[ad_1]

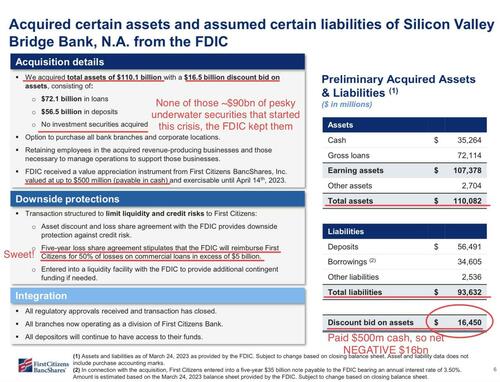

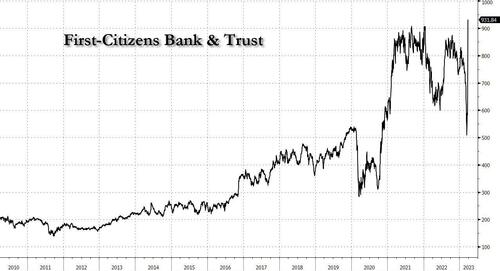

Yesterday, we defined that the rationale why the inventory worth of First-Residents Financial institution & Belief exploded on Monday after the FDIC revealed that it could “purchase” a lot of the now failed Silicon Valley Financial institution, is as a result of in trade for paying $500 million to the FDIC, the Raleigh, N.C. financial institution wouldn’t solely get $16.5 billion in clear property, however would additionally get a taxpayer backstop for future losses besides.

However whereas the transaction was instantly accretive to First-Residents shareholders (to not point out the billionaire dynasty of controlling shareholders) which doubled its market cap moments after the information hit…

… the query is who would find yourself footing the invoice. The logical reply, after all, is “US taxpayers”… until after all the FDIC discovered another person to entrance the huge prices which have emerged because of the continued financial institution failures.

Effectively, moments in the past Bloomberg reported that the FDIC might have discovered somebody to “volunteer” and choose up a lot of the tab: that somebody are the exact same giant, megabanks which have instantly benefited from the continued disaster of confidence shaking their small, regional friends.

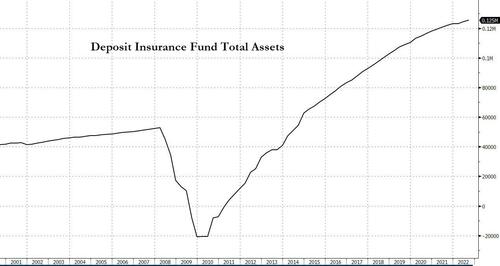

In accordance with Bloomberg, the Federal Deposit Insurance coverage Corp, which is dealing with nearly $23 billion in prices from latest financial institution failures, is “contemplating steering a larger-than-usual portion of that burden to the nation’s greatest banks.”

The company has mentioned it plans to suggest a so-called particular evaluation on the business in Might to shore up a $128 billion deposit insurance coverage fund that’s set to take main hits after the latest collapses of Silicon Valley Financial institution and Signature Financial institution, and whose function is to “insure” the roughly $10 trillion in assured deposits (these beneath $250,000) but which is a small fraction of that whole quantity.

The regulator — beneath political strain to spare small banks now that politicians and the Fed have decimated small banks with each their actions and inactivity — has famous it has latitude in the way it units these charges. Behind the scenes, Bloomberg reviews, officers wish to restrict the pressure on neighborhood lenders by shifting an outsize portion of the expense towards a lot bigger establishments, in response to individuals with information of the discussions. That will add to what already could also be multibillion-dollar tabs apiece for the likes of JPMorgan Chase, Financial institution of America and Wells Fargo.

Talks for setting the scale and timing of the evaluation are in early phases. Leaning closely on massive banks is seen as probably the most politically palatable answer, a few of the individuals mentioned, asking to not be named describing personal deliberations.

To make sure, the contentious query of the right way to unfold the price of SVB’s and Signature’s failures is already a scorching matter in Washington, the place lawmakers have pressed FDIC Chairman Martin Gruenberg, Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell over who will shoulder the burden — particularly after an uncommon resolution to backstop all of these banks’ deposits whereas refusing to backstop all uninsured deposits throughout different banks, thus retaining the financial institution run dormant. The extraordinary measure saved legions of tech startups and rich clients whose balances far exceeded the FDIC’s typical $250,000 restrict on protection, and sparked a backlash towards VC “billionaire bros” who have been the most recent beneficiaries of depositor bailouts.

“I’m involved that Arkansans must subsidize Silicon Valley Financial institution and Signature Banks deposits, and perhaps others that come ahead,” Republican Senator John Boozman instructed Yellen at a listening to final week. “Will the neighborhood banks get charged that particular evaluation?”

She assured him the FDIC has leeway in deciding which banks pays.

“We’re going to be keenly delicate to the affect,” Gruenberg added at a listening to on Wednesday, when requested in regards to the pressure on neighborhood banks. “Now we have the discretion to tailor that evaluation to the establishments that almost all instantly benefited.”

And simply as we defined in “Too-Huge-To-Fail Banks Flooded With Deposits As Financial institution Run Drains Small Financial institution Of Money“, with the large banks benefiting “probably the most instantly” from the regional financial institution disaster, it is sensible that they find yourself paying, and that the particular evaluation might be reserved for the Jamie Dimons of the world.

What sort of harm do the large banks should sit up for? Effectively, as Bloomberg calculates “leaning on massive banks can add up quick” – when the FDIC got down to elevate $5.5 billion with a particular evaluation in 2009, JPMorgan mentioned the surcharge extracted $675 million from its second-quarter earnings. In fact, the affect from SVB and Signature might simply go far past that; after all of the implicit reward to First Residents is no less than $16 billion. Certain sufficient, the company estimated Sunday that SVB’s failure will value $20 billion, on prime of the $2.5 billion chunk it expects from Signature.

It’s unclear is how shortly the FDIC desires to gather the evaluation. Just lately, some giant banks have additionally confronted strain to shore up the stability sheet of one other troubled lender, First Republic Financial institution. For now, regulators are giving that financial institution extra time to achieve a deal to bolster its stability sheet, individuals with information of the state of affairs mentioned late final week. FRC traded up 7% late on Wednesday.

The information initially hit the KBW Financial institution ETF, however as merchants assessed the broader implications of the report, they could concluded that extra capital from the large banks to offset the ache brought on by small banks might find yourself boosting confidence within the broader banking sector, and with some 40 minutes to go till he shut, the KBWB ETF rose to session highs amid contemporary optimism that the acute part of the financial institution disaster is now within the rearview mirror.

Loading…

[ad_2]