[ad_1]

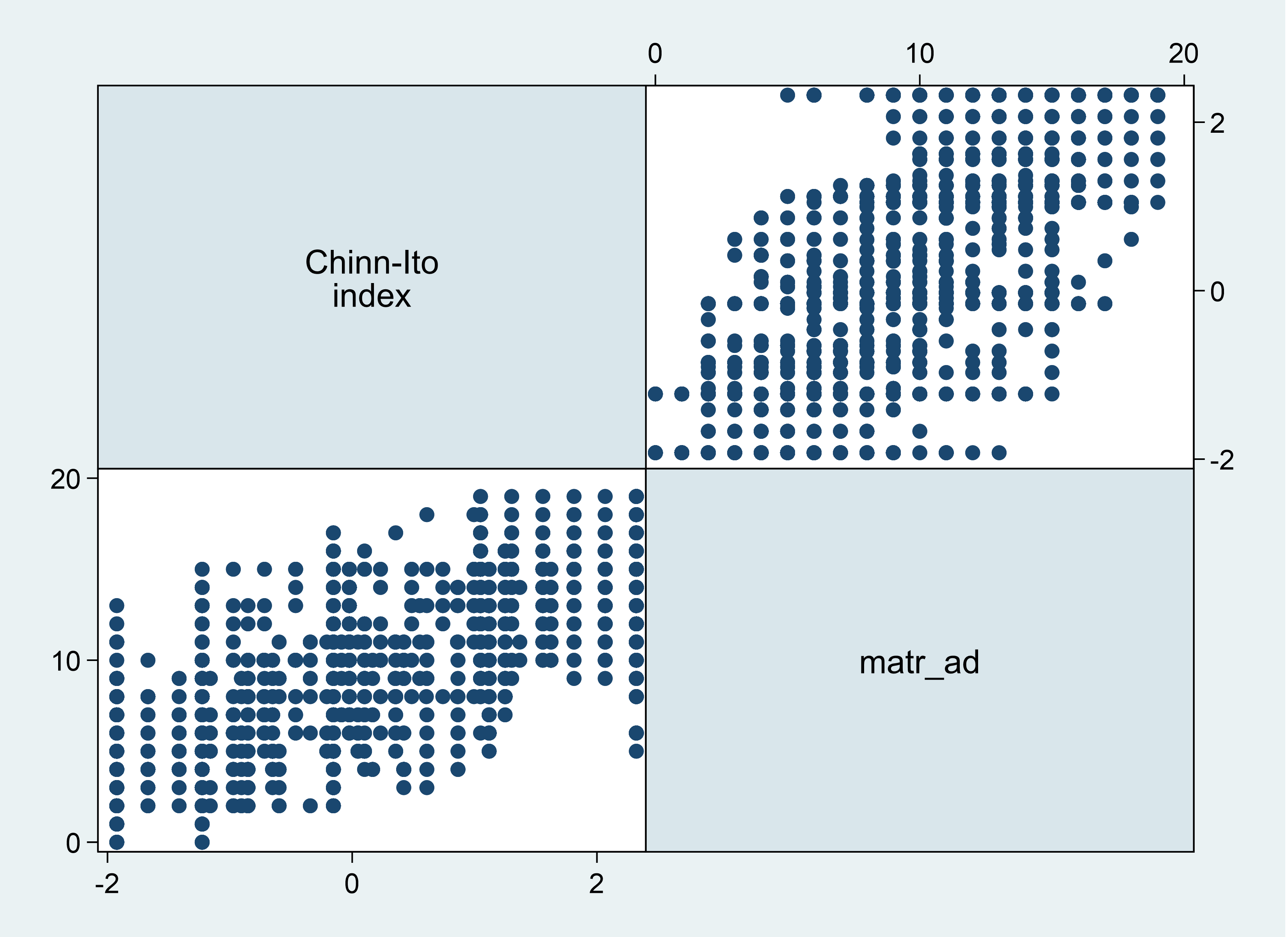

Engaged on one other venture, I discovered this attention-grabbing correlation between the IMF’s “Measure of Mixture Commerce Restrictions” (MATR) (Estafania-Flores, Furceri, Hannan, Ostry and Rose (2022)) and the Chinn-Ito (JDE 2006) measure of monetary openness (KAOPEN).

Determine 1: Chinn-Ito KAOPEN vs MATR (inverted) for Rising Market/Growing Economies (EMDEs). Larger values of every variable point out extra openness. Supply: Chinn-Ito, and MATR.

Every one unit change in KAOPEN is related to a 2.5 unit change in MATR (inverted). This estimate is comparatively unchanged (2.4, t-stat = 98) with the inclusion of time mounted results (adj-R2 = 0.69). With this diploma of correlation, it’s typically arduous to tell apart which variable is essential in a number of regression when each are included on the best hand facet (i.e., multicollinearity).

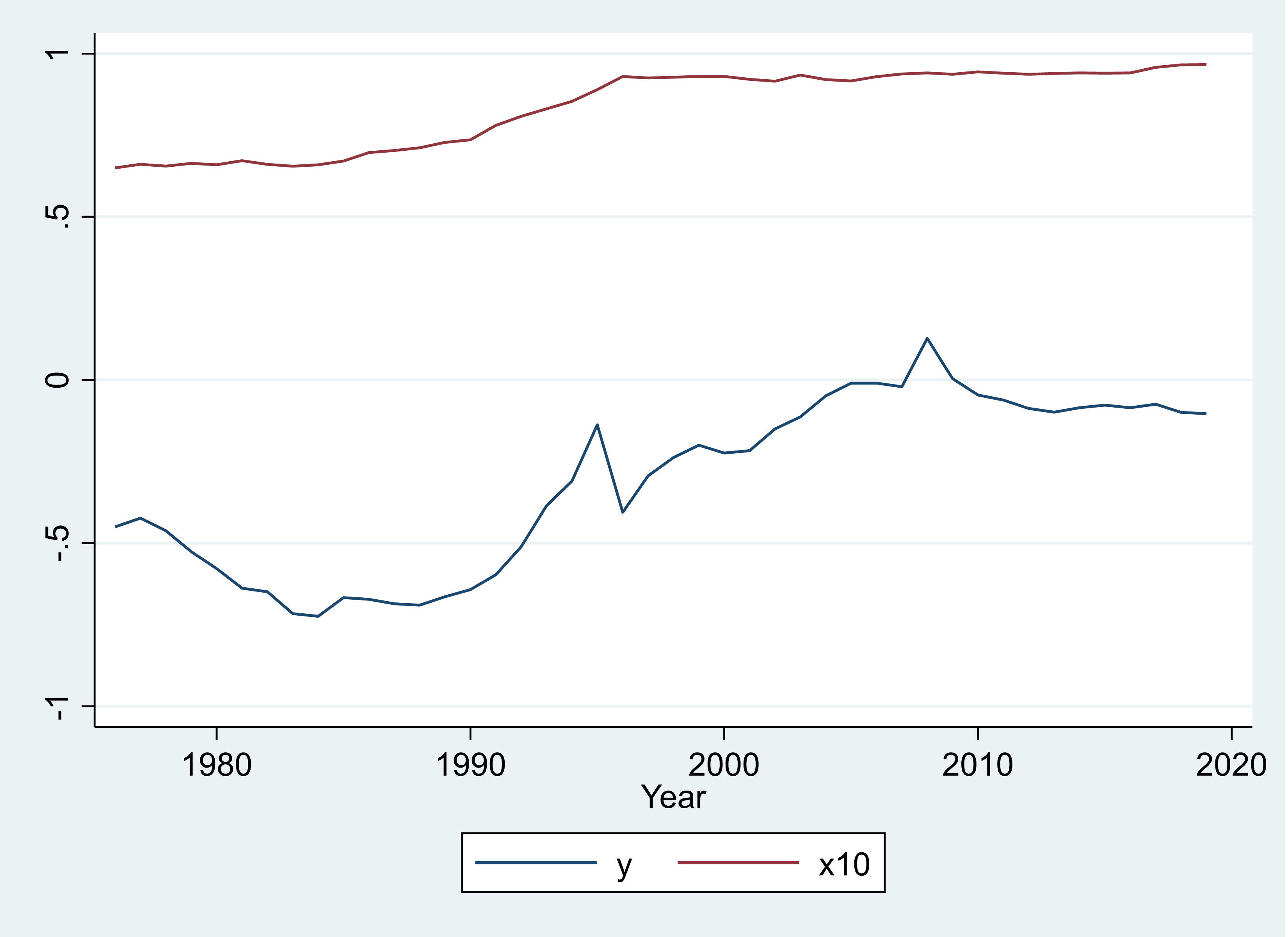

The time collection sample of the 2 variables common (cross-country) worth can also be of curiosity.

Determine 2: Y – common of Chinn-Ito KAOPEN, X10 – common MATR (inverted, divided by 10) for Rising Market/Growing Economies (EMDEs). Larger values of every variable point out extra openness. Supply: Chinn-Ito, and MATR.

[ad_2]