[ad_1]

Recall again in September, once we wrote that “The “Scariest Paper Of 2022” Reveals The Terrifying Destiny Of Biden’s Economic system: Thousands and thousands Are About To Lose Their Job” we reminded readers of what we wrote final June, once we stated that “sooner or later Fed will concede it has no management over provide. That is once we will begin getting leaks of elevating the inflation goal“…

Sooner or later Fed will concede it has no management over provide. That is once we will begin getting leaks of elevating the inflation goal

— zerohedge (@zerohedge) June 21, 2022

… and only a few months later that is exactly what occurred as a result of in response to a rising variety of economists, comparable to Obama’s personal prime financial adviser from 2013-2017 and at the moment financial coverage professor at Harvard, Jason Furman, “To deliver worth will increase right down to 2%, we might must tolerate unemployment of 6.5% for 2 years” who added that to keep away from a social disaster, “stabilizing at a 3% inflation price might be more healthy for the financial system than stabilizing at 2%—so whereas preventing inflation must be the central financial institution’s solely focus in the present day, sooner or later the Fed ought to reassess the which means of victory in that battle.”

(iii) Critically think about elevating the inflation goal to one thing like 3 %

This one is difficult. On a clean slate a 3% goal can be higher than a 2% goal. However shifting to that might deanchor expectations.

— Jason Furman (@jasonfurman) September 8, 2022

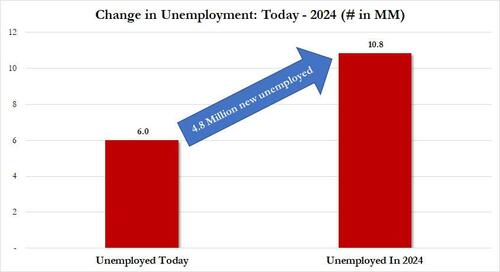

The purpose Furman – a lifelong democrat – was making was easy: if the Fed’s inflation goal doesn’t rise from 2%, it might result in (at the very least) a 6.5% unemployment price in 2024 which might translate into at least 10.8 million unemployed employees, an 80% improve from the 6 million in the present day. For sure, this might be political suicide for any Democratic administration .

To make certain, there are large implications to elevating the inflation goal, not least of which is – properly – increased inflation, in addition to sharply increased asset costs, and a catastrophic lack of credibility within the Fed. And but, when the commerce off is social unrest – which is inevitable if the Fed plans to maintain charges at 5% or increased for a number of years – then the choice is palatable. So palatable, actually, that as we reported in November, Goldman and TS Lombard additionally acquired on board, with the previous writing that “given that the majority would agree {that a} quick discount in inflation to 2% is unlikely we will now have a debate whether or not elevating the G10 inflation goal to the 3-4% vary is extra optimum for causes of sustaining employment ranges or public debt sustainability than the two% aim which might not be doable if inflation was sticky within the 6-10% vary” whereas TS Lombard chief strategist Steven Blitz chimed in with the next:

In the long run, a recession is just about baked in by what the Fed has performed, signalled, and can do. The general imbalance between the provision and demand for labor is an excessive amount of of a driver of inflation, by means of wages and, in flip, companies ex shelter, for the Fed to cease now and say they’ve performed sufficient. Powell, actually, was very clear there may be rather more to do. This doesn’t negate the incontrovertible fact that the approaching downcycle will drastically affect those who AIT [average inflation targeting] was looking for to guard and are solely simply getting nearer to even by way of employment. None of this modifications the Fed’s coming actions, what this coming hit to employment does imply is that the political cycle for the Fed is about to get rather a lot hotter – from all sides. That is one motive why I’ve lengthy believed, as have many others, that the Fed finally bails and raises the inflation goal to three%. Powell doesn’t have the identical license to maintain unemployment excessive and actual development low for an prolonged interval as did Volcker (extra so looking back than on the time). My guess is, Powell is aware of that.

Quick ahead to in the present day when yet one more monetary icon has joined the “increase the inflation goal” bandwagon, after Mohamed El-Erian informed Bloomberg TV that the Fed gained’t be capable to get US inflation right down to its 2% goal with out “crushing the financial system,” although he too conceded that the central financial institution is unlikely to formally change that aim put up, as an alternative the Fed must merely fake it has a 2% inflation goal even because it resets increased.

“You want the next secure inflation price. Name it 3 to 4%,” El-Erian, the chairman of Gramercy Funds informed Bloomberg Tv. “I don’t suppose they’ll get CPI to 2% with out crushing the financial system, however that’s as a result of 2% will not be the appropriate goal.”

Calling the Fed “too information dependent,” El-Erian stated supply-side developments, together with an vitality transition, the change in provide chains throughout the pandemic, a good labor market and shifting geopolitical points, necessitate the upper goal inflation price.

“It’s proper to take information under consideration however you’ve acquired to have a view of the place you’re going,” he stated.

The issue now, El-Erian stated, is that the Fed is caught chasing an elusive 2% aim.

“You may’t change an inflation goal once you’ve missed it in such a giant manner,” he stated. He’s beforehand cautioned that altering the goal can be a success to the Fed’s credibility.

When requested on Friday if the Fed may “tolerate” increased inflation, El-Erian stated that’s “the place I hope to go.”

El-Erian’s look follows an op-ed he wrote for Undertaking Syndicate final week wherein he stated that inflation has a 75% probability of rebounding, and the Fed may find yourself crushing the financial system because it struggles to rein in hovering costs.

“Almost two years into the present bout of inflation, the idea of ‘transitory inflation’ is making a comeback because the COVID-related provide shocks dissipate,” Costs would then skyrocket to a 41-year-high, forcing Fed officers to stroll again their phrases and aggressively hike rates of interest in 2022 to chill off the financial system.

He added the most probably situation was inflation remaining sticky at 3%-4%, which El-Erian estimates has a 50% chance.

“This might drive the Fed to decide on between crushing the financial system to get inflation right down to its 2% goal … or ready to see whether or not the US can stay with secure 3% to 4% inflation,” he stated, suggesting the Fed would wish to maintain rates of interest excessive.

After all, if Powell have been to even trace at a delicate inflation goal rise, all the things – from shares, to cryptos, to kitchen sinks – would go restrict up immediately.

Loading…

[ad_2]