[ad_1]

Authored by Michael Lebowitz by way of RealInvestmentAdvice.com,

U.S. Treasury Secretary Janet Yellen just lately said: “You don’t have a recession when you have got the bottom unemployment fee in 53 years.” Let’s HOPE she is right.

As logical as her assertion appears right now, it might look equally silly in brief order. As we’ll clarify, HOPE leads us to imagine Yellen doesn’t admire the time it takes for tighter financial coverage circumstances and diminished liquidity to trigger financial deterioration.

The Fed is tightening financial coverage on the quickest tempo in over 40 years. Moreover, the financial system is extra leveraged now than at any time in historical past and, due to this fact, extra delicate to rate of interest will increase. It appears naïve to imagine a recession isn’t possible as a result of a lagging financial indicator, like employment, is strong.

This text explores the HOPE framework, developed by Michael Kantro, Chief Funding Strategist of Piper Sandler. HOPE is an acronym describing the lags and the sequence by which financial exercise usually weakens earlier than a recession.

HOPE

Michael’s HOPE mannequin consists of Housing, New Orders (ISM), Company Profits, and Employment.

His framework acknowledges that essentially the most curiosity rate-sensitive sectors are first to really feel the brunt of tightening financial coverage. These sectors usually function main financial indicators. As rates of interest dampen financial exercise in curiosity rate-sensitive sectors, different sectors and sides of the financial system start to really feel the impression of upper charges. HOPE illustrates the assorted lags or the time it takes for fee hikes to have an effect on financial exercise absolutely.

Janet Yellen might not acknowledge financial coverage lags, however Jerome Powell and lots of Fed members are fretting about their lack of ability to evaluate how 2022’s rate of interest hikes will impression 2023’s financial exercise. Did they hike an excessive amount of? Or would possibly they cease too quickly, retaining inflation pressures too excessive?

At his most up-to-date post-FOMC press convention, Jerome Powell describes the lag impact the financial system faces.

We’re seeing the results of our coverage actions on demand within the most interest-sensitive sectors of the financial system, notably housing. It is going to take time, nevertheless, for the total results of financial restraint to be realized, particularly on inflation. – Jerome Powell 2/1/2023

The Fed first hiked charges on March 17, 2022, by .25%. Assuming it takes a 12 months or longer for the total impacts of a fee hike to be skilled, the primary, comparatively small fee hike isn’t absolutely being felt. There have been seven extra after March 2022, accounting for an extra 4.25% of rate of interest will increase.

H Housing

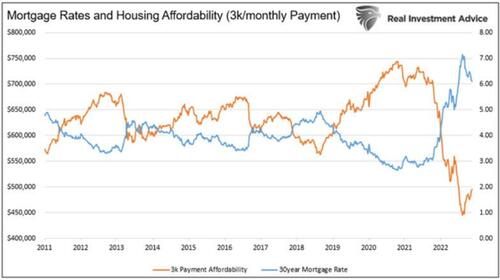

30-year mortgage charges have been slightly below 3% on the finish of 2021. They presently stand north of 6%. Like most debt, mortgage charges transfer in lockstep with different rates of interest. Subsequently, when the Fed will increase charges, the price of shopping for a brand new residence usually follows.

As Lance Roberts usually accurately reminds us, “individuals purchase mortgage funds, not home costs.” The graph under exhibits how the surge in mortgage charges grossly deflated housing affordability.

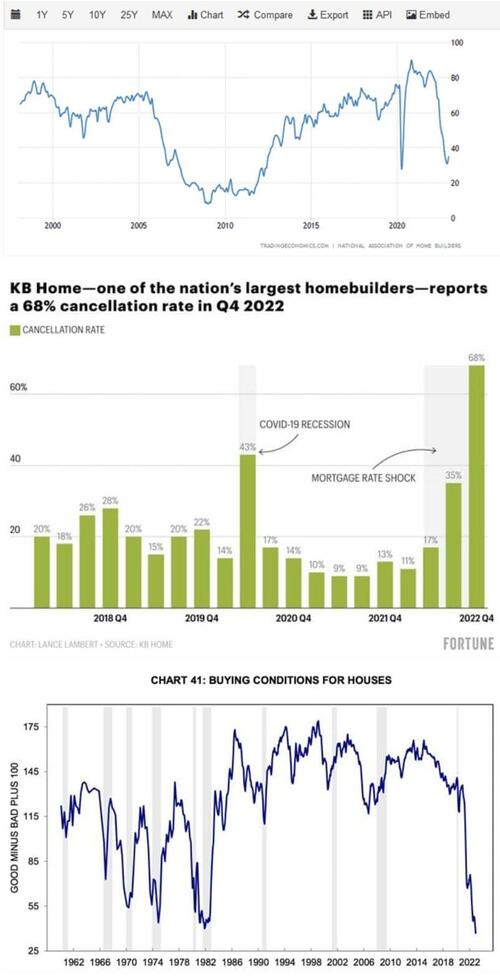

The next graph exhibits the NAHB homebuilders’ sentiment survey plummeted during the last 12 months. Such is no surprise on condition that cancellations of recent residence gross sales are actually off the chart, as proven within the second graphic. The third graph, the College of Michigan Survey Shopping for Circumstances for Homes, exhibits how rates of interest have negatively impacted homebuying sentiment.

O New Orders

New orders are inclined to observe interest-rate-sensitive sectors. Typically firms seeing accumulating inventories begin to cut back new stock orders. Current stock warnings and determined stock liquidation actions from Goal, Walmart, and different retailers lead to diminished demand to restock stock.

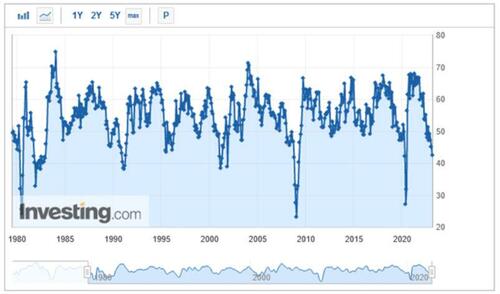

The Investing.com graph under exhibits the ISM New Orders survey is right down to 42.5, a stage usually related to recessions.

P Earnings

As firms order much less, company income and normally earnings fall.

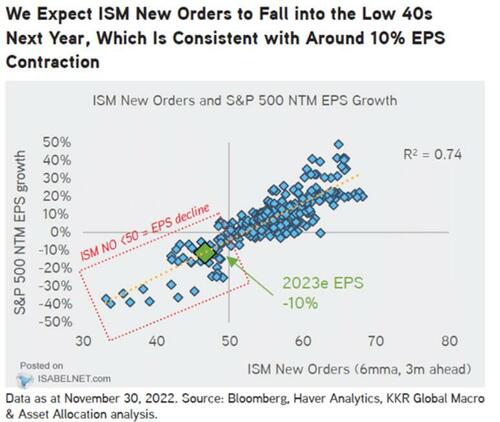

The KKR International Macro scatter plot graph under exhibits the six-month transferring common of ISM New Orders tends to guide company earnings by about three months. The plot implies earnings may drop 30-40%.

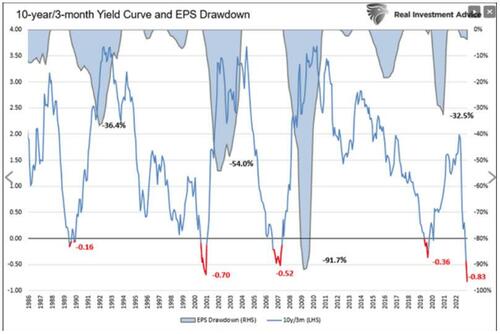

The yield curve, additionally a number one financial indicator, is one other prescient indicator of company earnings. It additionally exhibits a revenue droop of 20-50% could be commensurate with such an inverted yield curve.

So far, with greater than two-thirds of firms reporting fourth-quarter 2022 earnings, earnings progress is barely destructive. Estimates for 2023 are falling.

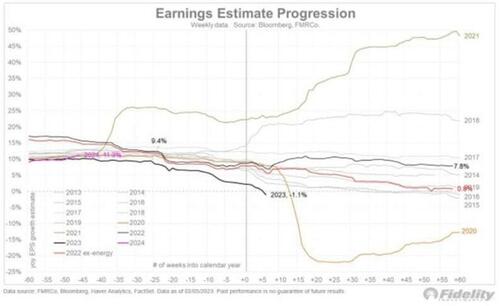

The Constancy graph under exhibits the development of 2023 earnings estimates. 2023 estimates simply went destructive after beginning the 12 months in optimistic territory. Aside from 2021 and 2018, earnings estimates during the last ten years trended decrease all year long. We suspect 2023 will as effectively.

The next quote comes from Morgan Stanley’s Mike Wilson:

Ahead EPS progress has simply gone destructive. This has solely beforehand occurred 4 occasions over the previous 23 yrs. In every prior occasion (2001, ’08, ’15, ’20), equities have confronted important value draw back related w/the shift from optimistic to destructive earnings progress.

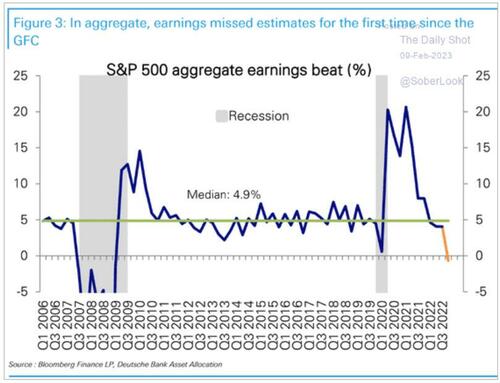

Lastly, the graph under from Deutsche Financial institution exhibits that final quarter’s combination earnings have been under estimates for the primary time in practically 15 years.

E Employment

Employment is commonly the final financial indicator to falter. Firms will usually take different cost-cutting actions earlier than laying workers off. Not solely is firing workers costly, however it may be very disruptive and worrying for the remaining workers. Earlier than firms’ hearth workers, we frequently see them cut back the common work week and wages. So far, there are few indicators that is occurring.

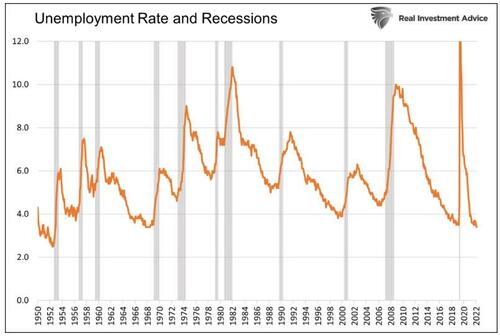

Very often, unemployment doesn’t improve till a recession has already begun.

The graph under contrasts the unemployment fee with recession intervals. Recessions start inside months of the cyclical low within the unemployment fee. Unemployment tends to shoot larger as soon as a downturn begins.

Janet Yellen’s False Consolation

As we started, Janet Yellen advised us to not fear a couple of recession as a result of the unemployment fee is at a 53-year low. 53 years in the past, in December 1969, the unemployment fee was 3.5%, marking the low for the nine-year financial enlargement beginning in 1960. By Could 1970, it was 4.8% and rose to six.1% inside a 12 months.

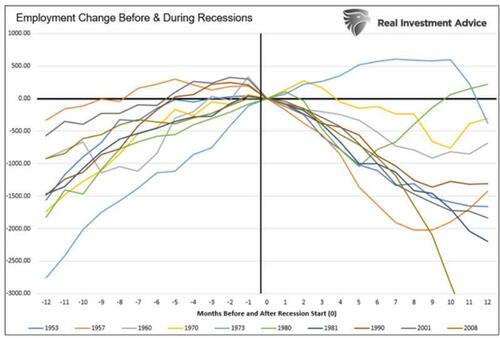

The next graph exhibits how employment and unemployment trended earlier than and over the last 11 recessions since 1950. The left facet exhibits that on the eve of recessions, the unemployment fee has at all times been inside half a p.c of its cycle low. In all circumstances, unemployment rose by not less than 1% and as much as greater than 3% in a recession’s first twelve months.

The fitting facet exhibits that whereas employment will increase proper till the recession begins, after which it drops instantly. 1973 is the one exception.

Abstract

Janet Yellen and most traders are failing to issue within the highly effective lag impact of financial coverage. Much more regarding, they appear to be making a vital mistake because the Fed is elevating charges and doing QT at a tempo most of us haven’t seen in our careers. We HOPE we’re flawed and such actions lead to a gentle touchdown. Sadly, historical past tells us it’s a matter of when and never if tighter financial will ship the financial system right into a recession.

Concentrate on the main, not the lagging indicators!

A particular thanks to Michael Kantro for his easy HOPE acronym that makes the lag impact of tighter financial coverage really easy to grasp.

Loading…

[ad_2]