[ad_1]

By Simon White, Bloomberg Markets Stay reporter and strategist

The belief that elevated inflation will linger quite a bit longer than initially anticipated ought to proceed to spice up worth shares, whereas disadvantaging the expansion phase.

The disinflationary development is more likely to peter out quicker than anticipated. It was at all times destined to finish in disappointment for these clinging to the notion of transitory inflation, however I anticipated the downtrend to final a bit longer, and for CPI to backside at a decrease stage than it’s more likely to trough at earlier than returning to its upwards bias.

International cyclical inflation pressures, which have hitherto pushed headline inflation within the US decrease, are more likely to flip again up quickly, as easing in China lastly begins to get traction, and reinforce domestically-driven inflation which has barely budged from its highs.

There are a number of components more likely to entrench inflation. One is well-discussed, wages, which can preserve providers CPI elevated and sticky. Much less talked about is the affect of revenue margins. 2021 noticed one of many quickest and sharpest rises in revenue margins, as corporations took benefit of tight provide and an indomitable surge in demand after the pandemic.

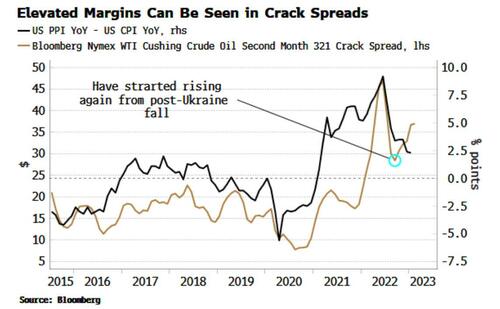

At the same time as margins fall as demand eases again, they’re more likely to stay excessive, serving to ingrain inflation. For instance, crack spreads (the distinction between fuel/petrol and oil costs) present a optimistic relationship with PPI versus CPI (a proxy for revenue margins). The actual fact they’ve began rising once more, after the autumn from the Ukraine-war highs, is an indication that margins could stay sticky.

Cussed inflation could also be a wake-up name for longer-term bond yields, which have to date remained comparatively contained, within the perception that inflation will quickly return to development and keep there.

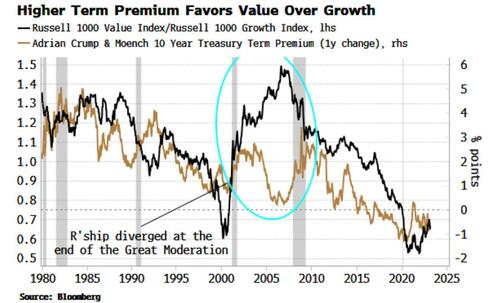

Time period premium, primarily the compensation bond holders require for inflation dangers, has stayed comparatively low, but when there’s a realization that elevated inflation goes to be with us for some time but, time period premium might start to rise. Because the chart under reveals, this is able to have a tendency to profit worth relative to progress shares.

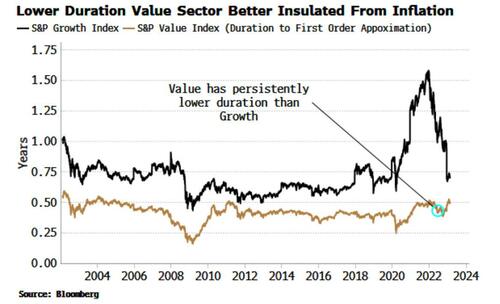

In inflationary environments, holding lower-duration property is preferable. Worth shares are typically decrease period than progress shares, that means they need to climate inflation higher.

The US inventory market total continues to look overvalued, regardless of a protracted bear market. Rekindled inflation would level in the direction of worth as an element to concentrate on for outperformance.

Loading…

[ad_2]