[ad_1]

From Fout and Duncan, Journal of Structured Finance (2020):

Supply: Fout and Duncan (2020).

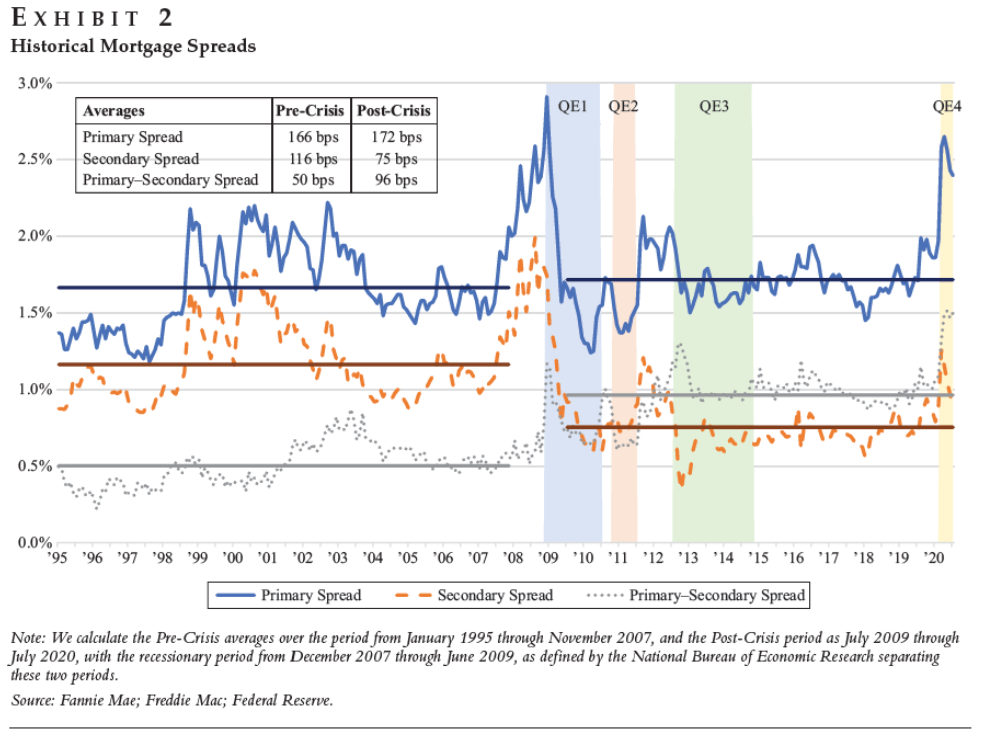

The “Major Unfold” is the 30 12 months mounted charge mortgage charge and 10 12 months Treasury. The “Secondary Unfold” is the distinction between the return on mortgage backed securities and 10 12 months Treasury. The “Secondary-Major Unfold” is the distinction between the 30 12 months mounted charge mortgage and the mortgage backed securities return.

From the abstract:

• Mortgage spreads, particularly the first–secondary unfold (mortgage charge versus present coupon yield on MBS), stay traditionally huge following the COVID outbreak within the US.

• Will increase in liquidity within the mortgage-backed securities (MBS) market coinciding with the Federal Reserve’s elevated MBS purchases have traditionally been correlated with declines within the secondary unfold (present coupon yield on MBS versus Treasuries), con-sistent with the post-COVID surge in Fed MBS purchases and subsequent decline within the secondary unfold.

• Will increase within the major–secondary unfold have traditionally been correlated with elevated capability constraints confronted by lenders, as an illustration, measured by will increase in manufacturing per mortgage-related worker. The persistent widened major–secondary unfold within the aftermath of COVID-19 is according to this historic sample.

[ad_2]