[ad_1]

Authored by Ryan McMaken by way of The Mises Institute,

Cash provide development fell once more in December, falling even additional into damaging territory after turning damaging in November for the primary time in twenty-eight years. December’s drop continues a steep downward development from the unprecedented highs skilled throughout a lot of the previous two years. Throughout the 13 months between April 2020 and April 2021, cash provide development in the USA typically climbed above 35 p.c 12 months over 12 months, effectively above even the “excessive” ranges skilled from 2009 to 2013.

Since then, the cash provide development has slowed rapidly, and since November, we have been seeing the cash provide contract for the primary time because the Nineteen Nineties. The final time the year-over-year (YOY) change within the cash provide slipped into damaging territory was in November 1994. At the moment, damaging development continued for fifteen months, lastly turning constructive once more in January 1996.

Throughout December 2022, YOY development within the cash provide was at –2.4 p.c. That is down from November’s price of –0.55 p.c and down from December 2021’s price of 6.44 p.c.

The cash provide metric used right here—the “true,” or Rothbard-Salerno, cash provide measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to offer a greater measure of cash provide fluctuations than M2.1

The Mises Institute now gives common updates on this metric and its development. This measure of the cash provide differs from M2 in that it contains Treasury deposits on the Fed (and excludes short-time deposits and retail cash funds).

In current months, M2 development charges have adopted a comparable course to TMS development charges. In December 2022, the M2 development price was –1.3 p.c. That is down from November’s development price of –0.01 p.c. December’s price was additionally effectively down from December 2021’s price of 12.5 p.c.

Cash provide development can typically be a useful measure of financial exercise and an indicator of coming recessions. During times of financial growth, cash provide tends to develop rapidly as business banks make extra loans. Recessions, however, are typically preceded by slowing charges of cash provide development. Nevertheless, cash provide development tends to start rising once more earlier than the onset of recession.

Unfavorable cash provide development shouldn’t be in itself an particularly significant metric. However the drop into damaging territory we have seen in current months does assist illustrate simply how far and the way quickly cash provide development has fallen in current months. That’s typically a pink flag for financial development and employment.

Cash provide development additionally seems to be linked to yield-curve inversion—itself a recession indicator. For instance, the 3s/10s yield unfold typically heads towards zero as cash provide development strikes in the identical course. This was particularly clear from 1999 via 2000, from 2004 to 2006, and through 2018 and 2019, and starting in 2022. This isn’t shocking as a result of developments in cash provide development have lengthy seemed to be linked to the form of the yield curve. As Bob Murphy notes in his guide Understanding Cash Mechanics, a sustained decline in TMS development typically displays spikes in short-term yields, which may gasoline a flattening or inverting yield curve.

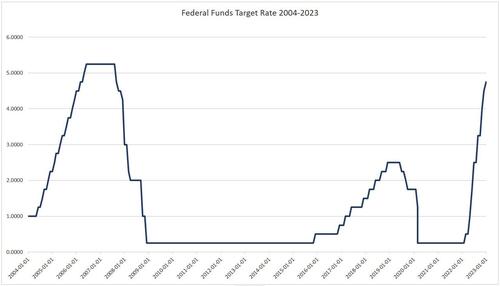

It is not particularly a thriller why short-term rates of interest are headed up quick, and why the cash provide is decelerating. Since January 2022, the Fed has raised the goal federal funds price from 0.25 p.c as much as 4.75 p.c.

This implies fewer injections of Fed cash into the market via open market operations. Furthermore, though it has achieved little or no to sizably cut back the scale of its portfolio, the Fed has nonetheless stopped including to its portfolio via quantitative easing and allowed a small quantity (about 5 p.c of $8.9 trillion) to roll off.

It needs to be emphasised that it isn’t needed for cash provide development to show damaging to be able to set off recession, defaults, and different financial disruptions. With current a long time marked by the Greenspan put, monetary repression, and different types of straightforward cash, the Federal Reserve has inflated quite a few bubbles and zombie enterprises that now depend on practically fixed infusions of latest cash to remain afloat. For a lot of of those bubble industries, all that’s needed for a disaster is a slowing in cash provide development, introduced on by rising rates of interest or a confidence disaster.

Quite a few indicators now level towards recession together with the falling cash provide and the inverted yield curve. The Main Financial Index is in recession territory. Actual wages have fallen for twenty-one months. Dwelling builder confidence fell each month of 2022. The Philadelphia Fed’s manufacturing index has been damaging since September. Dwelling value development has been reduce in half. The truth that the cash provide is definitely shrinking serves as only one extra indicator that the so-called comfortable touchdown promised by the Federal Reserve is unlikely to ever be a actuality.

Loading…

[ad_2]