[ad_1]

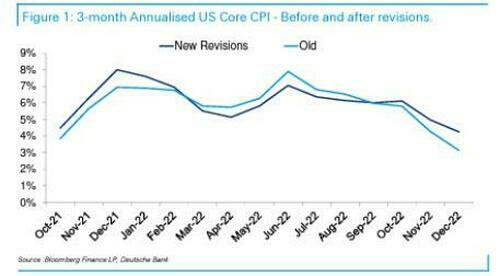

As a reminder, CPI revisions hit Friday – rewriting your entire final twelve months increased by a mean of round 0.1% monthly – so whereas the development going into immediately’s much-anticipated CPI is The Fed’s good friend, we’re additional away from their goal earlier than we see immediately’s print.

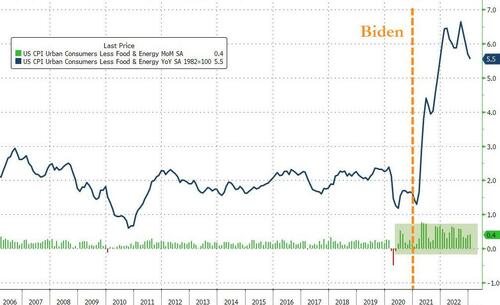

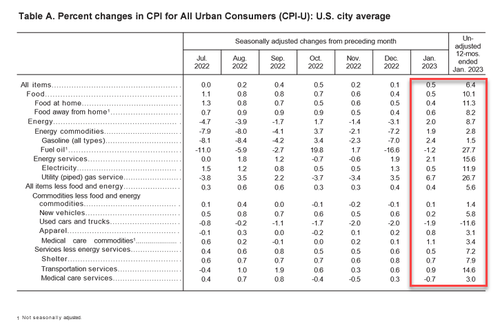

And so, after rising 0.1% MoM final month (up from the preliminary -0.1% print), consensus was for a reaccleration to +0.5% MoM in January and that’s what it printed, prompting a warmer than anticipated +6.4% YoY CPI print (+6.2% exp)…

Supply: Bloomberg

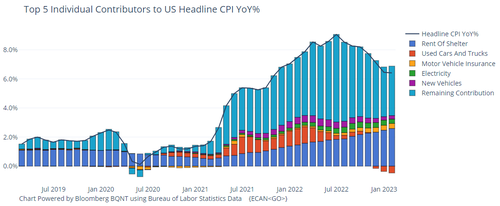

These are the Prime 5 contributors to headline CPI (rising shelter prices stand out)…

Core CPI was anticipated to rise 0.4% MoM and printed in line – the thirty second month in a row of rising Core CPI

Supply: Bloomberg

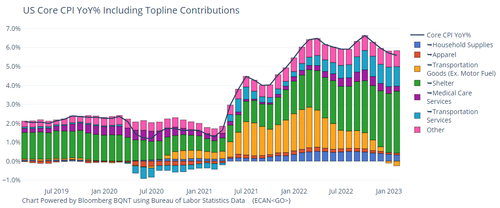

The highest drivers of Core CPI…

Supply: Bloomberg

The index for all objects much less meals and power rose 0.4 % in January. The shelter index continued to extend, rising 0.7 % over the month.

-

The lease index and the house owners’ equal lease index every rose 0.7 % since December. The index for lodging away from residence elevated 1.2 % in January.

-

The shelter index was the dominant issue within the month-to-month improve within the index for all objects much less meals and power, whereas different elements have been a mixture of will increase and declines.

Among the many different indexes that rose in January was the index for motorcar insurance coverage, which elevated 1.4 % over the month, whereas the index for recreation rose 0.5 %, and the index for attire elevated 0.8 %.

-

The family furnishings and operations index rose 0.3 % in January, and the communication index elevated 0.4 %

-

The medical care index fell 0.4 % in January, because the physicians’ providers index declined 0.1 %. The index for hospital providers elevated 0.5 % over the month and the index for pharmaceuticals rose 2.1 % in January.

-

Different indexes which declined over the month embrace the index for used automobiles and vans, which fell 1.9 % in January, persevering with a latest downward development. The index for airline fares fell 2.1 % over the month.

The index for all objects much less meals and power rose 5.6 % over the previous 12 months. The shelter index elevated 7.9 % over the past 12 months, accounting for almost 60 % of the entire improve in all objects much less meals and power. Different indexes with notable will increase over the past 12 months embrace family furnishings and operations (+5.9 %), medical care (+3.1 %), recreation (+4.8 %), and new automobiles (+5.8 %)

-

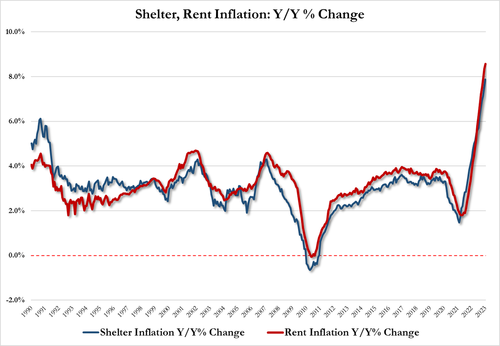

Shelter inflation +7.88%, up from 7.51% in Dec and the very best on document

-

Hire inflation +8.56%, up from 8.35% in Dec and the very best on document

Companies CPI soared to its highest since July 1982 and Items inflation continues to gradual…

Supply: Bloomberg

Most notably, Core providers CPI, excluding shelter – a measure Fed Chairman Powell has highlighted – has cooled on a year-over-year foundation. That ought to ease issues a few extra hawkish tilt, serving to threat property.

Supply: Bloomberg

Powell has additionally flagged housing providers as a phase of the financial system with disinflation within the pipeline, so long as rents hold coming down. Housing exercise has weakened with the bounce in mortgage charges. S&P 500 futures briefly turned crimson earlier than recovering and persevering with to climb

Is that this stall within the decline of inflation reflecting the lagged pause in M2’s decline?

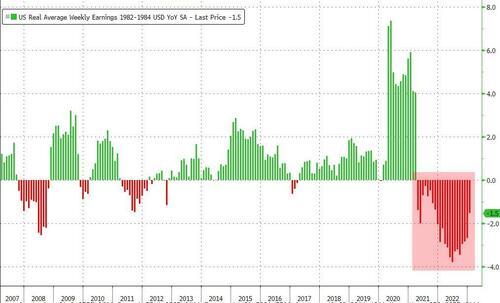

Lastly, the rise in People’ value of dwelling outpaced their earnings features for the twenty second month in a row (down 1.5% YoY)…

Supply: Bloomberg

Simply do not forget the financial system is “robust as hell”.

Loading…

[ad_2]