[ad_1]

Many have been questioning if Warren Buffett would deal with his current unwind of Berkshire’s $4+ billion stake in Taiwan Semi – a model new place that had catapulted into the investing conglomerate’s Prime 10 holdings as of Sept 30 ’22 solely to see it slashed by 86% only one quarter later…

… and this morning, when Buffett filed the newest Berkshire annual letter, they received the reply: an unequivocal no.

So what did Buffett speak about in his newest and – at simply barely 9 pages – shortest ever letter since Berkshire launched the apply of recapping his funding ideas, actions and outcomes some 46 years in the past in 1977? Nothing that he hasn’t addressed on numerous earlier events. Under we summarize a few of the key highlights.

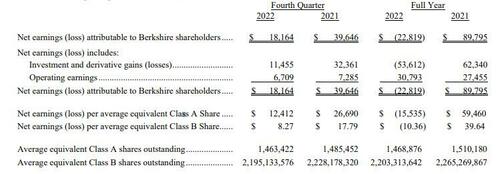

First, here’s a snapshot of Berkshire This autumn financials:

This autumn revenue fell, reflecting decrease good points from investments and international forex alternate losses because the U.S. greenback misplaced worth. Quarterly web earnings fell 54% to $18.16 billion, or $12,412 per Class A share, from $39.65 billion, or $26,690 per share, a 12 months earlier.

In fact, as is well-known, Buffett despises GAAP earnings and as a substitute urges traders to have a look at working earnings as a substitute which strip away the quarterly fluctuations of the conglomerate’s public inventory investments (i.e. unrealized good points/losses).

The GAAP earnings are 100% deceptive when considered quarterly and even yearly. Capital good points, to make certain, have been massively necessary to Berkshire over previous a long time, and we count on them to be meaningfully optimistic in future a long time. However their quarter-by-quarter gyrations, commonly and mindlessly headlined by media, completely misinform traders.

For the 4th quarter, Berkshire generated $6.71BN in working profis, down 8% from $7.29BN a 12 months in the past. Earnings fell as its rail street enterprise and insurance coverage operations noticed softer outcomes amid larger costs for supplies and labor. That, nevertheless, didn’t dent the billionaire investor’s perception within the resiliency of the US economic system, as he touted Berkshire’s file working earnings of $30.8 billion for the 12 months.

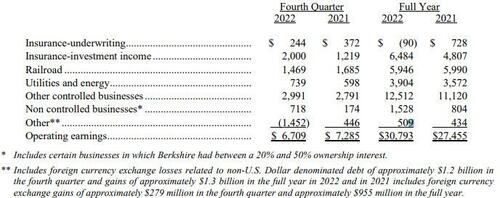

Berkshire repurchased $2.6 billion of its personal inventory within the quarter, essentially the most since Q1, and boosting full-year buybacks to $7.9 billion. Buffett additionally famous that a few of Berkshire’s greatest investments akin to Apple and American Specific, additionally engaged in sizable inventory buybacks.

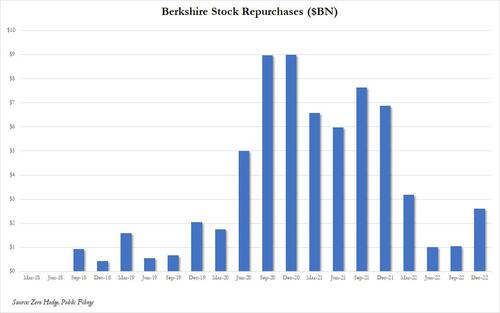

Regardless of the buybacks, the corporate’s money hoard jumped by $20 billion in This autumn to $128.6 billion, the ninth largest money stockpile within the firm’s historical past.

The money mountain was so massive that curiosity earnings alone in 2022 soared by 186% to $1.1 billion “primarily resulting from vital will increase in curiosity earnings resulting from rate of interest will increase in the course of the 12 months.”

Financials apart, listed below are a few of the notable highlights from Buffett’s annual letter to traders.

On success:

In 58 years of Berkshire administration, most of my capital-allocation choices have been no higher than so-so. In some instances, additionally, dangerous strikes by me have been rescued by very massive doses of luck. (Keep in mind our escapes from near-disasters at USAir and Salomon? I definitely do.)… The lesson for traders: The weeds wither away in significance because the flowers bloom. Over time, it takes only a few winners to work wonders. And, sure, it helps to begin early and stay into your 90s as properly.

On Berkshire’s float:

Aided by Alleghany [a purchase made in late 2022], our insurance coverage float elevated throughout 2022 from $147 billion to $164 billion. With disciplined underwriting, these funds have a good probability of being cost-free over time. Since buying our first property-casualty insurer in 1967, Berkshire’s float has elevated 8,000-fold by acquisitions, operations and improvements. Although not acknowledged in our monetary statements, this float has been a unprecedented asset for Berkshire.

On inventory buybacks… and a uncommon jab at Joe Biden (or moderately, Joe Biden’s handlers) from Buffett, a consummate, Hillary Clinton-supporting Democrat:

A really minor acquire in per-share intrinsic worth came about in 2022 by Berkshire share repurchases in addition to comparable strikes at Apple and American Specific, each vital investees of ours. At Berkshire, we straight elevated your curiosity in our distinctive assortment of companies by repurchasing 1.2% of the corporate’s excellent shares. At Apple and Amex, repurchases elevated Berkshire’s possession a bit with none price to us.

Positive aspects from value-accretive repurchases, it needs to be emphasised, profit all house owners – in each respect. Think about, if you’ll, three fully-informed shareholders of a neighborhood auto dealership, one in every of whom manages the enterprise. Think about, additional, that one of many passive house owners needs to promote his curiosity again to the corporate at a worth enticing to the 2 persevering with shareholders. When accomplished, has this transaction harmed anybody? Is the supervisor by some means favored over the persevering with passive house owners? Has the general public been harm? If you find yourself advised that each one repurchases are dangerous to shareholders or to the nation, or significantly helpful to CEOs, you’re listening to both an financial illiterate or a silver-tongued demagogue (characters that aren’t mutually unique).

On company income:

In combination, the S&P500 earned $1.8 trillion in 2021. I don’t but have the ultimate outcomes for 2022. Utilizing, subsequently, the 2021 figures, solely 128 of the five hundred (together with Berkshire itself) earned $3 billion or extra. Certainly, 23 misplaced cash. At year-end 2022, Berkshire was the biggest proprietor of eight of those giants: American Specific, Financial institution of America, Chevron, Coca-Cola, HP Inc., Moody’s, Occidental Petroleum and Paramount International.

On beating expectations and the “deep want to deceive”:

Even the working earnings determine that we favor can simply be manipulated by managers who want to take action. Such tampering is commonly regarded as subtle by CEOs, administrators and their advisors. Reporters and analysts embrace its existence as properly. Beating “expectations” is heralded as a managerial triumph. That exercise is disgusting. It requires no expertise to control numbers: Solely a deep want to deceive is required. “Daring imaginative accounting,” as a CEO as soon as described his deception to me, has grow to be one of many shames of capitalism.

On money as preparation for the long run:

As for the long run, Berkshire will all the time maintain a boatload of money and U.S. Treasury payments together with a wide selection of companies. We will even keep away from conduct that would end in any uncomfortable money wants at inconvenient occasions, together with monetary panics and unprecedented insurance coverage losses. Our CEO will all the time be the Chief Danger Officer – a activity it’s irresponsible to delegate. Moreover, our future CEOs can have a major a part of their web value in Berkshire shares, purchased with their very own cash.

On the distinction between “environment friendly” private and non-private markets:

One benefit of our publicly-traded phase is that – episodically – it turns into simple to purchase items of great companies at great costs. It’s essential to grasp that shares typically commerce at actually silly costs, each excessive and low. “Environment friendly” markets exist solely in textbooks. In reality, marketable shares and bonds are baffling, their conduct often comprehensible solely on reflection…. Managed companies are a special breed. They generally command ridiculously larger costs than justified however are virtually by no means out there at discount valuations. Until below duress, the proprietor of a managed enterprise offers no thought to promoting at a panic-type valuation.

On taxes:

Throughout the decade ending in 2021, the US Treasury obtained about $32.3 trillion in taxes whereas it spent $43.9 trillion…. Enormous and entrenched fiscal deficits have penalties. The $32 trillion of income was garnered by the Treasury by particular person earnings taxes (48%), social safety and associated receipts (34 1⁄2%), company earnings tax funds (8 1⁄2%) and all kinds of lesser levies. Berkshire’s contribution by way of the company earnings tax was $32 billion in the course of the decade, virtually precisely a tenth of 1% of all cash that the Treasury collected. And meaning – brace your self – had there been roughly 1,000 taxpayers in the usmatching Berkshire’s funds, no different companies nor any of the nation’s 131 million households would have wanted to pay any taxes to the federal authorities. Not a dime.

At Berkshire we hope and count on to pay rather more in taxes in the course of the subsequent decade. We owe the nation no much less: America’s dynamism has made an enormous contribution to no matter success Berkshire has achieved – a contribution Berkshire will all the time want. We depend on the American Tailwind and, although it has been becalmed occasionally, its propelling power has all the time returned.

On Buffett’s conventional optimism in regards to the US:

I’ve been investing for 80 years – greater than one-third of our nation’s lifetime. Regardless of our residents’ penchant – virtually enthusiasm – for self-criticism and self-doubt, I’ve but to see a time when it made sense to make a long-term wager in opposition to America. And I doubt very a lot that any reader of this letter can have a special expertise sooner or later.

He ends with a number of Charlie Munger (who will probably be 100-years-old quickly) aphorisms.

- The world is stuffed with silly gamblers, and they won’t do in addition to the affected person investor.

- If you happen to don’t see the world the best way it’s, it’s like judging one thing by a distorted lens.

- All I need to know is the place I’m going to die, so I’ll by no means go there. And a associated thought: Early on, write your required obituary – after which behave accordingly.

- If you happen to don’t care whether or not you’re rational or not, you gained’t work on it. Then you’ll keep irrational and get awful outcomes

- Persistence will be discovered. Having an extended consideration span and the flexibility to focus on one

- factor for a very long time is a large benefit.

- You may study lots from useless individuals. Learn of the deceased you admire and detest.

- Don’t bail away in a sinking boat for those who can swim to at least one that’s seaworthy.

- An amazing firm retains working after you aren’t; a mediocre firm gained’t try this.

- Warren and I don’t deal with the froth of the market. We search out good long-term investments and stubbornly maintain them for a very long time.

- Ben Graham stated, “Daily, the inventory market is a voting machine; in the long run it’s a weighing balance.” If you happen to maintain making one thing extra precious, then some clever individual goes to note it and begin shopping for.

- There isn’t a such factor as a 100% certain factor when investing. Thus, the usage of leverage is harmful. A string of great numbers occasions zero will all the time equal zero. Don’t depend on getting wealthy twice.

- You don’t, nevertheless, have to personal a whole lot of issues in an effort to get wealthy.

- You must continue learning if you wish to grow to be an excellent investor. When the world modifications, you could change.

- Warren and I hated railroad shares for many years, however the world modified and at last the nation had 4 large railroads of important significance to the American economic system. We have been gradual to acknowledge the change, however higher late than by no means.

- Lastly, I’ll add two quick sentences by Charlie which have been his decision-clinchers for many years: “Warren, suppose extra about it. You’re good and I’m proper.”

Full letter beneath (pdf hyperlink).

Loading…

[ad_2]