[ad_1]

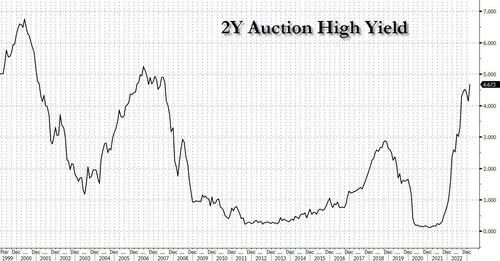

After two months of declines, in February the excessive yield on the 2Y public sale exploded greater, and within the Treasury’s sale of $42 billion in 2Y paper accomplished moments in the past, the US needed to pay curiosity of 4.673%, up from 4.152%, and tailing the When Issued 4.670% by 0.3bps. The yield was additionally the best going again to July 2007.

Amusingly, at the very same time, at present’s 52-Week Invoice public sale additionally closed. Its yield: 4.795%, so sure – the curve is now inverted at that 1Y-2Y kink.

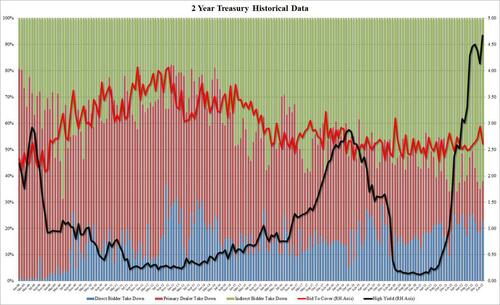

The bid to cowl on at present’s 2Y public sale was 2.613, a pointy drop from final month’s 2.944 which was the best for the reason that Covid lockdown days of Could 2020. At the moment’s BtC was additionally under the latest, six-auction common of two.65%.

The internals have been additionally moderately forgettable, with Indirects awarded 62.04%, the bottom since November, however above the latest common, because of the ugly September and October ’22 auctions. And with Directs awarded 23.0%, that left sellers with simply 14.97%, which whereas not a document low for the sequence wasn’t that far off.

Backside line: this was a mediocre, tailing and total forgettable public sale, if hardly horrible and a mirrored image of the market’s total temper at present which has seen danger hammered throughout the board, and yields throughout the curve leaping to the best since November.

Loading…

[ad_2]