[ad_1]

In a new paper ready for the Handbook of Monetary Integration, edited by Guglielmo Maria Caporale, Hiro Ito and I look at bond primarily based measures of monetary market integration (so, no amount inventory/move measures, nor banking integration).

In brief, coated curiosity differentials have risen, however uncovered curiosity differentials appear to have shrunk. There’s ambiguous proof concerning actual curiosity differentials.

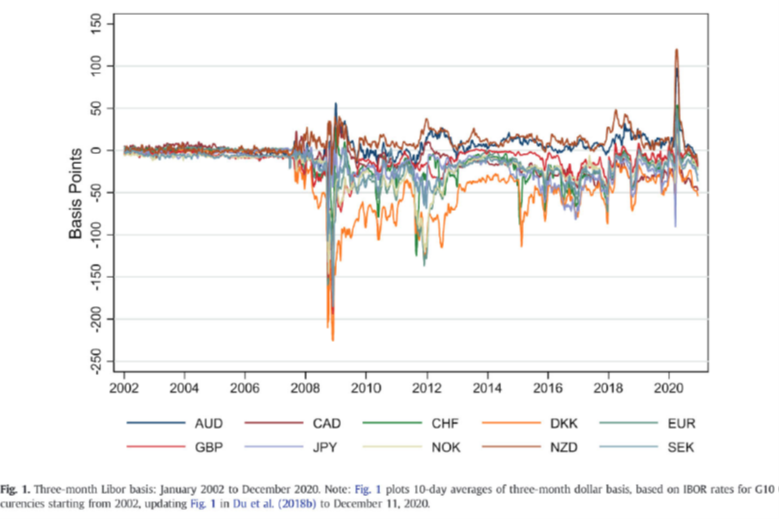

Determine 1: Lined curiosity differentials, bps. Supply: Cerutti et al. (2021).

See some dialogue of this phenomenon on this 2016 submit.

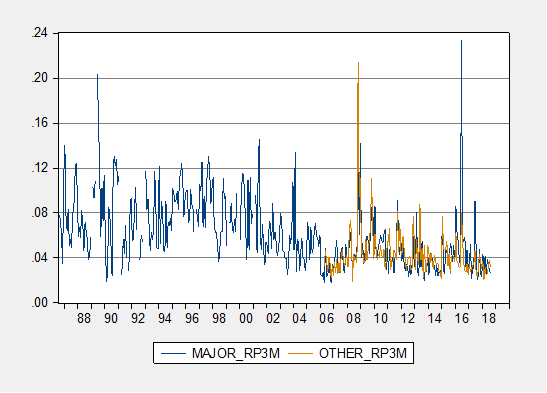

Determine 2: Common absolute uncovered curiosity differential for superior economic system currencies (blue), for rising market currencies (tan), annualized. Calculated utilizing survey knowledge.

See dialogue of utilizing survey knowledge to deduce what is occurring with expectations, and the way this modifications our view of uncovered curiosity parity, right here, and right here; see Chinn and Frankel (2020).

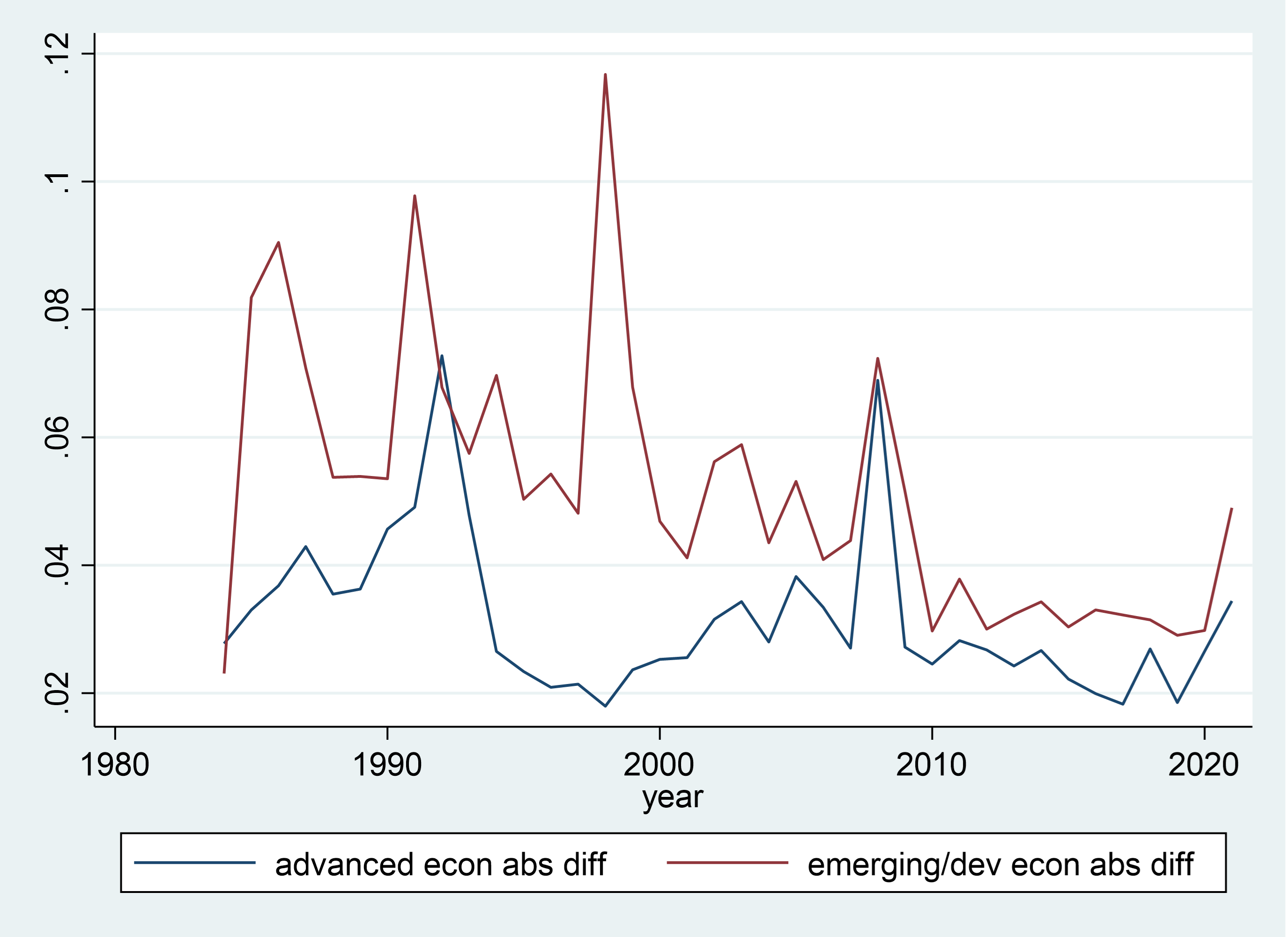

Determine 3: Common absolute actual curiosity differentials (3 month charges, utilizing ex submit inflation charges)

We conclude:

- Lined curiosity parity which was beforehand thought to carry, as much as transactions prices, now not holds submit international monetary disaster. At one juncture, a part of this is because of default danger (in order that measured yields now not relate to property of similar default danger), and extra not too long ago to the change within the regulatory regime that now makes hedging expensive.

- Uncovered rate of interest parity must be distinguished from the unbiasedness speculation – i.e., the joint speculation of uncovered curiosity parity and unbiased expectations. As soon as that is carried out, the proof in favor of uncovered curiosity parity (and therefore good capital substitutability) is way better.

- Authorities bonds will not be solely differentiated by the diploma to which their yields covary with wealth or consumption, but in addition by their comfort yield. Given this, it’s unsurprising that nominal monetary integration, outlined as nominal yield equalization in widespread foreign money phrases, has been incomplete.

- Ex submit quick time period actual returns have shrunk over time, however are nonetheless removed from being equalized (and seemingly reversed in the course of the pandemic and its aftermath).

Your entire paper is right here.

[ad_2]