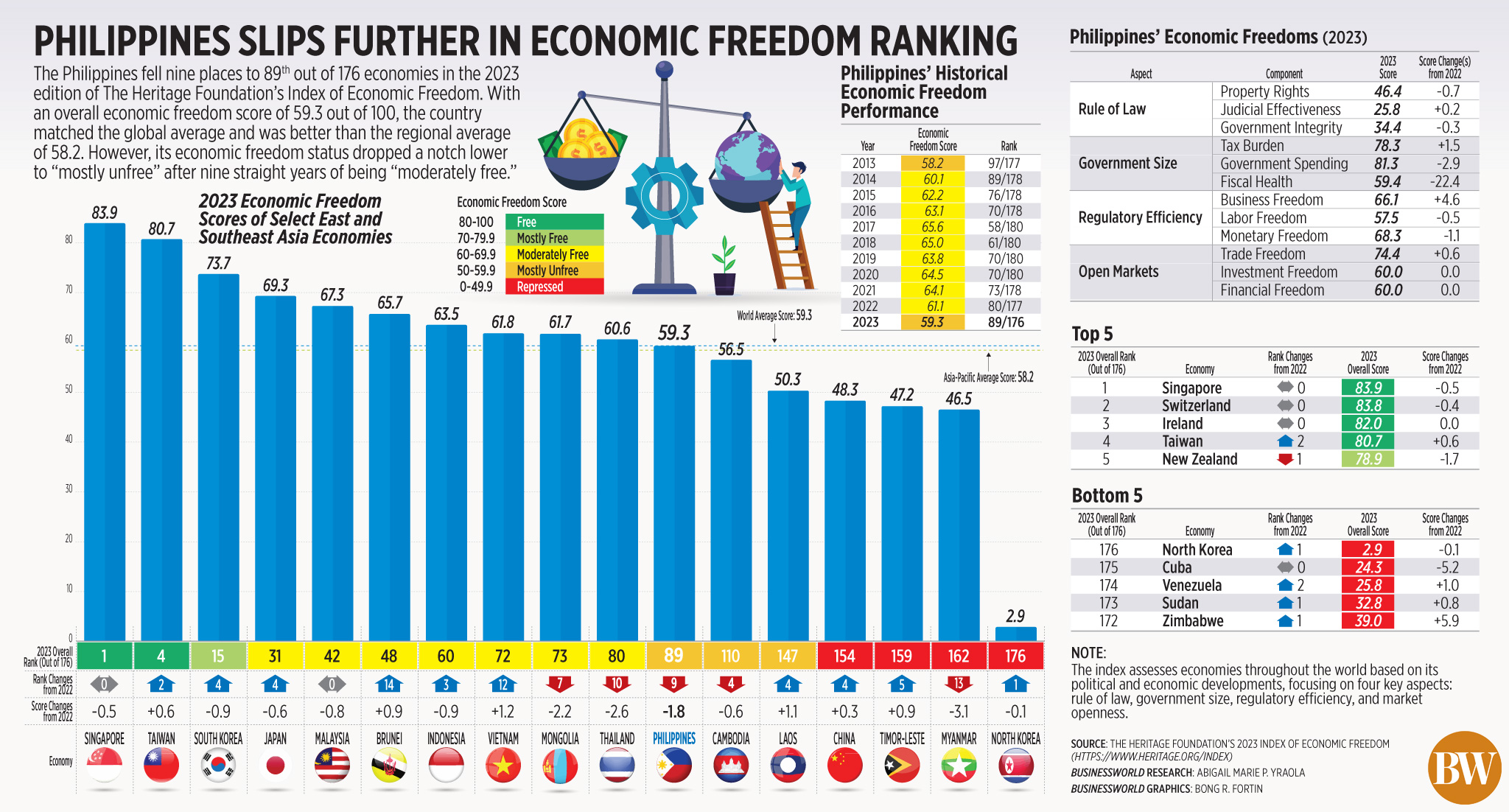

Within the 2023 Index of Financial Freedom report, the Philippines slumped to 89th out of 176 international locations with a rating of 59.3, 1.8 factors decrease than a 12 months in the past. Its financial freedom rating is roughly the world common.

Final 12 months, the Philippines ranked 80th out of 177 international locations with a rating of 61.1.

The nation’s newest rating is now equal to an financial freedom standing of “principally unfree,” after being “reasonably free” for 9 straight years.

The Philippines’ financial freedom rating has declined for a 3rd straight 12 months, after putting 73rd in 2021 and 80th in 2022. It stood at 70th place in 2019 and 2020.

Singapore was the world’s freest economic system, adopted by Switzerland, Eire, Taiwan, and New Zealand.

Amongst 39 Asia-Pacific international locations, the Philippines ranked 18th, lagging behind Malaysia (42th), Indonesia (60th), Vietnam (72nd) and Thailand (80th).

The Heritage Basis stated the Philippine authorities pushed for legislative reforms to enhance the entrepreneurial atmosphere and generate extra jobs.

“General progress has been gradual. There are institutional challenges that should be overcome. Regardless of some progress, corruption continues to undermine long-term financial improvement,” it stated.

The index analyzes economies utilizing 4 key elements: rule of regulation, authorities measurement, regulatory effectivity, and market openness.

“The general rule of regulation is weak within the Philippines. The nation’s property rights rating is beneath the world common; its judicial effectiveness rating is beneath the world common; and its authorities integrity rating is beneath the world common,” the Heritage Basis stated.

Below the regulatory efficiency, the Philippines improved its rating for enterprise freedom however noticed a decline in scores for labor and financial freedom.

The Heritage Basis famous that the Philippine enterprise regulatory atmosphere has usually been streamlined.

“The time and price concerned in coping with licensing necessities have been decreased. The labor market stays structurally inflexible, however rules are usually not significantly burdensome,” it added.

For market openness, the Philippines logged a better rating for commerce freedom, whereas scores for funding and financial freedom had been unchanged.

“The monetary sector is dominated by banking and comparatively steady, however capital markets are underdeveloped,” The Heritage Basis stated.

Hunted for remark, College of Asia and the Pacific (UA&P) Senior Economist Cid L. Terosa stated the nation’s financial freedom rating might be improved by addressing the rule of regulation considerations.

“The Philippines is woefully beneath the world common. Though judicial effectiveness has improved, property rights and authorities integrity fared poorly. Which means that a clearly specified and well-enforced construction of property rights continues to be a problem for the nation, and that wavering public belief in authorities continues to erode the legitimacy and credibility of the federal government,” Mr. Terosa informed BusinessWorld in an e-mail interview.

The federal government’s efforts to pursue digitalization may also assist enhance transparency and cut back corruption, he added.

Mr. Terosa stated the Philippines ought to enhance its scores in regulatory efficiency and open markets after the passage of key financial reforms such because the amendments to the Overseas Funding Act, Retail Commerce Liberalization Act, Public Service Act, and the Company Restoration and Tax Incentives for Enterprises Act.

He stated participation within the Regional Complete Financial Partnership (RCEP) commerce deal will enhance the nation’s financial freedom rating as it’s “a sign of the federal government’s want to strengthen and facilitate commerce and funding, analysis and improvement, expertise switch, and public-private partnerships.”

Touted because the world’s largest free commerce settlement, the RCEP is about to take effect for the Philippines round Might. It contains Australia, China, Japan, South Korea, New Zealand and members of the Affiliation of Southeast Asian Nations.

Ebb Hinchliffe, American Chamber of Commerce of the Philippines (AmCham) govt director, stated that the nation’s rating was not a shock as a consequence of financial challenges.

“This information is saddening however not stunning since our economic system has been badly affected by the coronavirus illness 2019 (COVID-19) pandemic, excessive overseas debt and regional disturbances. Nevertheless, the chamber stays optimistic about the way forward for the Philippines,” Mr. Hinchliffe stated in a Viber message.

Mr. Hinchliffe stated digitalization of presidency processes would handle corruption and mitigate bribery.

“We acknowledge that corruption appears to be a mainstay within the Philippines — however so is the world, and it could possibly certainly be discouraging for potential traders. AmCham firmly helps measures that will strengthen accountability, transparency, and promote checks and balances in all public workplaces,” he stated.

The passage of legal guidelines on ease of doing enterprise, freedom of knowledge and the creation of the Anti-Pink Tape Authority “signifies that the federal government is severe about eliminating corruption,” Mr. Hinchliffe stated.

Calixto V. Chikiamco, Basis for Financial Freedom president, informed BusinessWorld in a Viber message that the Philippines’ financial freedom rating would enhance if it amends some provisions of the 1987 Structure.

“Take away the Filipino First and Filipino Solely provisions within the (1987) Structure as a result of it is going to enhance honest competitors and improve selection,” Mr. Chikiamco stated.

On Feb. 28, a invoice containing the procedures for Constitution change by way of a hybrid constitutional conference handed on second studying on the Home of Representatives.

[ad_2]