[ad_1]

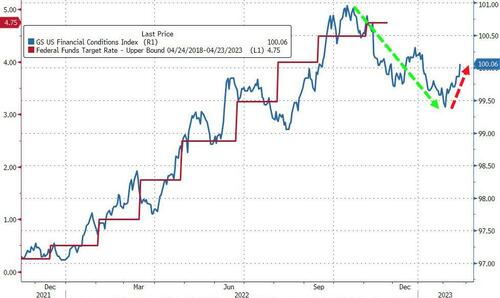

Tl:dr: Fed Minutes seem to argue in opposition to what Powell mentioned throughout the presser on the decoupling of economic circumstances from financial coverage:

Powell declined to attempt to speak down monetary markets, pointedly noting that it wasn’t as much as him to steer folks, saying:

“We’re simply going to should see.”

In contrast, it looks like there have been others on the panel that have been involved.

“Members famous that it was necessary that general monetary circumstances be in keeping with the diploma of coverage restraint that the Committee is placing into place to be able to carry inflation again to the two p.c aim.”

Moreover:

“a number of members noticed that some measures of economic circumstances had eased over the previous few months.”

Whereas Powell mentioned on the assembly

“Monetary circumstances didn’t actually change a lot from the December assembly to now.”

And there is a lengthy strategy to go to catch up…

Total, Bloomberg’s sentiment mannequin suggests the Minutes have been extra dovish than the final…

That’s the most dovish assertion in no less than two years.

However, David Wilcox of Bloomberg Economics famous on BTV, there may be solely a single point out of a “pause” in charges — and that one is in reference to different central banks!

* * *

For the reason that final FOMC assembly (on Feb 1st) when Chair Powell dismissed any fears about loosening monetary circumstances, prompting a panic-bid in shares, monetary circumstances have carried out nothing however tighten because the FedSpeak together with ‘good’ financial information has nuked the ‘Fed pivot’ narrative…

Supply: Bloomberg

That’s much more evident within the hawkish explosion larger out there’s expectation for The Fed’s terminal price and the collapse in hopes of a H2 2023 rate-cut…

Supply: Bloomberg

With the chances of 25bp hikes in March, Could, and June all rising quickly…

Supply: Bloomberg

All of which has prompted chaos throughout asset courses with gold and bonds down notably, bitcoin and the greenback stronger and shares fading quick in the previous couple of days…

Supply: Bloomberg

And if there may be one last factor to think about earlier than The Minutes come out, it is the truth that US macro information has dramatically shocked to the upside (and sticky inflation expectations together with it):

-

the 517,000 surge in January payrolls that blew away estimates

-

the re-acceleration of month-on-month CPI inflation in January

-

the largest leap within the ISM companies gauge since mid-2020

-

the biggest enhance in retail gross sales in practically two years

…making the Minutes very stale.

Supply: Bloomberg

As a reminder, Fed Chair Powell truly instructed us throughout the press convention on Feb 1st that:

“The minutes will come out in three weeks and will provide you with plenty of element. We spend plenty of time speaking concerning the path forward and the state of the financial system. And I wouldn’t wish to begin to describe all the small print there, however that was — the sense of the dialogue was actually speaking fairly a bit concerning the path ahead.”

Whereas the largest subject to look at for is simply how dovish sentiment actually is inside The Fed, we already know that no less than two Fed members pushed for 50bps (Mester and Bullard) on the final assembly, so what’s going to The Minutes inform us (now that they’re so stale)…

On 25 or 50 bps

Of their consideration of acceptable financial coverage actions at this assembly, members concurred that the Committee had made vital progress over the previous yr in shifting towards a sufficiently restrictive stance of financial coverage. Even so, members agreed that, whereas there have been latest indicators that the cumulative impact of the Committee’s tightening of the stance of financial coverage had begun to average inflationary pressures, inflation remained effectively above the Committee’s longer-run aim of two p.c and the labor market remained very tight, contributing to persevering with upward pressures on wages and costs.

In opposition to this backdrop, and in consideration of the lags with which financial coverage impacts financial exercise and inflation, virtually all members agreed that it was acceptable to lift the goal vary for the federal funds price 25 foundation factors at this assembly. Many of those members noticed {that a} additional slowing within the tempo of price will increase would higher permit them to evaluate the financial system’s progress towards the Committee’s targets of most employment and worth stability as they decide the extent of future coverage tightening that will probably be required to achieve a stance that’s sufficiently restrictive to attain these targets.

Just a few members said that they favored elevating the goal vary for the federal funds price 50 foundation factors at this assembly or that they may have supported elevating the goal by that quantity. The members favoring a 50-basis level enhance famous {that a} bigger enhance would extra shortly carry the goal vary near the degrees they believed would obtain a sufficiently restrictive stance, bearing in mind their views of the dangers to attaining worth stability in a well timed approach.

All members agreed that it was acceptable to proceed the method of decreasing the Federal Reserve’s securities holdings, as described in its beforehand introduced Plans for Decreasing the Dimension of the Federal Reserve’s Stability Sheet.

On Threat Administration

“Nearly all members noticed that slowing the tempo of price will increase on the present juncture would permit for acceptable threat administration.”

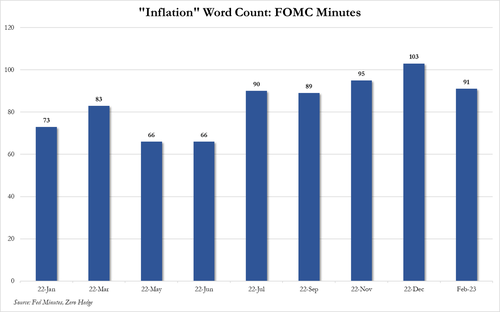

On Inflation

“A lot of members noticed that a coverage stance that proved to be insufficiently restrictive might halt latest progress in moderating inflationary pressures.”

The Fed employees doesn’t see inflation shifting again to 2% till 2025:

“With steep declines in client power costs and a considerable moderation in meals worth inflation anticipated for this yr, whole inflation was projected to step down markedly this yr after which to trace core inflation over the next two years. In 2025, each whole and core PCE worth inflation have been anticipated to be close to 2 p.c.”

On market valuations

“The employees judged that asset valuation pressures remained notable. Particularly, the employees famous that measures of valuations in each residential and industrial property markets remained excessive, and that the potential for giant declines in property costs remained better than traditional. As well as, the ahead price-to-earnings ratio for S&P 500 corporations remained above its median worth regardless of the decline in fairness costs over the previous yr.”

On Family Spending Slowdown

“Of their dialogue of the family sector, members famous that progress in client spending had softened just lately. A number of members remarked that there had been a discount in discretionary expenditures, particularly amongst lower- and middle-income households, whose purchases have been shifting towards lower-cost choices.”

On Labor Hoarding

“A lot of members remarked that some companies have been eager to retain staff after their latest experiences of labor shortages and hiring challenges. These members famous that this consideration had restricted layoffs even because the broader financial system had softened”

On The Debt Restrict

“A lot of members burdened that a drawn-out interval of negotiations to lift the federal debt restrict might pose vital dangers to the monetary system and the broader financial system.”

On monetary circumstances

…officers mentioned it was necessary “that general monetary circumstances be in keeping with the diploma of coverage restraint that the Committee is placing into place to be able to carry inflation again to the two p.c aim.”

Moreover:

“a number of members noticed that some measures of economic circumstances had eased over the previous few months.”

Whereas Powell mentioned on the assembly

“Monetary circumstances didn’t actually change a lot from the December assembly to now.”

Nonetheless an extended strategy to go to normalize again to financial coverage…

However, David Wilcox of Bloomberg Economics famous on BTV, there may be solely a single point out of a “pause” in charges — and that one is in reference to different central banks!

Learn the complete Minutes under:

Loading…

[ad_2]