[ad_1]

By Helen Solar, Bloomberg markets stay reporter and strategist

The PBOC injected a internet 199b yuan of medium-term loans Wednesday, 1b yuan shy of the market expectation. That is the second month in a row it determined to not present liquidity in a spherical quantity (was 779b in January), signaling its cautious stance in opposition to extreme liquidity within the monetary system.

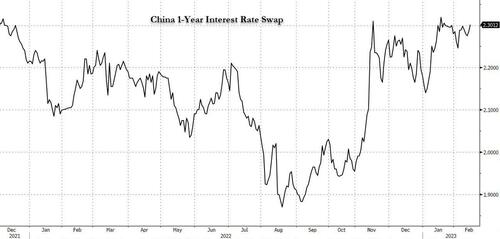

This may in all probability put a flooring underneath China’s fee swaps and money-market charges, barring any surprises on the financial restoration.

Immediately, the price of 1-year interest-rate swaps climbed to a two-week excessive, nearing the latest peak reached in November 2022, and can in all probability keep elevated.

The central financial institution gauges lenders’ wants for such funds forward of its operations, and within the assertion as we speak it stated demand from monetary establishments has been “sufficiently met.” In one other signal of its cautiousness, the PBOC has been draining funds for 3 consecutive days within the every day reverse repo operations, pulling a mixed 844b yuan after injecting a internet 1t yuan that helped to deliver the in a single day funding value off a two-year excessive.

Loading…

[ad_2]