[ad_1]

In a serious transfer to determine itself as a crypto hub, Hong Kong plans to permit retail traders to commerce sure digital currencies on licensed exchanges. This transfer contradict China’s stance on crypto associated transactions that are outright banned and U.S. crack down on crypto business.

Whereas there was no point out as to which large-cap tokens could be allowed, Securities and Futures Fee (SFC) spokesperson mentioned they’d seemingly be Bitcoin and Ether, two of the most important digital property by market worth.

Hong Kong securities and futures markets regulator introduced safeguards like information assessments, danger profiles and affordable limits on publicity.

SFC additionally introduced that the session interval ends on Mar.31 and goal is to permit retail buying and selling from June 1.

Presently, town’s framework for crypto exchanges is a voluntary one which restricts them to shoppers with portfolios of not less than HK$8M.

In late October 2022, Hong Kong had taken its steps in the direction of legalizing retail-investor crypto buying and selling.

Hong Kong authorities has already allowed ETFs investing in CME Group (CME) Bitcoin and Ether futures and in addition bought inaugural digital inexperienced bonds beginning February.

In mid-February, Interactive Brokers (IBKR) launched cryptocurrency buying and selling in Hong Kong in collaboration with OSL Digital Securities.

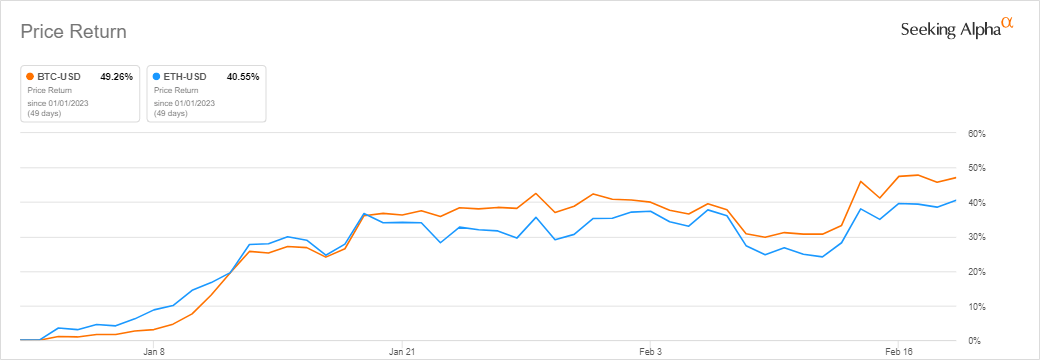

Efficiency on YTD foundation:

Associated Learn: Previously-week, bitcoin ended the week ~14% greater compared to broader fairness markets which noticed a decrease sentiment led by issues over the way forward for the Federal Reserve’s price hikes.

As per CoinMarketCap information, the 2 largest tokens (Bitcoin and Ether) by market cap each contributed to a 7.1% climb within the complete worth of the crypto market, standing at $1.12T on the time of writing.

In 2023, Crypto associated ETFs have seen a big surge main the highest 10 YTD share gainers amongst non-leveraged ETFs.

[ad_2]