[ad_1]

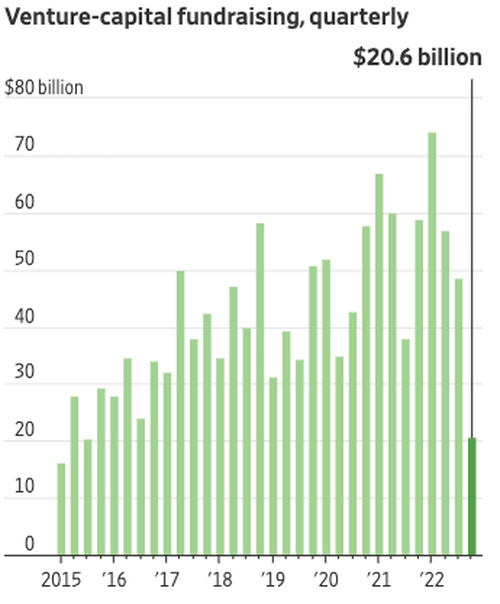

Fundraising by venture-capital (VC) corporations plunged to a nine-year low within the fourth quarter as rising market volatility, geopolitical uncertainty, and better inflation spooked traders, in accordance with WSJ.

Preqin Ltd., a agency that tracks venture-fund information, launched a brand new report that reveals VCs raised a measly $20.6 billion in new funds within the fourth quarter. That was a whopping 65% decline in contrast with the quarter a 12 months earlier and the bottom fourth-quarter quantity since 2013.

“The quantity was additionally lower than half the extent raised within the previous three months, the primary time fundraising volumes decreased from the third to a fourth-quarter since 2009,” WSJ famous.

Preqin information confirmed that fund backers, often known as restricted companions (LPs), invested in 226 venture-capital funds within the fourth quarter, the smallest quantity since 2012. For some context, within the final three months of 2021, in the course of the Covid mania, LPs invested in 620 funds.

A few of these backers embrace college endowments, pension funds, and household places of work. A lot of them plowed an unlimited quantity of capital into VCs in the course of the previous half-decade. However that each one started to unravel late within the second half of 2022 as uncertainty plagued markets due to the Federal Reserve’s aggressive rate of interest hikes to fight excessive inflation.

The decline in VC fundraising coincides with a plunge in know-how shares.

The funding surroundings in 2023 is far completely different from the mania section that started within the second half of 2020.

The enterprise corporations that guess on tech startups slowed the tempo of investing amid a dearth of corporations going public, plunging shares and valuations, and rising rates of interest and inflation. For restricted companions, that has meant fewer alternatives to again new funds and a pause in payouts from their present bets. –WSJ

In the meantime, VC investments recorded the sharpest drop in additional than 20 years final 12 months, surpassing the declines of the Dot-Com crash and monetary disaster.

What’s taking place is a Fed-induced de-risking of the frothiest a part of the market. Many LPs and VCs are on the sideline and ready for an all-clear sign from the Fed concerning a shift in financial coverage. Nevertheless, the most recent communication from Fed members suggests rates of interest will likely be held increased for longer, which could proceed to roil the funding aspect of the market by way of 2023.

Loading…

[ad_2]