[ad_1]

Hartnett: “The Subsequent Nice Bull Markets Begins After The Subsequent Recession, When The Fed Is Compelled To Bail Out The US”

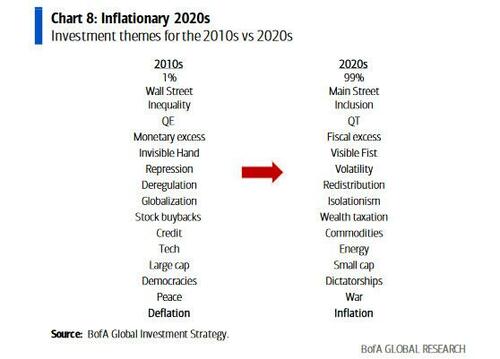

In his newest Stream Present word (accessible to professional subs right here), BofA CIO and essentially the most correct Wall Avenue strategist of the previous a number of years, Michael Hartnett, seems on the 12 months anniversary of the Ukraine conflict and makes the next observations: “conflict = inflationary de-globalization theme = larger charges”; no shock than that theme “winners” of the previous 12 months are: vitality 29% (XLE), manufacturing re-shoring 21% (AIRR), defence/aerospace 14% (PPA), pure assets 14% (IGE), and the “losers”: Bitcoin -39%, innovation -34% (ARKK), bonds -23% (TLT), oil dependency -19% (Taiwan/Korea).

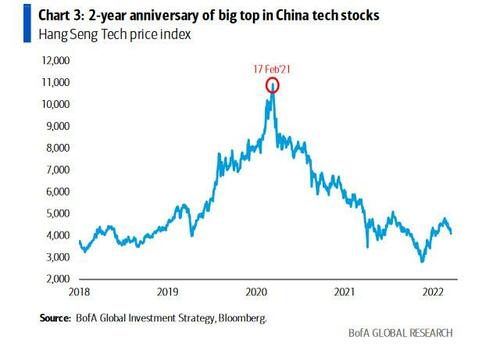

However whereas that anniversary will dominate the airwaves this weekend, merchants might be fast to remind us that at the moment can be the 2-year anniversary of the secular peak in China tech which as Hartnett writes was the “1st QE bubble to pop, HSTECH was 11k, now 4k, in traditional post-bubble buying and selling vary.

Since then lots has modified and the next anecdote from Hartnett in neighboring Japan captures it greatest: “greatest 5% wage hike at Honda in 30-years as BoJ emergency shopping for bonds to take care of failed YCC regime – a humiliating finish to QE-era… In the meantime Tesla prioritizing battery-cell manufacturing in US not Germany as a result of protectionist tax breaks in Biden Inflation Discount Act” which once more brings us to “conflict, protectionism, de-globalization…larger inflation, larger charges.“

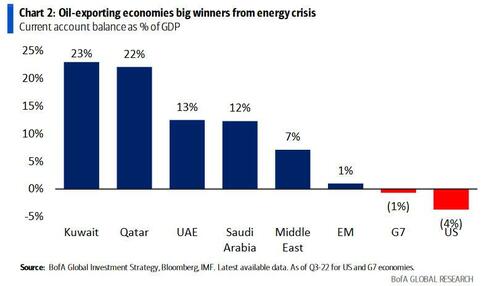

And better debt, after all, however principally in “developed international locations” – the greatest authorities steadiness sheets in world at the moment are these belonging to oil-exporting Gulf economies which based on the BofA strategist are the “greatest winners from conflict, transition to web zero, vitality disaster; present account surplus of Gulf Cooperation Council (GCC) is 15% GDP at the moment vs 4% for US and -1% for G7…therefore launch of 1st Center East US$ Bond ETF (ticker TGCC, yielding 5.4%).”

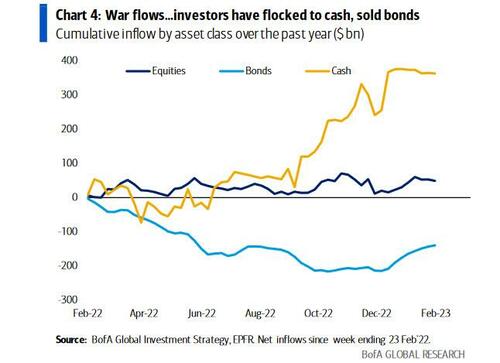

The affect of the conflict has additionally been felt in asset flows, the place money has been the largest beneficiary: as hartnett exhibits within the chart beneath, since Feb’22. flows have been $354bn to money (largely because of sharply larger rates of interest), $40bn to equities, $12bn from gold, $135bn from bonds.

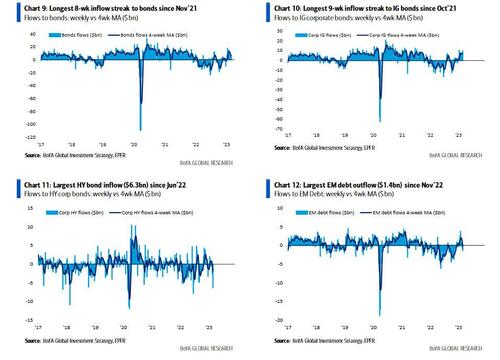

As for flows within the newest week, right here we’ve seen some notable risk-off largely as a result of continued promoting in shares: $4.9bn to bonds, $0.7bn from gold, $3.8bn from money, $7.0bn from equities. Listed here are the flows to know:

- Bond inflows $4.9bn, longest 8-week influx streak since Nov’21 (Chart 9);

- IG inflows $9.9bn, longest 9-week influx streak since Oct’21 (Chart 10);

- HY outflows $6.3bn, largest since Jun’22 (Chart 11);

- EM debt outflow $1.4bn, largest since Nov’22 (Chart 12);

- US fairness outflows $9.0bn, third straight week of outflows;

- Outflows resume to financials ($0.5bn), after 4 consecutive weeks of inflows;

- Outflows resume from US progress ($1.6bn) after 2 straight weeks of inflows.

However what concerning the one factor everybody needs to know: what does Hartnett assume shares do subsequent. Right here, nothing has modified from final week when as a reminder, Hartnett predicted that “the S&P will swoon to three,800 by March 8″ after the promote it did not rise above 4,200 simply as Hartnett had additionally predicted earlier.

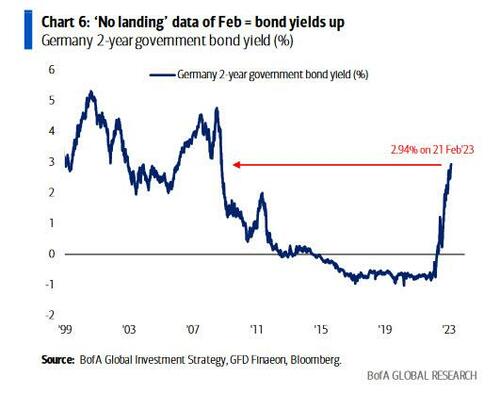

Immediately, Hartnett picks up on this forecast and repeats that this “3.8K by 3/8” prediction is generally pushed by tighter world monetary circumstances, because the “Jan “no touchdown” knowledge might be adopted by Feb “no touchdown‘ knowledge (launched early March)” which can propel yields up >4% = SPX <3.8k, a repeat of what he mentioned final week, when he laid out his expectations that resilient progress within the first half of the 12 months will coincide with larger rates of interest and result in a sharper financial slowdown within the second half.

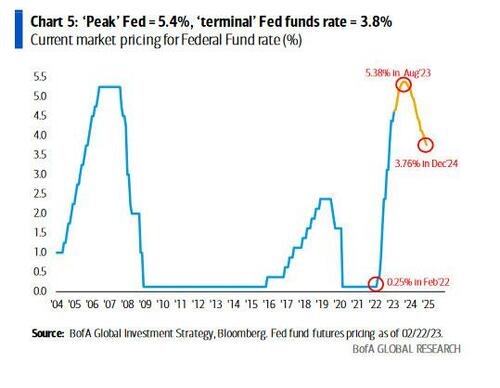

In the meantime, in only a few quick weeks, the Dec’24 Fed funds fee expectations had been 2.9% earlier than the blowout (and laughably seasonally adjusted) Jan payrolls, and at the moment are 3.8%.

On the similar time, German 2-yields have risen to 14-year highs, and at the moment rose above 3%.

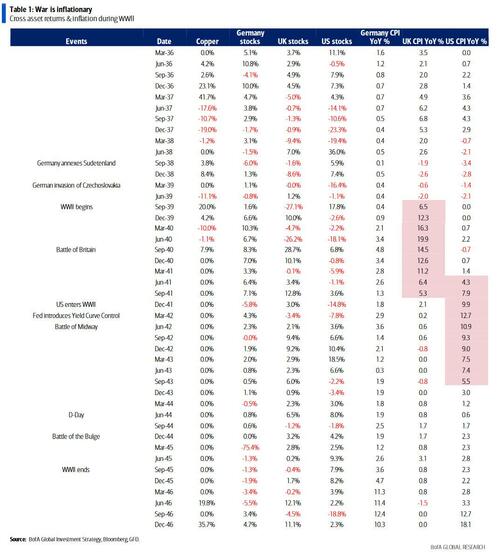

The underside line (in case he did not repeat it sufficient occasions already at the moment): “conflict is inflationary and causes larger bond yields (see WW2 asset costs).”

Not like final week, Hartnett concludes not along with his downbeat – if correct – truism that Fed tightening cycles all the time “break” one thing…

… however that larger image means there actually is not any different different. Recall one week in the past we confirmed the CBO’s long-term US debt/GDP forecast which might solely be described as “recreation over.”

The CBO simply printed the only greatest advert for treasured metals and cryptos.

In case there may be confusion, that is the “recreation over” forecast. pic.twitter.com/dc7descDnm

— zerohedge (@zerohedge) February 15, 2023

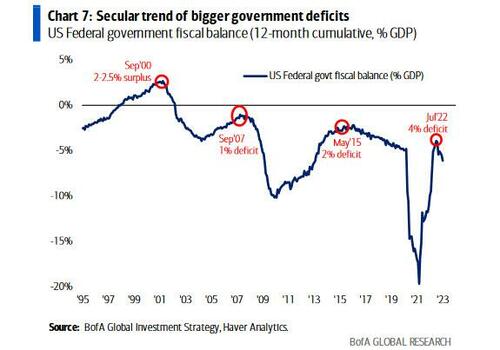

Hartnett agrees, and writes that whereas fiscal stimulus panic (vitality worth caps/rebates, bailouts, nationalization) was profitable in averting recession in early-2020s; the offset is that deficits are rising once more: UK Jan’23 fiscal deficit as much as 5.2% of GDP, as a result of larger vitality subsidies; EU vitality bailouts > $750bn previous 12 months; US Federal deficit as much as 6.1% of GDP (was 3.9% of GDP Jul ’22) as a result of fiscal infrastructure spend; at peak of 2000 growth, US ran fiscal surplus, peak of 2007 growth deficit was 1% of GDP, peak of final growth deficit was 2.5% of GDP, in newest one deficit was 4% of GDP…

…clear secular deterioration.

Hartnett’s punchline can be his “endgame” commerce advice – go all in the subsequent massive recession, when the Fed goes all-in “Japan”, and is pressured to launch yield curve management (YCC) the identical approach it did throughout World Battle 2, to maintain the greenback reserve standing, and the western monetary system from disintergrating:

“US authorities debt to rise >$21tn subsequent 10 years = $5.2bn each day, $218mn each hour… the nice irony of inflationary 2020s might be in subsequent recession Fed pressured to resort to YCC to bail out US authorities…and that’s when the subsequent nice bull market in threat begins.”

Someplace Zoltan Pozsar is smiling.

Extra within the full Hartnett Stream Present accessible to professional subs right here.

Tyler Durden

Fri, 02/24/2023 – 18:00

[ad_2]