[ad_1]

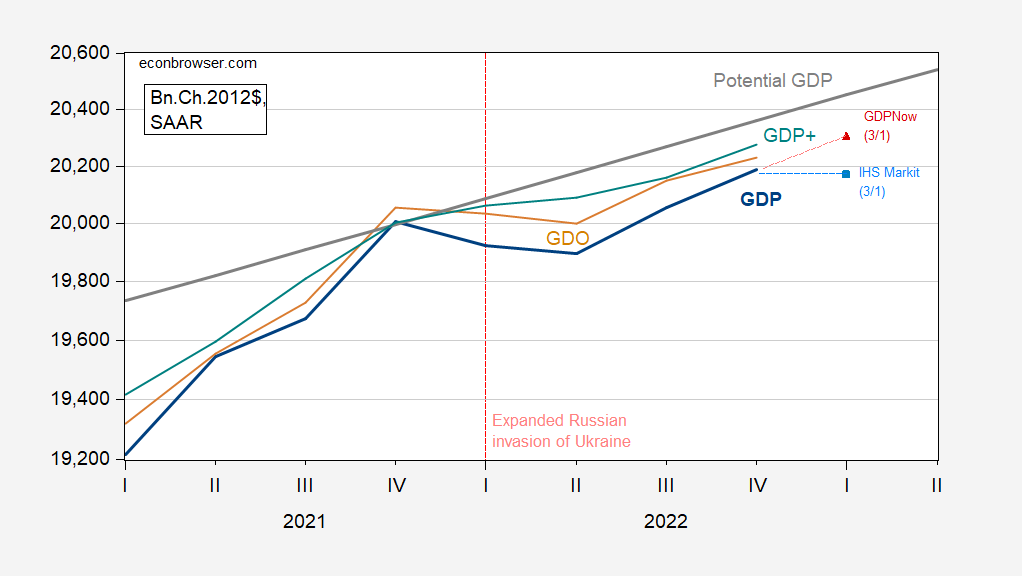

We have now a 2nd launch for GDP, and nowcasts for Q1. We even have GDP+ and a guess for GDO for This autumn. That is the image, taking CBO’s estimate of potential GDP.

Determine 1: GDP (blue), GDO (tan), GDP+ (teal), nowcast from Atlanta Fed (pink triangle), and IHS Markit/S&P World (sky blue sq.), and potential GDP (grey line), all in billions Ch.2012$ SAAR. GDO estimate holds enterprise surplus in GDI fixed at nominal 2022Q3 ranges. GDP+ cumulates development charges onto 2019Q4. Supply: BEA 2nd launch, Philadelphia Fed, Atlanta Fed (3/1), S&P World (3/1), CBO Finances and Financial Outlook, February 2023, and writer’s calculations.

Curiously, even estimates of sturdy financial development, comparable to within the Atlanta Fed’s GDPNow estimate of two.3% q/q SAAR for Q1, fail to considerably shut the estimated output hole.

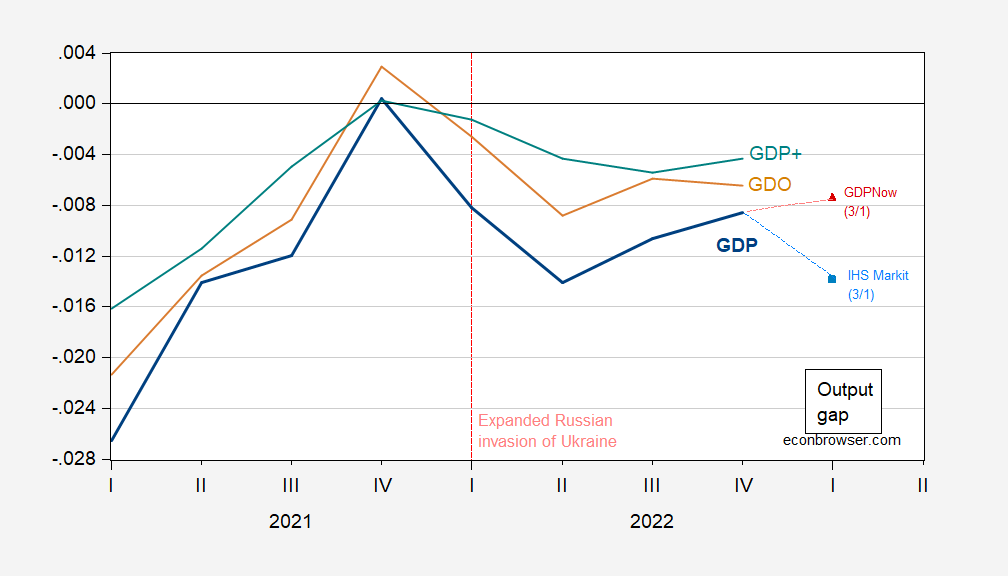

It’s attention-grabbing to watch that the output hole went unfavourable with the shock induced by the expanded Russian invasion of Ukraine in February 2022.

Determine 2: Output hole implied by GDP (blue), GDO (tan), GDP+ (teal), nowcast from Atlanta Fed (pink triangle), and IHS Markit/S&P World (sky blue sq.). GDO estimate holds enterprise surplus in GDI fixed at nominal 2022Q3 ranges. GDP+ cumulates development charges onto 2019Q4. Supply: BEA 2nd launch, Philadelphia Fed, Atlanta Fed (3/1), S&P World (3/1), CBO Finances and Financial Outlook, February 2023, and writer’s calculations.

The output hole as of 2022Q4 is between -0.4 and -0.8 share factors of GDP, relying on measure. IHS Markit/S&P World sees a recession coming in 2023, with its nowcast indicating a widening of output hole at the same time as nowcasted development is simply barely unfavourable in Q1 (at -0.3% annualized).

[ad_2]