[ad_1]

It has grow to be unattainable to be an economist or data-watcher (and thus strategist, investor, pundit or analyst) within the US: the reason being that seasonal changes have made nearly each information set a load of rubbish, with little relevance to the actual world.

Take into account the newest nonfarm payroll quantity, the place the seasonally adjusted print got here at a surprising 517K, however solely due to a close to report seasonal adjustment issue which reworked a 2.5 million decline right into a blowout achieve which had a profound affect on market – and Fed psychology.

Or what in regards to the newest retail gross sales, which additionally shocked to the upside, however solely after beneficiant seasonal changes – that are based mostly on just a few excel modeling (and some political faucets on the shoulder) transformed the historically weak January right into a blowout month.

It is not simply plain vanilla financial information: it now seems that arbitrary – and large – seasonal changes are additionally hitting the weekly DOE oil stock report: the previous two weeks, after we noticed close to report stock builds, have been nothing greater than the figment of some excel spreadsheet’s creativeness as a result of because the chart beneath exhibits, that is when the DOE Crude Oil provide “adjustment” issue was one of many highest on report.

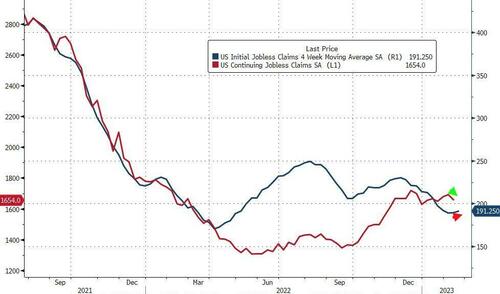

Which brings us to right now’s weekly preliminary jobless claims report, which as soon as once more shocked to the draw back, and regardless of wave after wave of mass layoffs (and severance), it magically dropped to four-week lows, as soon as once more underscoring simply how “fantastic” Biden’s financial insurance policies are as they translate into such an ideal labor market.

Which in fact is horseshit solely this time, it isn’t zero hedge, and even UBS, however the largest US financial institution that’s calling the bullshit on the more and more ridiculous, politicized GIGO that comes out of the admin.

In a word from JPM’s Dan Silver, the financial institution’s economist factors to the stubbornly, laughably low preliminary jobless claims, particularly when contemplating straight tabulated stories of layoffs which in January simply hit a multiyear excessive (in accordance with Layoffs.fyi)…

… and politely says that “some various seasonal changes of the preliminary claims information present some much less favorable adjustments in filings from current weeks than the official figures.”

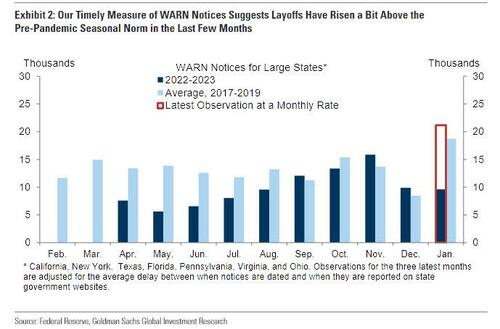

Right here, JPM is merely echoing Goldman, which a number of weeks in the past additionally discovered that preliminary claims are unrealistic, and that when credible, state-level WARN mass layoff notices preliminary claims are far larger.

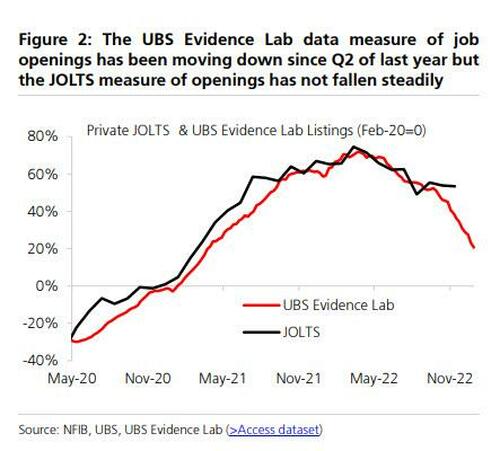

It is not simply JPM and Goldman, nonetheless: three weeks in the past, UBS additionally joined the fray, and confirmed that yet one more information collection – Job Openings – is both deliberately or by accident inflated, and that when have a look at third get together information, the actual variety of job openings is a few third of what the month-to-month JOLTS report signifies.

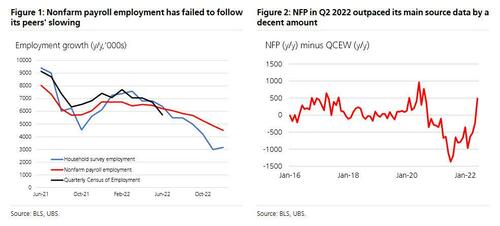

What is very humorous is that banks now not merely observe how the information now not matches, however are making it into a sort of non-public campaign to show the grotesque ranges of BS emanating from the Biden admin. Working example, one other UBS economist only a few days in the past revealed a report asking (rhetorically) if the NFP report is overestimating job beneficial properties.

But it surely’s not simply the sellside: each the Philadelphia Fed and the BLS itself (!) not too long ago discovered that the month-to-month NFP information is ineffective. Right here is UBS economist Jonathan Pringle explaining why:

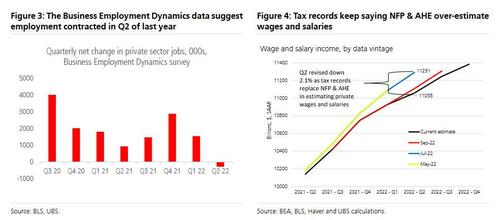

he Bureau of Labor Statistics reported final week that the web change in non-public sector jobs in 2022Q2 was -287K. In distinction, within the month-to-month employment report, non-public nonfarm payroll employment (NFP) is estimated to have risen 1.045 million! The previous estimate comes from the BLS’s Enterprise Employment Dynamics (BED) information. The latter comes from the month-to-month institution survey information, NFP, the information collection that normally makes the primary Friday of each month an thrilling one for monetary markets and economists (in good methods and dangerous). Plus, the Federal Reserve Financial institution of Philadelphia workers revealed a paper final month estimating NFP overstated the employment beneficial properties in 2022Q2 by greater than 1 million (hyperlink right here). If BLS and Fed researchers say NFP was improper, may there be some reality to that? We expect so…

And here is why:

In late September, the Bureau of Financial Evaluation (BEA) revised down estimates of personal wage and salaries sharply. The preliminary estimates are based mostly on NFP and common hourly earnings. These month-to-month estimates are changed with a 1 to 2 quarter lag as extra correct tax data grow to be obtainable. The tax data are additionally the supply information to which NFP is ultimately benchmarked. The Q1 wage and wage estimates based mostly on NFP have been too sturdy. That giant downward revision to Q1 revenue information was a sign that NFP could be overstating the power of job beneficial properties. The Q2 tax data then revised down wage and wage estimates additional.

How massive is the information discrepancy between the actual information and the revealed month-to-month NFP report? Here is the reply to that too:

QCEW information then confirmed extra weak point than NFP too: The Quarterly Census of Employment and Wages (QCEW) can be derived from these tax data, usually assumed to be an correct evaluation of payroll employment as a result of fines employers incur for failure to correctly report back to the states’ unemployment insurance coverage techniques. The info covers roughly 95% of staff within the US. It’s the NFP supply information, in a way. Nevertheless, the information is launched with a lag.

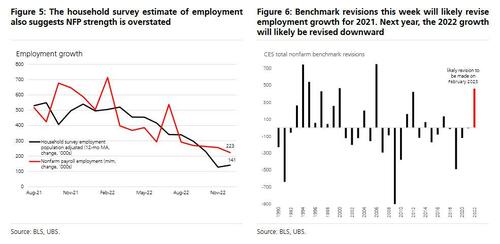

The QCEW information exhibits that within the 12 months ending on June 2022, job progress was 5.7 million. The present revealed change in NFP is 6.2 million. Plus, NFP is about to revise up by roughly 500K as of March 2022 on the annual revision to be reported subsequent week. We count on that the upward revision displays the power in 2021. We count on that NFP went from understating employment power in 2021 to overstating it in 2022.

And that is the place the seasonal changes are available:

If the BED and QCEW level to Q2 weak point, why alter that story? Due to what we see within the BEA information and seasonal adjustment. The BEA revisions to the wage and wage information level to extra overstatement in 2022Q1. As well as, the QCEW information is troublesome to adequately seasonally alter. Take into account the detailed, disaggregated seasonal adjustment for the month-to-month employment report, and nonetheless there are periodic issues. Our guess is the estimates of 400K to 1 million jobs too many, or overstatement, within the month-to-month NFP information, have been doubtless unfold over 6 to 9 months. We’ll know higher after we get the QCEW Q3 information in a month.

In fact, if UBS is aware of this, and JPM is aware of this, and Goldman is aware of this, why not simply name out the BS? Easy: the Biden admin has till February 2024 to come back clear, which is when the official corrections to all the information errors can be revealed, as UBS concludes:

… Sadly, what we, the BLS, and the Philly Fed workers see as overstatement in 2022, is not going to be corrected till February 2024.

In different phrases, there can be one other 12 months of randomly fabricated information meant to serve only one narrative – a political one – as a substitute of representing the true (unhappy) state of the economic system. The issue is that the Fed, and the market, are each utilizing this flawed, seasonally manipulated adjusted information to make financial coverage and capital allocation selections; selections which on reflection one yr from right now can be proved to have been useless improper.

By then, Powell can be lengthy gone, Biden – having collected the massive man’s share for one more 12 months – can be on his drooling approach out to some tropical island paradise, however for the reason that BLS continues to misrepresent the true state of the labor market, Fed funds could also be within the double digits, resulting in a historic implosion of the US economic system. The one query then can be whether or not stated gutting, like the worldwide covid emergency and financial lockdowns, was orchestrated and by whom.

The complete UBS report on payroll “ovestatement” could be discovered right here for professional customers.

Loading…

[ad_2]