[ad_1]

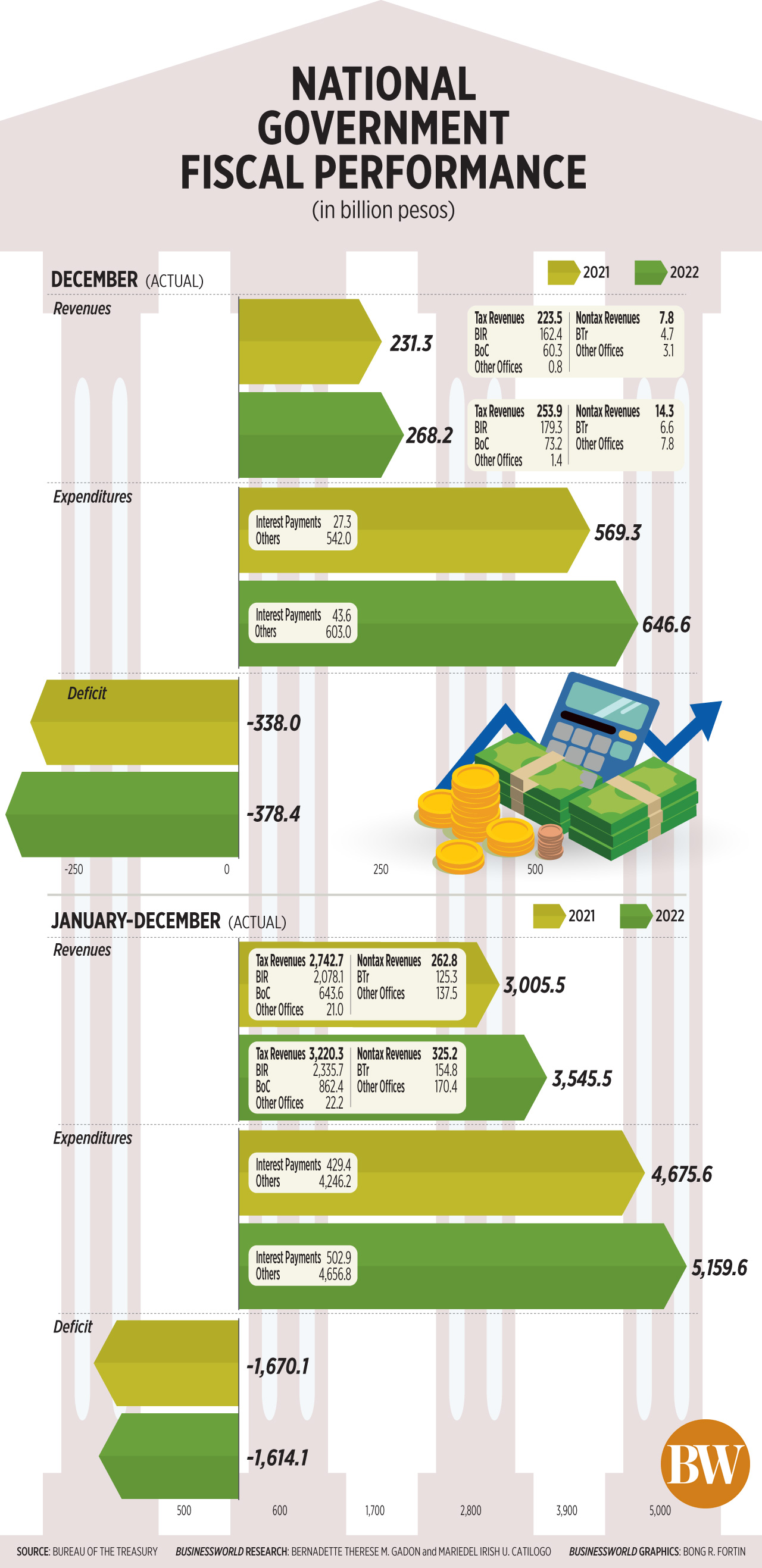

THE NATIONAL Authorities’s (NG) fiscal hole narrowed yr on yr to P1.61 trillion in 2022, however exceeded the finances deficit ceiling.

Information from the Bureau of the Treasury (BTr) confirmed the full-year deficit was decrease by 3.35% or P56 billion than the P1.67 trillion shortfall in 2021.

It was additionally increased than the revised P1.502-trillion goal set by the Improvement Finances Coordination Committee (DBCC) final December.

“The fiscal outturn was pushed by income progress of 17.97% outpacing the ten.35% enlargement in authorities spending,” the BTr stated in a press launch on Wednesday.

This introduced the fiscal deficit to 7.33% of gross home product (GDP), decrease than 8.6% in 2021 however increased than the DBCC goal of 6.9%.

In December alone, the finances hole widened to a document P378.4 billion, up 11.94% from the P338 billion in the identical month in 2021.

Revenues in December elevated by 15.95% yr on yr to P268.2 billion.

Tax revenues grew by 13.61% to P253.9 billion throughout the month, as Bureau of Inside Income’s (BIR) assortment rose by 10.42% to P179.3 billion and the Bureau of Customs (BoC) revenues reached P73.2 billion, up by 21.4% from a yr in the past.

Alternatively, nontax revenues from the Treasury went up by 38.31% to P6.6 billion in December.

In the meantime, authorities spending jumped by 13.57% to P646.6 billion in December from P569.3 billion in the identical month a yr in the past.

Major spending — which refers to complete expenditures minus curiosity funds — rose by 11.25% to P603 billion from P542 billion.

FULL YEAR

For the full-year 2022, income assortment jumped by 17.97% to P3.55 trillion from P3.01 trillion in 2021. It was additionally barely increased than its P3.52-trillion program for the yr.

Tax revenues, which accounted for 91% of the overall revenues, rose by 17.41% to P3.22 trillion from P2.74 trillion a yr in the past.

Of this, revenues generated by the BIR went up by 12.39% to P2.34 trillion, whereas collections from the BoC jumped 34.01% to P862.4 billion.

Different tax accumulating places of work posted P22.2 billion in income, a rise of 5.69% from a yr earlier.

Nontax revenues from the BTr reached P154.8 million, up by 23.48% from a yr in the past.

“The BTr’s sturdy assortment was largely pushed by increased remittances of dividends on shares of shares, revenue from Bond Sinking Fund investments, and curiosity on NG deposits,” the Treasury added.

In the meantime, expenditures elevated by 10.35% to P5.16 trillion, from the earlier yr’s P4.68 trillion. This additionally surpassed the DBCC’s P5.02-trillion program for the complete yr.

The BTr stated that spending was largely attributed to the “quicker execution of capital outlay tasks amid the bottom COVID-19 (coronavirus illness 2019) alert degree classification for many elements of the nation; implementation of focused subsidy applications to mitigate the impression of upper meals and gas costs; and cost of compensation and different advantages for COVID-19 healthcare employees in well being services.”

Major spending rose by 9.67% to P4.66 trillion from P4.25 trillion a yr in the past.

Rizal Business Banking Corp. Chief Economist Michael L. Ricafort stated in a Viber message that inflation could have contributed to the month-on-month widening of the finances deficit in December.

“The upper inflation may have pushed up nominally the incomes of taxpayers, raised nominal values of property, and allowed the federal government to borrow cash at increased charges and earn extra curiosity revenue on its holdings of presidency bonds. The primary result’s the rise in authorities revenues,” Leonardo A. Lanzona, who teaches economics on the Ateneo de Manila College, stated in an e-mail.

Mr. Lanzona famous the federal government must search for new sources of revenues, resembling new taxes.

“Presently, as a substitute of elevating taxes straight, governments allowed inflation to cut back the worth of cash, which in flip diminished the true worth of excellent money owed and generated further revenues. Nevertheless, counting on inflation as a income supply is mostly seen as a dangerous coverage, as it might probably result in financial instability, uncertainty, and distortions within the economic system,” he added.

Union Financial institution of the Philippines, Inc. Chief Economist Ruben Carlo O. Asuncion stated the narrower full-year NG finances shortfall “is a welcome improvement even amid rising international and home borrowing prices.”

“Larger-than-expected income collections because of the financial reopening narrative and higher-than-expected 2022 GDP progress has enabled the trimmed fiscal deficit. Nonetheless, we nonetheless sense robust near- to medium-term fiscal pressures because of the increased debt inventory this yr and the uncertainties on the backdrop of rising financial coverage rates of interest (to take care of increased costs),” Mr. Asuncion stated. — Luisa Maria Jacinta C. Jocson

[ad_2]