[ad_1]

A mixture of provide chain chaos, increased prices and considerations about working circumstances is forcing some western vogue manufacturers to rethink their decades-old dependence on factories in China.

Dieter Holzer, the previous chief govt and a board member of Marc O’Polo, stated the Swedish-German vogue model began to swap some suppliers within the nation in favour of factories in Turkey and Portugal in 2021.

The choice was meant to “stability and take out threat out of your provide chain and make it extra sustainable”, he stated. “I believe many corporations throughout the trade are reviewing their publicity [to China].”

The shift away from mass textile manufacturing within the nation, albeit nonetheless in its early levels, marks the reversal of years of outsourcing to a area that has come to dominate the textile provide chain.

Large names reminiscent of Mango and Dr Martens have just lately minimize or signalled their intention to shift manufacturing out of China or south-east Asia.

“The massive message is decreasing reliance on China,” Dr Martens’ chief govt Kenny Wilson stated in November. “You don’t need your entire eggs in a single basket.”

The bootmaker has moved 55 per cent of its whole manufacturing in another country since he took over in 2018. Simply 12 per cent of its manufacturing for the 2022 autumn/winter assortment was manufactured in China in contrast with 27 per cent in 2020 and it estimated it will drop to five per cent this yr.

“We’re being deafened by the sound of garments producers [moving] away from Asia,” stated Rosey Hurst, director of moral enterprise consultancy Impactt.

The relocation was additionally being pushed by stricter legal guidelines being launched within the US and Europe towards labour abuses, she added, following the alleged use of pressured labour within the cotton-rich territory of Xinjiang in China.

Mango’s chief govt Toni Ruiz stated in December he was contemplating shopping for much less from China “however we’ll be very alert to how issues evolve”.

“What we’re taking a look at is the extent to which all this international sourcing, developed over a few years, may develop into extra native,” he stated.

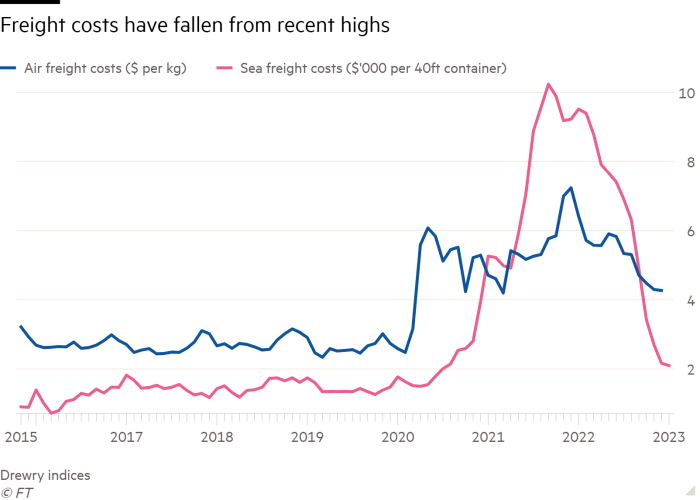

The shift was accelerated by continued provide chain disruption because the onset of the Covid-19 pandemic, which led to a bounce in freight prices, in addition to vital delivery delays as manufacturing unit staff at manufacturing hubs throughout Asia fell in poor health or had been pressured to isolate.

One trade advisor stated that one retail consumer’s ski put on, from a earlier season, arrived in the summertime of 2022.

“For a lot of, gone are the times of producing solely in China and delivery in all places,” stated Todd Simms, vice-president at provide chain intelligence platform FourKites.

“Disruptions have elevated prices to ship completed items, making it simpler to justify operations in new international locations in alternate for extra resilience,” he added.

The monetary incentives to stay within the area are diminishing as wages go up after years of low-cost labour — a serious draw for a lot of family names to outsource manufacturing to far-flung locations.

In line with statistics from China’s Nationwide Bureau of Statistics, the common manufacturing unit wage doubled between 2013 and 2021, from Rmb46,000 ($6,689) per yr to Rmb92,000.

Jose Calamonte, chief govt of on-line vogue retailer Asos, advised traders on the firm’s full-year outcomes presentation final yr that merchandise manufactured in China weren’t as aggressive as they appeared relative to Europe, as soon as delivery and transport prices had been taken into consideration.

“We strive to consider the ultimate [profit] margin as soon as we’ve made the ultimate sale,” he stated.

European clothes retailers’ efforts to chop supply occasions, as vogue developments and shopper wants change shortly, is one more reason behind their resolution to go for suppliers nearer to house.

“We’ve been taking management of our manufacturing,” stated a spokesman for a British luxurious model, including that the trade has been consolidating in Europe for years now. “This has been a development for causes to do with velocity and effectivity.”

Plans to shift manufacturing away from Asian garment hubs, nonetheless, aren’t that superior owing to their complexity. International locations reminiscent of China and Vietnam characterize the lion’s share of textile exports, in keeping with 2020 knowledge from CEPII.

For instance, greater than half of suppliers to Inditex, the world’s largest vogue retailer, had been based mostly in Asia in 2021, solely a marginal discount on 2018.

Turkey has been positioning itself as a winner from western manufacturers shifting their manufacturing, not least as a result of it’s a part of the EU customs union, permitting frictionless commerce between member states.

“It’s a in style vacation spot and already utilized by the likes of Hugo Boss, Adidas, Nike, Zara,” stated Simon Geale, govt vice-president of procurement at provide chain consultancy Proxima.

An more and more essential consideration for retailers is traceability within the provide chain after years of broadly reported labour abuses.

“[Because of US laws against cotton from Xinjiang], manufacturers must have a lot better traceability, ” stated Impactt’s Hurst.

“Then now we have bought European legal guidelines [on forced labour] arising. It’s placing stress on the trade to get a grip,” she stated.

However she warned: “There isn’t sufficient cash in [international supply chains] to run issues the way in which they need to be carried out. [Given the current economic crisis], that’s solely going to worsen.”

Maximilian Albrecht, an analyst at AlixPartners, stated that many quick vogue labels had been additionally abandoning China in an effort to differentiate themselves from Shein, the quickly rising Chinese language quick vogue big.

“European manufacturers can’t match Shein on their prices of manufacturing, their community of manufacturing, their relationships,” Albrecht stated.

“I believe you’ll see some manufacturers say ‘effectively, we are able to’t match that so we’ll transfer to Europe’. You’ll be able to nonetheless promote the story that they’ve increased high quality merchandise. Whether or not that’s really true is one other factor.”

[ad_2]