[ad_1]

Authored by Simon White, Bloomberg macro strategist,

Credit score spreads are trying more and more indifferent to rising leverage, tight international liquidity and recession danger…

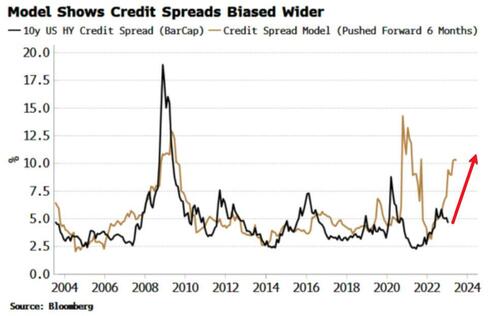

Since peaking out in October, spreads have been tightening, however that is more and more at odds with many different indicators.

The worldwide liquidity surroundings stays very tight, which pressures spreads wider. Equally, private financial savings have been rising, which on the margin is unhealthy for firms as revenue is diverted away from them.

My mannequin for credit score spreads, which makes use of these and different inputs, reveals they ought to transfer wider within the coming months.

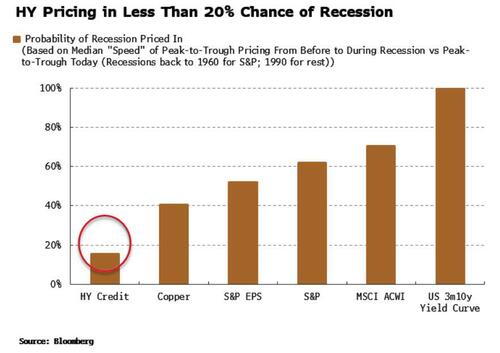

Credit score markets are additionally complacent on the danger of a recession. We will take a look at how varied belongings have behaved in earlier ones and evaluate it to how they’ve carried out on this cycle to deduce an implied likelihood of a recession.

Whereas the yield curve is “sure” a recession is on the best way, and even rose-tinted equities see a hunch occurring as higher than evens, credit score spreads are implying solely a one-in-six likelihood of a downturn. However the chance of a recession from a number of angles suggests the danger is way increased.

One other warning is that bank-lending requirements proceed to tighten whilst credit score spreads are available in.

Typically banks take their cues of credit score situations from spreads as they’re a every day gauge of the credit score scenario. However the Fed’s Senior Mortgage Officer Survey, with the most recent quarter’s information launched yesterday, confirmed banks continued to tighten mortgage requirements regardless of tighter spreads.

On the optimistic facet of the ledger is a fall in companies’ debt-servicing prices as inflation has improved nominal incomes. Additionally, the company financing hole is unfavourable, exhibiting that firms’ inside funds are on mixture ample to cowl capital expenditures, decreasing the necessity for financing. And corporations had been capable of refinance amid strong demand for credit score. However these are unlikely to be sufficient to counter poor liquidity and heightened recession danger.

One clarification for credit score markets’ optimistic outlook comes from fevered hypothesis in fairness choice markets, with the explosive rise in 0DTE (zero days to expiry) buying and selling a possible aggravating issue.

There was a latest burst in exercise in lending markets, with even the famed CLO behemoth, Japanese farmers’ financial institution Norinchukin, able to return to the fray. However with credit score trying one of the crucial mispriced belongings, such renewed hypothesis is fated to finish with crushing disappointment.

Loading…

[ad_2]