[ad_1]

Bluntly put, time period spreads moved towards inversion, and inflation expectations adjusted for premia elevated. VIX has been elevated since February 2022, and GeoPolitical Threat rose within the interval proper after the invasion. Progress, which had been accelerating in keeping with weekly indicators, then decelerated. In different phrases, “Thanks, Putin”.

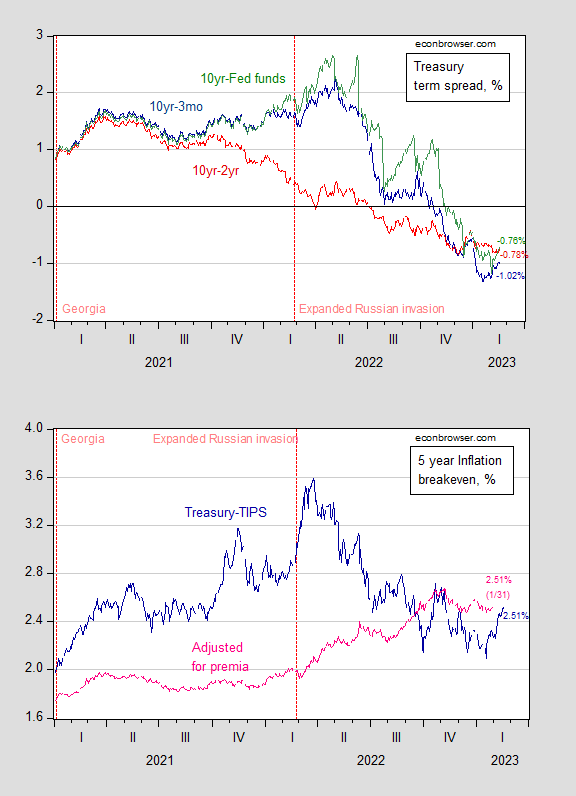

Determine 1: Prime panel: 10 yr – 3 month Treasury unfold (blue), 10 yr – 2 yr unfold (purple), 10 yr – Fed funds unfold (inexperienced), all in %. Backside panel: 5 yr Treasury – TIPS unfold (darkish blue), and 5 yr anticipated inflation (pink), each in %. Supply: Treasury through FRED, and KWW following D’amico, Kim and Wei (DKW) accessed 2/18,

Discover that whereas Treasury-TIPS unfold widens instantly after which drops within the wake of the invasion, inflation expectations measured after accounting for danger and time period premia have risen fairly repeatedly because the invasion.

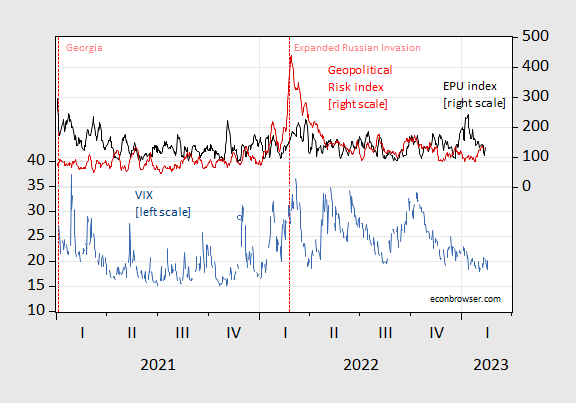

Determine 2: VIX (blue, left scale), and Financial Coverage Uncertainty index, centered 7 day transferring common (black, proper scale), Geopolitical Threat index, centered 7 day transferring common (purple, proper scale). Supply: CBOE through FRED, policyuncertainty.com through FRED, Caldara/Iacoviello, and writer’s calculations.

The VIX has been elevated — as has the Geopolitical Threat index — because the invasion.

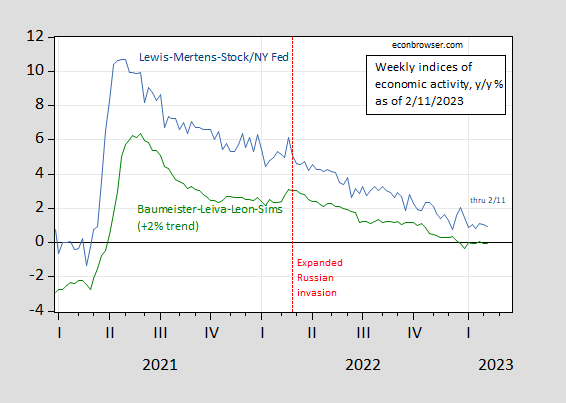

Given these observations, it’s not mysterious that top frequency indicators of financial exercise resumed a decline with the invasion.

Determine 3: Lewis-Mertens-Inventory Weekly Financial Index (blue), Baumeister-Leiva-Leon-Sims Weekly Financial Circumstances Index for US plus 2% pattern (inexperienced). Supply: NY Fed through FRED, WECI, and writer’s calculations.

[ad_2]