[ad_1]

By Wolf Richter, editor of Wolf Road. Initially printed at Wolf Road

Individuals need to get on with their lives, it appears. Their temper has improved. They’ve gotten used to dwelling with excessive inflation. They bought raises or bought higher-paying jobs. Gasoline costs have plunged because the peak in mid-2022, and that issues loads as a result of it’s essentially the most in-your-face inflation together with meals inflation. They could nonetheless gripe about greater costs, however you reside solely as soon as?

And they also spent cash left and proper in January, and so they outspent even this raging inflation. We already noticed shocking power from new and used car gross sales popping out of the auto trade, and from the retailers’ viewpoint earlier this month, which confirmed that shoppers had been in no temper for a touchdown.

Immediately, we bought inflation-adjusted (or “actual”) client spending traits for January from the Bureau of Financial Evaluation. Private Consumption Expenditures (PCE) on sturdy items, nondurable items, and companies is adjusted for inflation based mostly on the PCE value index, which blew out.

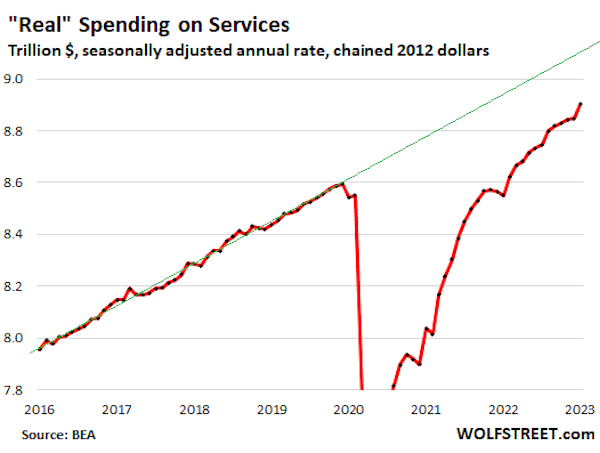

Spending on companies, adjusted for the raging inflation in companies, jumped by 0.6% in January from December, seasonally adjusted, and by 4.1% year-over-year (not seasonally adjusted).

Not adjusted for inflation, spending on companies spiked by 1.3% from the prior month, and by 10% year-over-year!

Companies accounted for 62% of whole client spending. It contains housing, utilities, insurance coverage of all types, healthcare, journey bookings, streaming, software program, subscriptions, leisure, repairs, cleansing companies, haircuts, and so forth.

Sure kinds of discretionary companies – airplane journey, cruises, reside leisure, and so forth. – bought crushed throughout the pandemic. Revenge spending on a few of these companies set in a while in the past.

Regardless of the sturdy development over the previous 12 months, and regardless of the large restoration from the knock-out in 2020, spending on companies, adjusted for inflation, nonetheless hasn’t reverted to pre-pandemic pattern:

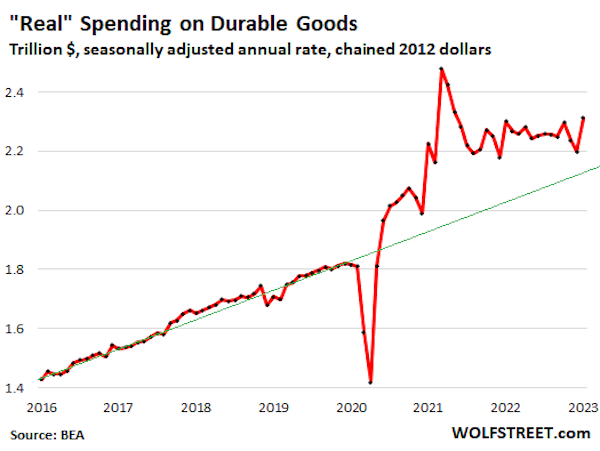

Spending on sturdy items, adjusted for inflation, spiked by 5.2% in January, seasonally adjusted. However year-over-year, it was up solely 0.5%. The year-over-year determine is essential right here, and it’s not seasonally adjusted.

I mentioned earlier the power of latest and used car gross sales in January, based mostly on models delivered to finish customers, that triggered used-vehicle wholesale costs to leap once more in January and within the first half of February, as sellers bid up costs on the public sale to restock their inventories.

After the massively over-stimulated spike throughout the pandemic, “actual” spending on sturdy items was supposed revert rapidly to the imply, to the pre-pandemic pattern, and it did a few of that, however almost two years after the spike, it’s nonetheless properly above the pre-pandemic pattern.

Seasonal changes for sturdy items in November, December, and January are at all times enormous, as they try and iron out the large spike in spending on sturdy items throughout the vacation season and the plunge in spending in January. These seasonal changes are linked. In the event that they’re too aggressive for November and December (pushing seasonally adjusted spending down too far), they’re additionally too aggressive in January (pushing seasonally adjusted spending up too far), which is what we could also be seeing within the above chart.

For those who take a look at the above chart whereas holding your tongue good, you may see that spending, adjusted for inflation, roughly flattened out over the previous 12 months at very excessive ranges.

That is confirmed by year-over-year spending, adjusted for inflation, however not seasonally adjusted, which ticked up simply 0.5% from the very excessive ranges a yr in the past.

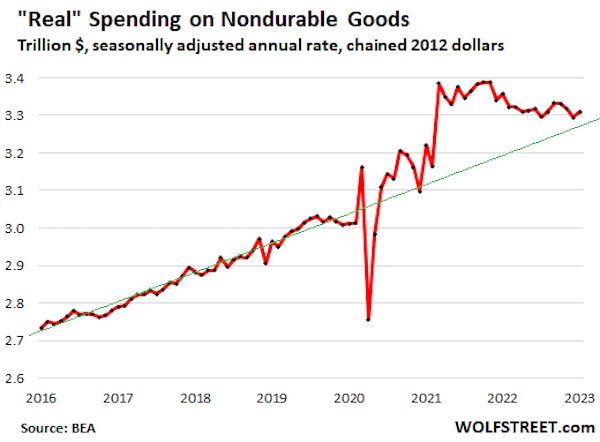

Spending on nondurable items, adjusted for inflation, rose by 0.5% in January from December, seasonally adjusted, however declined 1.4% from a yr in the past.

Nondurable items are dominated by meals, power, and family provides. We’ve already seen that gasoline consumption, measured in barrels per day, dropped in 2022 in response to spiking gasoline costs. So on an inflation-adjusted foundation, client spending on gasoline dropped.

Spending on nondurable items has now almost reverted to pre-pandemic pattern.

The individuals don’t need this factor to land.

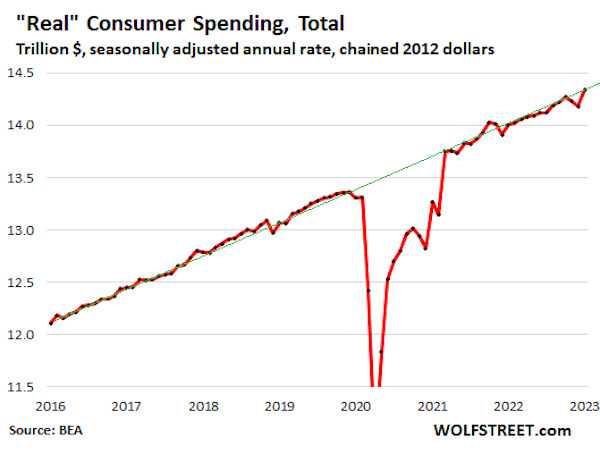

General “actual” spending development jumped by 1.1% in January from December, inflation-adjusted and seasonally adjusted.

Yr-over-year, not seasonally adjusted, “actual” spending grew by 2.4%. Within the 10 years earlier than the pandemic, annual development of “actual” spending ranged from +1.4% on the low finish (2012) to +3.3% on the excessive finish (2015), and averaged 2.2% over these 10 years.

So the year-over-year development in January of two.4%, adjusted for inflation, was simply above the 10-year common of two.2% earlier than the pandemic. This isn’t the signal of any form of touchdown. Clearly, individuals don’t need this factor to land.

Be aware the quirks of the seasonal changes within the Novembers and Decembers of 2021 and 2022, when seasonal changes could have pushed down spending figures too far, after which conversely pushed up spending figures too far within the Januaries of 2022 and 2023. These quirks are largely associated to sturdy items, as we noticed above.

The month-to-month seasonal changes, that are based mostly on the historical past of seasonal swings, have been just a little tough since March 2020, when radically totally different client spending patterns distorted the whole lot and threw all historic patterns out the window.

However year-over-year spending development (+2.4%) isn’t seasonally adjusted.

And the chart reveals the pattern – the continued power of spending development regardless of the quirks in Novembers and Decembers (when the media proclaimed the demise of the shoppers), and Januaries (when the media proclaimed the resurrection of the shoppers), when in actual fact, these shoppers had been plodding alongside simply fantastic, energetically outspending inflation:

[ad_2]