[ad_1]

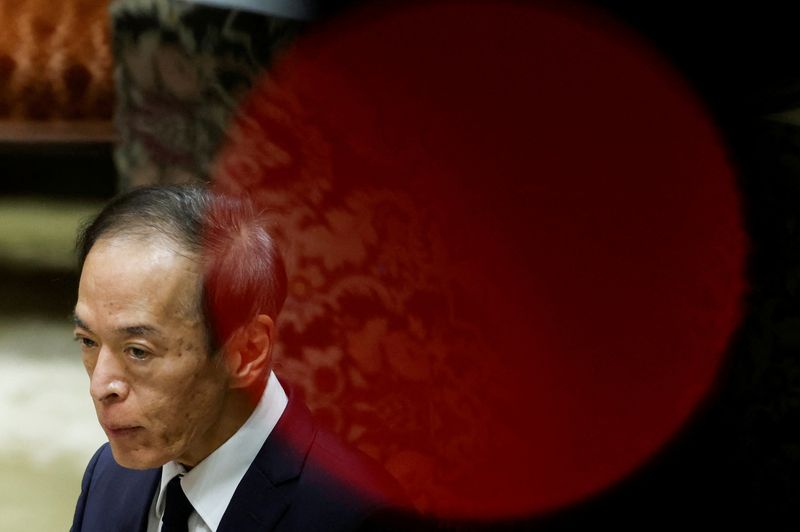

© Reuters. The Japanese authorities’s nominee for the Financial institution of Japan (BOJ) Governor Kazuo Ueda speaks throughout a listening to session on the decrease home of the parliament in Tokyo, Japan, February 24, 2023. REUTERS/Issei Kato

By Leika Kihara and Tetsushi Kajimoto

TOKYO (Reuters) -Incoming Financial institution of Japan (BOJ) Governor Kazuo Ueda stated on Monday the nation’s development inflation should heighten considerably for the central financial institution to contemplate tightening financial coverage.

The latest rise in Japan’s client inflation is pushed by cost-push elements fairly than sturdy demand, warranting the BOJ to take care of ultra-loose coverage, Ueda stated.

“There’s nonetheless a ways for Japan to see inflation sustainably and stably meet the BOJ’s 2% goal,” he informed an higher home affirmation listening to.

For now, the deserves of the BOJ’s present financial coverage outweigh the prices, Ueda stated, stressing the necessity to preserve help for the nation’s economic system with ultra-low rates of interest.

“Massive enhancements have to be made in Japan’s development inflation for the BOJ to shift in direction of financial tightening,” Ueda stated.

“It is not that I’ve no concepts on the way to tweak the BOJ’s present coverage. However the fascinating tweak will differ relying on financial adjustments on the time,” Ueda stated, including it was untimely to touch upon how the central financial institution might shift coverage.

Earlier this month, the federal government named the 71-year-old educational as its decide to develop into subsequent central financial institution governor in a shock selection that markets initially noticed as heightening the prospect of an finish to the unpopular YCC coverage.

With inflation exceeding the BOJ’s goal, Ueda faces the problem of phasing out yield curve management (YCC), which has drawn public criticism for distorting market capabilities and crushing banks’ margins.

Whereas the BOJ’s YCC coverage has helped stimulate the economic system, it has had destructive results on market perform, Ueda informed an higher home affirmation listening to.

“In guiding financial coverage, central banks should weigh the advantages and prices of every step,” Ueda stated. “At current, the advantages of the BOJ’s present coverage exceed the prices.”

“There are numerous side-effects rising, however the BOJ’s present coverage is important and acceptable” to attain its 2% inflation goal, he stated.

The higher home listening to follows testimony on the decrease home of parliament on Friday, the place Ueda burdened the necessity to preserve ultra-loose coverage for now.

Upon approval by parliament, Ueda succeeds incumbent Kuroda, whose second, five-year time period ends on April 8.

The nominations want the approval of each chambers of the Food regimen, that are successfully carried out offers because the ruling coalition holds stable majorities in each.

[ad_2]