[ad_1]

Readers could query why the New York Fed would publish a analysis paper that described a brand new mechanism by which the US caring solely in regards to the results of its financial coverage on the US might have dangerous results on growing economies.

On the IMF, the analysis arm has lengthy been to the left of the “program” and has typically issued papers which describe how austerity is counterproductive. A well-known one within the early 2010s decided that in weak economies, fiscal multipliers had been over one, which in layperson communicate meant finances cuts would really worsen debt to GDP ratios as a result of the financial system would contract greater than the discount in borrowing. Thoughts you, this key perception had little influence on how the IMF does enterprise.

The Fed hires very vivid financial economists. Whereas some could search to remain on the Fed, for many, a promising profession path is to land within the analysis arm of an enormous Wall Avenue agency or cash supervisor. For them, publishing insightful papers is profession enhancing. Additionally they make the Fed appear like extra of an sincere mental dealer whereas being not possible to spur requires change.

A protracted-standing criticism of the Fed’s lack of curiosity on the worldwide results of its curiosity strikes is that sizzling cash washes out and in of higher-risk growing economies. A gaggle of central bankers complained to Bernanke throughout his 2014 taper tantrum, to no avail. As we wrote in 2015:

India’s central financial institution governor Raghuram Rajan took to Bloomberg to criticize the Fed for its failure to coordinate insurance policies with the remainder of the world. And Rajan can’t be dismissed as a partisan defending his nation’s insurance policies. Rajan is a Critical Economist, former IMF chief economist, and finest recognized in fashionable circles for presenting a badly-received paper at Greenspan’s final Jackson Gap session that stated that monetary innovation was making the world riskier and will properly trigger a full blown monetary disaster. And he assumed workplace solely final September, so he’s additionally not defending insurance policies he carried out…

Rajan is blunt by the requirements of official discourse:

A few of his key factors:

Rising markets had been damage each by the straightforward cash which flowed into their economies and made it simpler to neglect in regards to the vital reforms, the mandatory fiscal actions that needed to be taken, on high of the truth that rising markets tried to help world development by large fiscal and financial stimulus throughout the rising markets. This simple cash, which overlaid already robust fiscal stimulus from these nations. The rationale rising markets had been sad with this simple cash is “That is going to make it troublesome for us to do the mandatory adjustment.” And the economic nations at this level stated, “What would you like us to do, now we have weak economies, we’ll do no matter we have to do. Let the cash stream.”

Now when they’re withdrawing that cash, they’re saying, “You complained when it went in. Why do you have to complain when it went out?” And we complain for a similar cause when it goes out as when it goes in: it distorts our economies, and the cash coming in made it harder for us to do the adjustment we’d like for the sustainable development and to arrange for the cash going out.

Again to the present submit. In The Greenback’s Imperial Cycle, New York Fed authors Ozge Akinci, Gianluca Benigno (professor of economics on the College of Lausanne) and

Serra Pelin describe how greenback pricing of exports whipsaws rising economies, each by making their items much less aggressive and by making dollar-based financing extra expensive. From their article:

Behind our evaluation lies a multi-polar characterization of the worldwide financial system, comprised of america, superior financial system nations, and rising market economies. In our multi-country DSGE mannequin, as within the Dominant Foreign money Paradigm (DCP), we assume that corporations within the rising market bloc set their export costs in {dollars} whereas corporations in superior financial system nations set export costs in their very own foreign money. A stronger greenback due to this fact creates a aggressive drawback for rising market economies. We additionally assume that there are financing constraints in order that corporations have to borrow in {dollars} to finance purchases of imported intermediate inputs. As we present in our mannequin simulations, introduced in a current workers report, these two forces make greenback appreciation notably detrimental for the manufacturing sector in rising market economies.

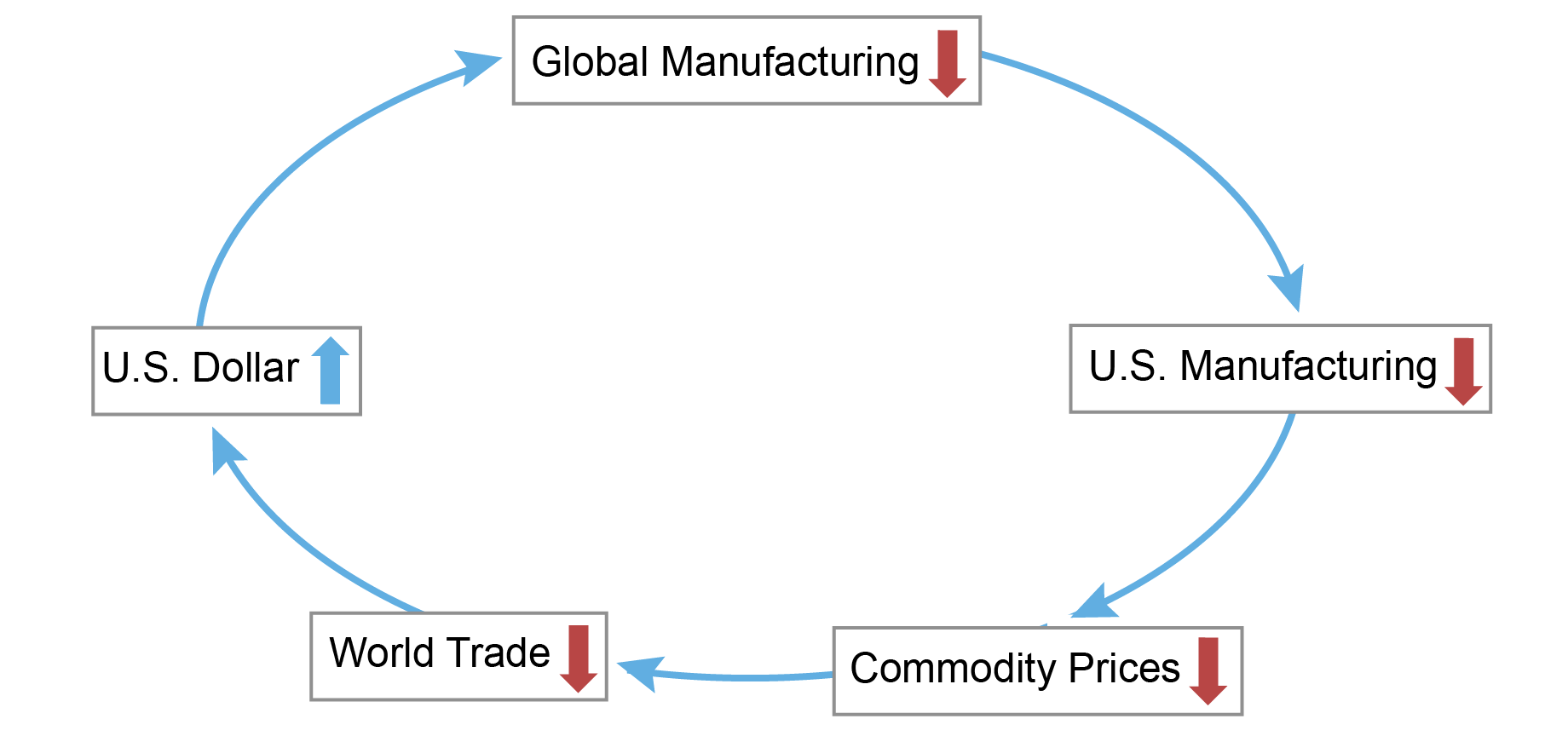

The chart under visualizes the Greenback’s Imperial Circle. A tightening of U.S. financial coverage units the circle in movement, producing an appreciation of the greenback. Given the structural options of the worldwide financial system, tighter coverage and an appreciation of the greenback result in a contraction in manufacturing exercise globally, led by a comparatively bigger decline in rising market economies. The ensuing contraction in world (ex-U.S.) manufacturing will spill again to the U.S. manufacturing sector because of the discount in international last demand for U.S. items. These similar forces can even result in a drop in commodity costs and world commerce. Within the last flip of our mechanism, provided that the U.S. financial system is comparatively much less uncovered to world developments, the contraction of worldwide manufacturing and world commerce is related to an extra strengthening of the greenback, reinforcing the circle.

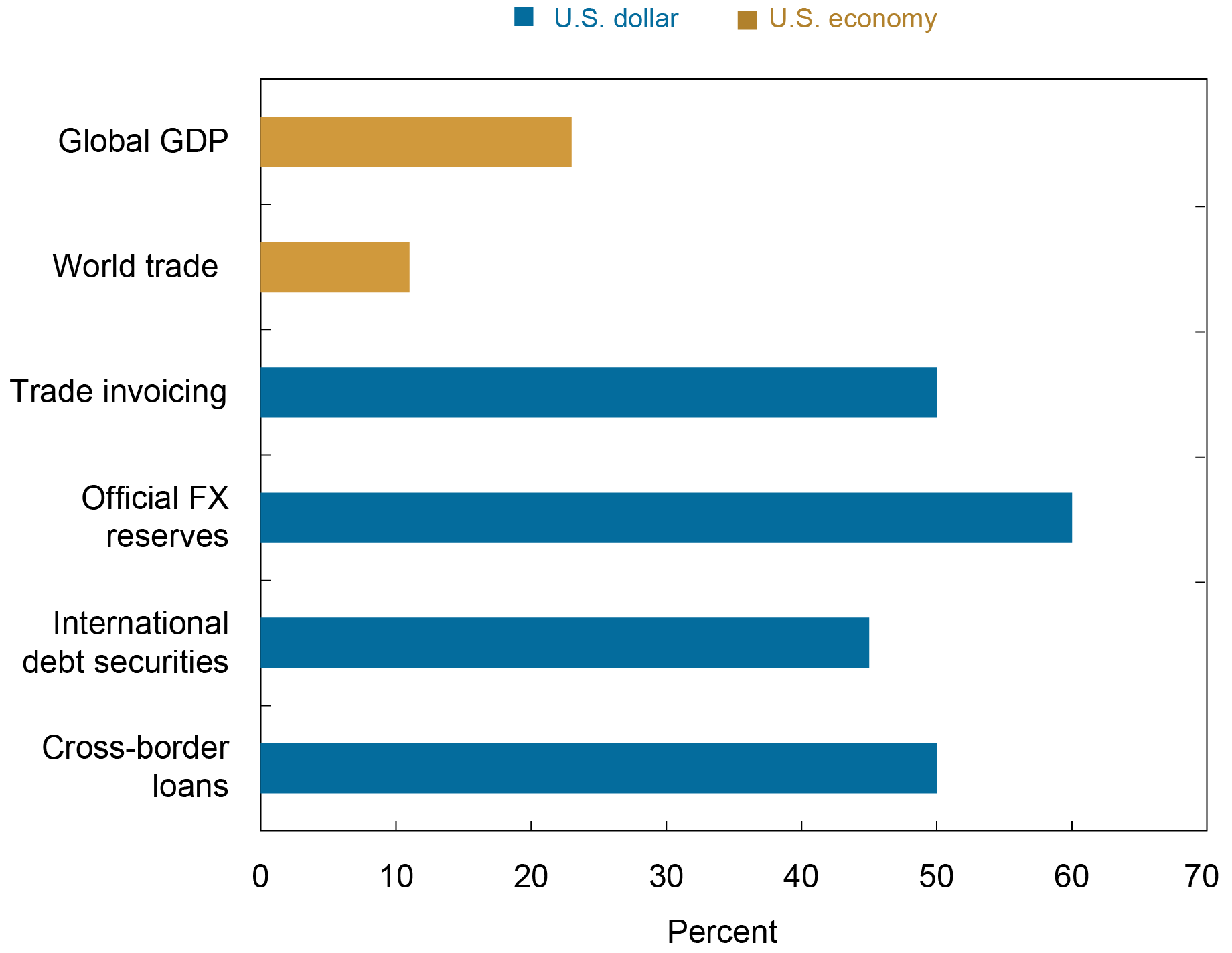

Behind the Greenback’s Imperial Circle are two key asymmetries within the construction of the worldwide financial system and the U.S. financial system. The primary asymmetry arises from the truth that world use of the greenback within the worldwide financial system tremendously exceeds the relative measurement of the U.S. financial system. The next chart captures this basic asymmetry.

…. Moreover its dominant function in commerce invoicing, the U.S. greenback can be the dominant foreign money in worldwide banking. About 60 p.c of worldwide and international foreign money liabilities and claims are denominated in U.S. {dollars} (see Bertaut et al. (2021)).

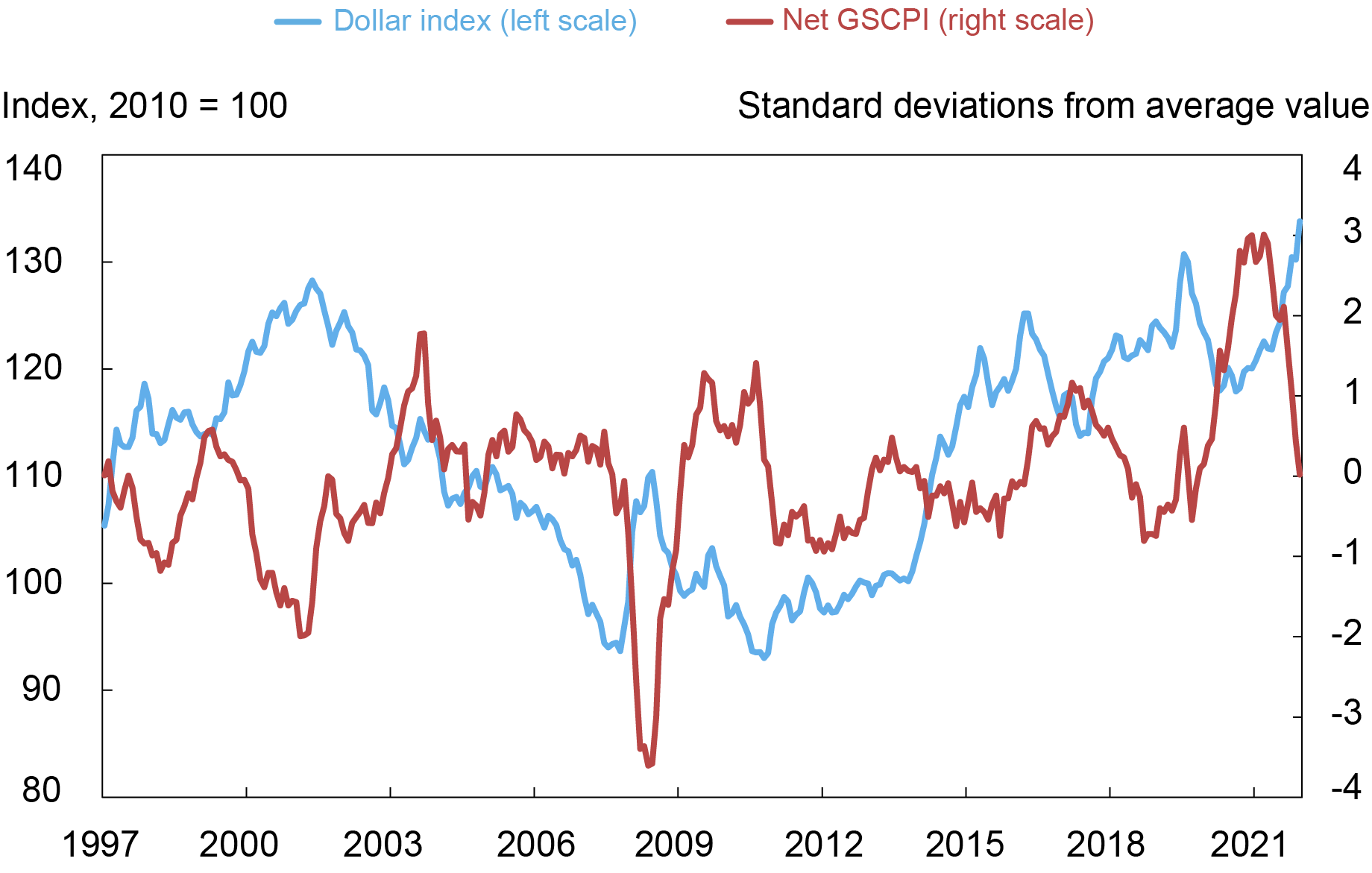

As well as, as mentioned by Bruno and Shin (2021), a powerful greenback tends to scale back the supply of the greenback financing wanted to help provide chain linkages. In consequence, actions within the greenback have an effect on world exercise by way of this monetary channel. The chart under captures the hyperlink between the broad greenback index and world provide chain imbalances, a measure that builds upon the New York Fed’s International Provide Chain Strain Index (GSCPI).

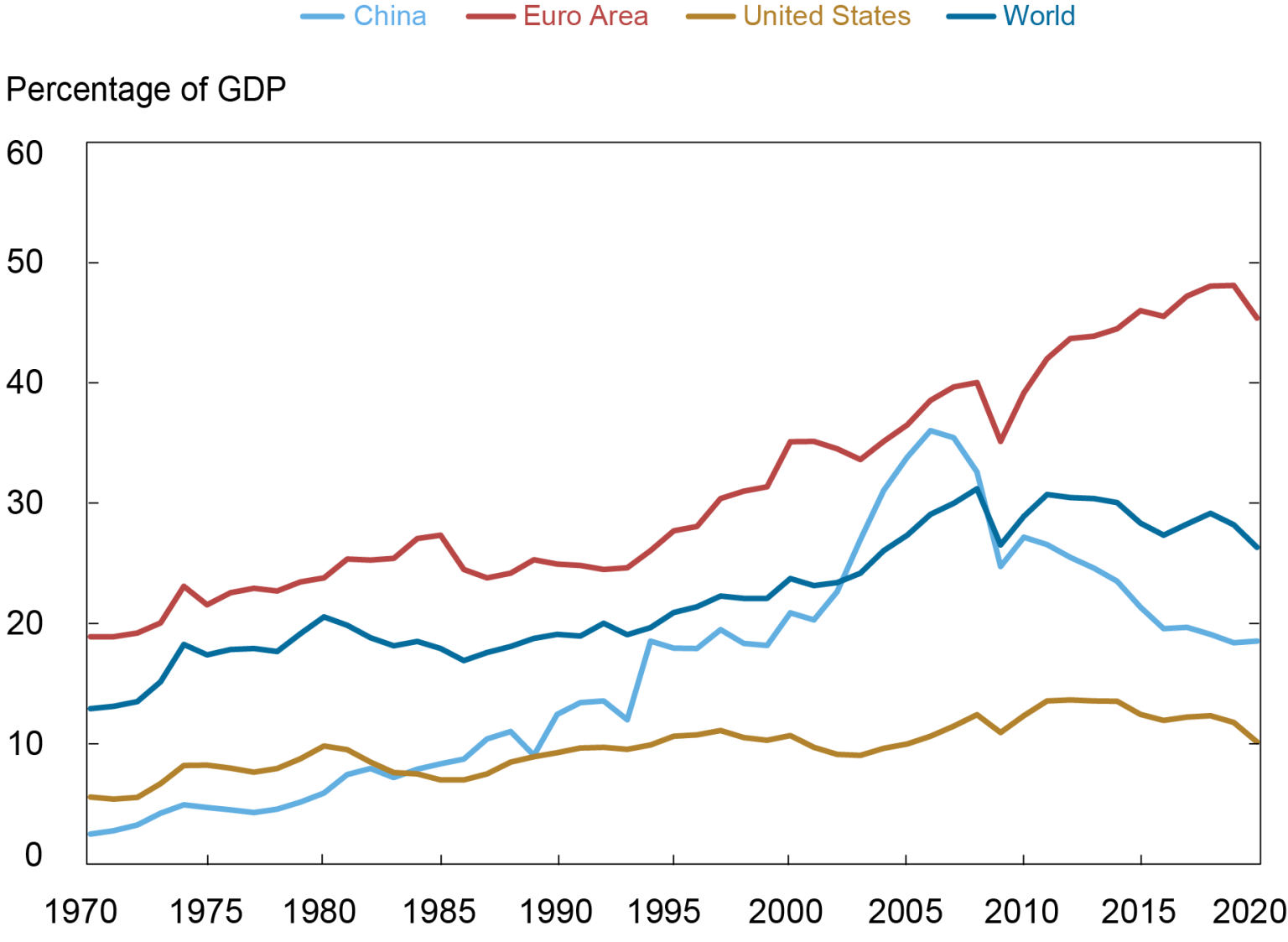

The second asymmetry happens because the U.S. financial system is much less uncovered to actions in world commerce relative to its buying and selling companions….

There’s extra in this intelligent and well-presented paper, which I encourage you to learn in full, however the extracts above provide the gist of the argument.

Discover that the impact of rate of interest improve and greenback worth actions on commerce invoicing and dollar-based (as in typically commerce) financing is to amplify financial cycles, which will increase volatility and instability. Economists name that “procyclical” which = “dangerous”.

The second is that despite the fact that the world has develop into extra globalized, the US export share of GDP is low by world requirements and therefore we aren’t a lot affected even not directly (as in by rate of interest tightening whacking our export companions).

I hope you’ll ship this paper round to probably readers.

[ad_2]