[ad_1]

-slav-

Because the affect of the COVID-19 pandemic continues to ease and the U.S. will elevate the general public well being emergency in Could, vaccine makers are in for a steep drop in gross sales of their COVID pictures.

That is the evaluation from analytics agency GlobalData, which estimates COVID vaccine gross sales will decline by $10B between 2021 and 2028.

The marketplace for COVID vaccines is presently dominated by Pfizer (NYSE:PFE)/BioNTech (NASDAQ:BNTX) and Moderna (NASDAQ:MRNA), which produce mRNA pictures.

In 2022, Pfizer (PFE) and BioNTech’s (BNTX) shot, Comirnaty, accounted for for 58% of complete COVID vaccine gross sales. Moderna’s (MRNA) Spikevax had a 30% share, which is anticipated to say no to 16% by 2028.

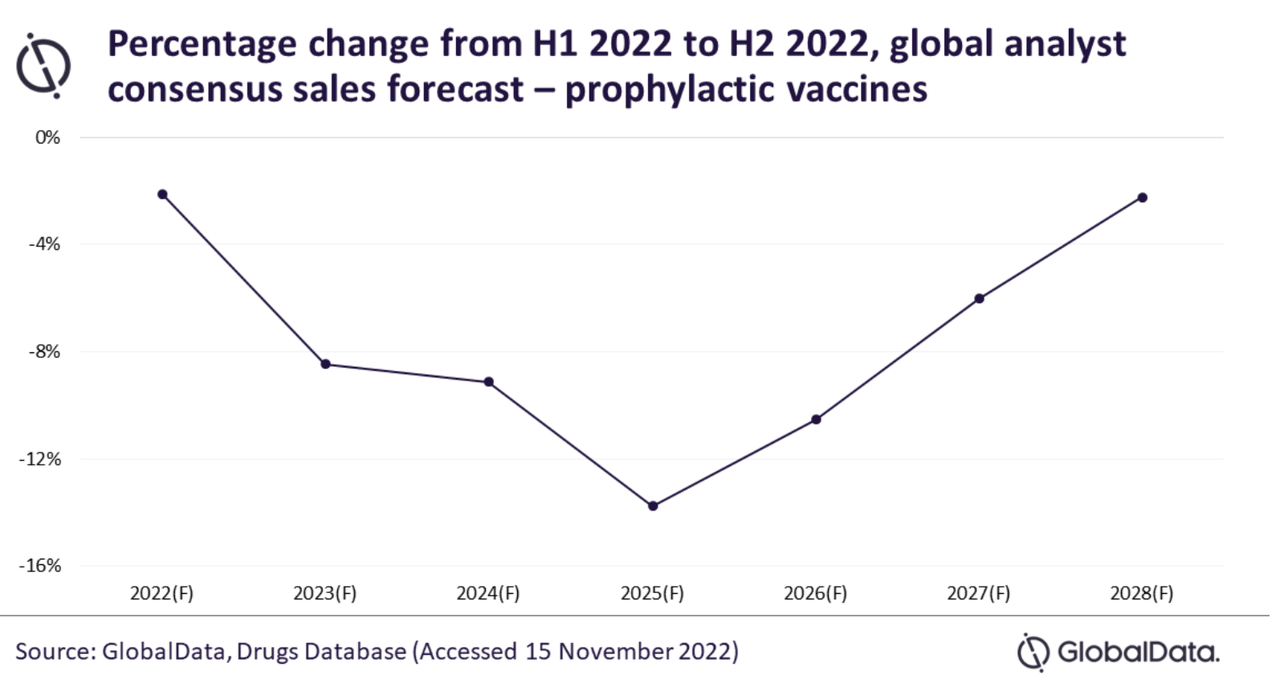

A brand new report from GlobalData discovered that between the primary and second halves of 2022, analysts lowered their anticipated gross sales by 2028 by a median 7%.

The best decline is anticipated in 2025, when ~14% drop is anticipated. After that, the decline will turn out to be much less.

Quentin Horgan, an affiliate director at GlobalData, famous that the decline will affect some drugmakers greater than others. He stated that gross sales of AstraZeneca’s (AZN) Vaxzevria are projected to say no a median of 47% from 2022-28 primarily based on analyst opinion. Between 1H and 2H 2022, analysts on common lowered anticipated gross sales of Moderna’s (MRNA) Spikevax in 2022 by 23%.

The report comes because the COVID public well being emergency will finish on Could 11. This might additional hamper COVID vaccine gross sales because the pictures will not be free for all People no matter insurance coverage standing. Though the value per shot is anticipated to rise, which has drawn criticism, there are indications that uptake of additional booster pictures could also be extra restricted than up to now.

Pfizer (PFE) has already been predicting a serious decline in Comirnaty gross sales for 2023. In its This autumn 2022 monetary outcomes launched in late January, the pharma large expects Comirnaty revenues to say no 64% from 2022 to ~$13.5B.

In its current This autumn earnings, Moderna (MRNA) stated it could take a $333M cost for stock write-downs associated to COVID-19 merchandise that may seemingly should be tossed.

The GlobalData report additionally famous that vaccine gross sales will probably be undermined by extra COVID therapeutics in growth, lots of which will be given orally, a way more handy possibility.

The agency’s Medication Database noters that there are 148 therapies for COVID in late-stage growth — 136 in part 3 and 12 in pre-registration.

[ad_2]