[ad_1]

Is it time to return into rising markets? Institutional buyers actually assume so. They’ve poured cash into rising market shares and bonds at a near-record price this yr.

With the IMF predicting that the worldwide economic system is prone to do higher in 2023 than it thought even just a few months in the past, rising market bulls say this might be a very good second to look once more at growing economies and their hopes of catching up with the industrialised world.

However the bears marvel whether it is actually the suitable time to return to markets which might be much less predictable than most, at a time of appreciable geopolitical uncertainty.

The query is especially difficult for retail buyers who might lack the assets correctly to analysis markets which might be typically distant and opaque.

“We really feel there’s worth in searching for out the higher worth nations and areas in rising markets — however you need to go in together with your eyes open,” says Mark Preskett, senior portfolio supervisor at funding administration and analysis agency Morningstar. “It’s very straightforward to get it flawed and for a rustic to remain out of favour for years.”

Too typically, rising market belongings are buffeted by world storms that neither governments nor company executives can do a lot about. However for savers who can trip these waves and keep invested in a diversified portfolio for the long run, the returns may be rewarding.

FT Cash takes a take a look at whether or not readers ought to dive in or maintain their toes firmly on the shore.

Assorted and risky

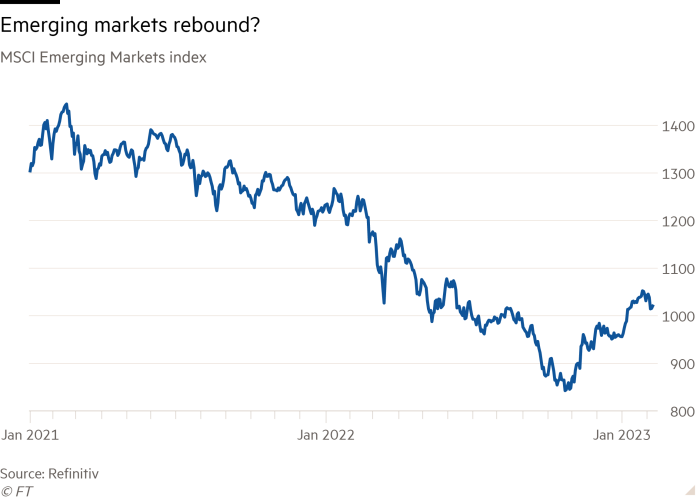

If proof was wanted that rising markets are risky, final yr delivered it in bucketfuls. For the primary 9 months of the yr, overseas buyers — principally large establishments resembling pension funds, banks and insurers — fled rising market shares and bonds on a scale by no means earlier than seen within the historical past of the asset class — not since western funding managers made their first important inroads within the Eighties.

However in October all the things modified and buyers flooded again in. Since early 2023, the benchmark MSCI Rising Market equities index has been buying and selling 20 per cent or extra above final yr’s low — which means it’s again in a bull market.

Does this volatility reinforce the message to retail buyers that they need to keep away? Or is that this upswing an indication of a sustained restoration providing even these buyers who purchase now loads of revenue? Even after the restoration, EM equities are nonetheless about 30 per cent under their peak in February 2021.

Preskett at Morningstar says retail buyers ought to take a cautiously constructive view. “We might see rising markets virtually as a core asset class, the place your weighting is dependent upon your angle to danger.”

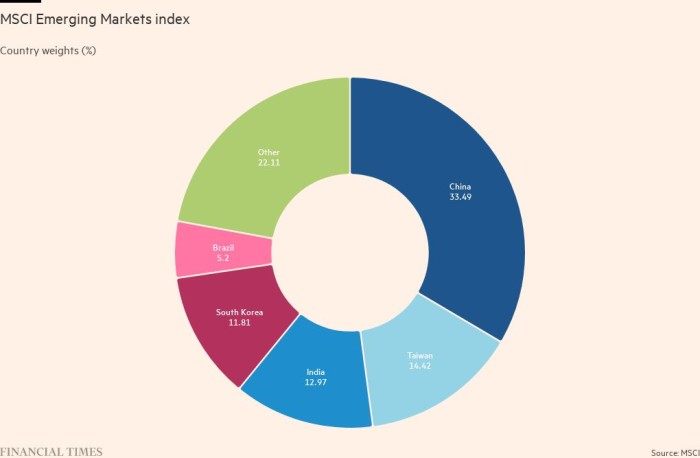

Many retail buyers, he notes, will already be uncovered to rising markets by way of funds that observe world fairness indices. The extensively adopted MSCI All Nation World Index, for instance, has about 11 per cent of its weight in rising market shares, together with 3 per cent in China alone. (Some would say these weightings needs to be bigger: China’s weighting is lower than that of both Apple, at 3.7 per cent, or Microsoft, at simply over 3 per cent.)

But, José Mazoy, world chief funding officer at Santander Asset Administration, says personal buyers ought to take nice care in venturing any additional, and “solely make investments that match their danger profile”.

Emphasising that his considerations prolong past rising markets to the general outlook, he provides: “Within the context of worldwide diversified portfolios, we stay usually cautious on equities.”

Potential patrons ought to keep in mind that, given the additional volatility, EM forecasts can go flawed way more spectacularly than mainstream market predictions.

Excessive charges hit hopes

Simply 12 months in the past, many analysts anticipated 2022 to be a very good yr for the asset class, as coronavirus lockdowns and journey restrictions have been lifted.

Russia’s full-on invasion of Ukraine modified all that, regardless that some commodity exporters quickly benefited from sharply rising costs. Even they have been hit quickly after by the consequences of rising world inflation, climbing rates of interest and a strengthening US greenback. Few analysts anyplace had anticipated the yield on benchmark 10-year US Treasuries to greater than double from lower than 2 per cent in February to greater than 4 per cent by October.

Excessive US charges and a robust greenback are anathema for rising market buyers. Because the rewards supplied by safe-looking belongings resembling US Treasury bonds rise, and the greenback appreciates, investing in rising markets appears to be like much less interesting.

Nor have been Ukraine or the greenback/charges mixture the one elements in a tough yr. Paul Greer, portfolio supervisor for EM fastened revenue at Constancy Worldwide, says the “absolute nadir” got here in October with “the entire episode of fiscal chaos within the UK” underneath shortlived prime minister Liz Truss, mixed with the Communist social gathering congress in China, which recommended that president Xi Jinping would stick together with his hardline zero-Covid insurance policies.

UK fiscal turmoil issues to EM belongings as a result of it bears on buyers’ willingness to take dangers, particularly for the various fund managers primarily based within the UK.

China’s zero-Covid insurance policies — and China’s economic system extra broadly — matter way more. Because it joined the World Commerce Group in December 2001, China’s fast-growing economic system, with its hovering demand for supplies and manufactured items from different growing nations, has been one other large driver of EM efficiency.

However China’s progress, operating at greater than 10 per cent a yr within the early 2000s, slowed to lower than 6 per cent in 2019 and simply 2.2 per cent within the first pandemic yr of 2020.

Progress rebounded to eight per cent in 2021 however then Xi’s zero-Covid insurance policies despatched it tumbling once more to three.2 per cent final yr. The IMF doesn’t count on a lot of a bounce again — it forecasts progress of lower than 5 per cent a yr for the subsequent 4 years.

Not surprisingly, the MSCI China dollar-denominated fairness index misplaced virtually two-thirds of its worth between mid February 2021 and the tip of October 2022. This was dangerous for rising market equities extra broadly, with Chinese language shares making up a 3rd of the MSCI Rising Markets benchmark index.

However quickly after final October’s nadir, Truss stop and Xi delivered a 180-degree U-turn. On the identical time, indicators started to emerge that world inflation might be close to its peak and that the US Federal Reserve would quickly sluggish the tempo of its rate of interest rises.

Traders sensed a possibility and jumped on it. Chinese language shares rallied, recovering a 3rd of their losses, and lifted the MSCI Rising Markets index as buyers poured in.

A sustained restoration?

So what subsequent? Jahangir Azia, an analyst at JPMorgan, says there’s “lots of fuel within the tank” for additional funds inflows provided that rates of interest, the greenback and the Chinese language economic system are all now transferring in EMs’ favour.

Furthermore, after a while within the doldrums, rising economies are as soon as once more set to develop quicker than the superior world. JPMorgan economists count on GDP in rising markets to develop by 1.4 share factors greater than the speed in superior economies this yr, up from zero within the second half of 2022.

The IMF’s newest revisions give EMs an additional increase. It says that whereas the tempo of GDP progress in superior economies will sluggish this yr, rising and growing economies turned the nook final yr and can develop by a mean of 4 per cent this yr and 4.2 per cent in 2024, up from 3.9 per cent in 2022. That compares with simply 1.2 per cent in superior economies this yr and 1.4 per cent in 2024, down from an estimated 2.7 per cent in 2022.

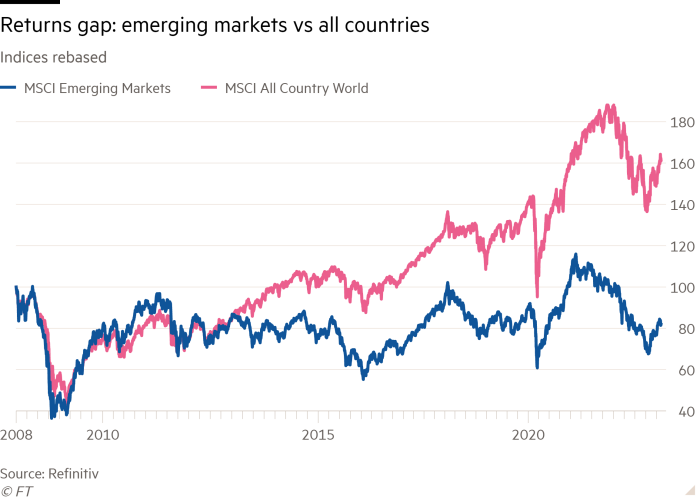

The prospect of accelerating progress in rising markets is a welcome change for EM belongings. Ever because the 2008 world monetary disaster, many rising economies have struggled to copy their robust pre-crisis progress.

On prime of this, a transparent decelerate within the extended surge in funding into US tech shares means risk-on buyers are searching for different progress alternatives.

“I firmly imagine there’s solely a lot funding capital to go round and it has all been channelled into US progress shares,” says Preskett at Morningstar. “If we do get a change on this perceived exceptionalism of US progress shares, capital would possibly begin flowing the opposite method and be interested in rising markets.”

For EM bulls, it’s a heady mixture of positives: falling inflation and rates of interest; a weaker US greenback; a restoration of progress in China and, by extension, in different rising economies, and huge quantities of funding capital searching for a brand new house.

But when they do rise, not all rising markets will rise collectively. The times when the Brics — Brazil, Russia, India, China and South Africa — have been anticipated to drive world progress and funding returns in lockstep are lengthy gone. Russia has self-destructed as an funding prospect. South Africa has didn’t dwell as much as its promise. Different EM groupings — Civets, Eagles or Mints, anybody? — have come and gone as nations have more and more adopted extra various financial paths.

Beneath Morningstar’s projections for the subsequent 10 years, the nations with the very best anticipated fairness market annual returns are all in rising markets: Brazil (12.9 per cent), China (11.1 per cent) and South Korea (10.4 per cent), with the very best projected returns in developed markets in fourth-placed Germany, at 9.6 per cent. By comparability, Morningstar expects the UK to return 7.8 per cent and the US, 3.5 per cent.

Additionally, some EM fairness valuations are low, providing a very good entry level — so long as they then get better. For instance, Brazilian equities are at about 7.3 occasions ahead earnings, effectively under their 10-year common of 11.3 occasions.

However would-be buyers ought to notice that after their latest surge, Chinese language shares usually are not so low-cost — the FTSE China fairness index trades at about 10.7 occasions projected ahead earnings, just under the 10-year common of 11.2, in line with S&P Capital IQ.

Greer at Constancy Worldwide says: “Will probably be a bit extra incremental from right here on. We might have seen the lion’s share of the rally on this cycle.”

As at all times in rising markets, count on volatility. Not one of the elements of their favour is everlasting. Surprising shocks might come, as they did, in dramatic trend, final yr.

In Preskett’s view, most retail buyers have but to be satisfied, regardless of the latest market restoration and the beneficial prospects. “It is a very unloved rally,” he says. And it’s straightforward to see why. “Should you learn the headlines, try to be staying away.”

Consultants’ rising market suggestions

For institutional buyers, inventory markets are dwarfed by bond markets. However retail buyers concentrate on fairness markets, the place long-term returns have historically been larger.

Additionally, rising market bonds may be particularly dangerous, by fixed-income requirements, given a historical past of sharp swings in rates of interest and alternate charges. And since EM bonds and shares are extra intently correlated, EM bonds don’t supply the diversification supplied by superior economic system bonds.

Dzmitry Lipski, head of funds analysis at Interactive Investor, the funding platform, says 2022’s EM fairness worth swings exhibit the “important dangers” but additionally the “engaging alternatives” for long-term buyers.

Be “very cautious and selective”, he says. Interactive Investor recommends an allocation of simply 10 per cent to EM equities in its mannequin progress portfolios.

His picks embody: Utilico Rising Markets Belief: invests in infrastructure and utilities, primarily in Asia, Latin America, rising Europe and Africa.

M&G Rising Markets Bond fund: invests in authorities and company bonds, cut up about 70/30, in native currencies and US {dollars}. Prime nations embody Brazil, Indonesia, South Africa and Mexico.

Stewart Traders International Rising Markets Sustainability fund: buys EM mid-to-large-cap corporations targeted on sustainable improvement, aiming for long-term capital progress. Half the portfolio is invested in expertise and shopper staples, with virtually 70 per cent in rising Asia.

Laith Khalaf, head of funding evaluation at AJ Bell, additionally likes the Stewart fund. His different decisions are:

Constancy Rising Markets: run by the skilled Nick Value and a robust workforce who search high quality progress corporations.

Lazard Rising Markets: targeted on attractively priced large-cap corporations with sturdy profitability.

Morningstar’s Mark Preskett recommends an fairness revenue and a bond fund:

JPM Rising Markets Revenue: this targets increased dividend-paying shares, providing a sexy yield and the entire return potential of investments within the growing world.

L&G Rising Market Markets Authorities Bond (Native Foreign money) Index: an index tracker fund providing a low-cost technique of accessing rising market bonds. The present distribution yield is a helpful 5 per cent.

[ad_2]