[ad_1]

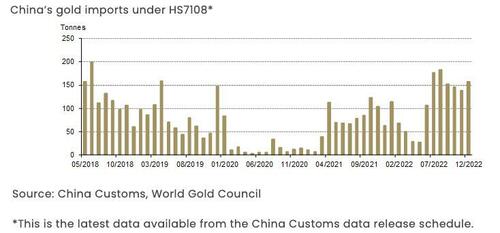

China imported 1,343 tons of gold in 2022, the best import stage since 2018. Whole gold imports for the 12 months had been up 64% over 2021.

China ranks because the world’s greatest gold shopper.

Gold demand in China picked up over the past half of the 12 months as the federal government relaxed some COVID restrictions. China imported 157 tons of gold in December to shut out a powerful H2.

The World Gold Council referred to as it “a story of two halves.”

On-and-off lockdowns in main cities through the first half suppressed native gold demand and imports. As COVID-controlling measures eased and the native gold worth premium rose to a multi-year excessive, imports through the second half jumped. “

In response to the WGC, power within the Chinese language gold market continued into January. The Shanghai-London gold worth premium charted a light rebound, placing a cease to the declining development since final October. Stronger gold demand throughout January was key.

A restoration within the Chinese language economic system after it was strangled by authorities COVID restrictions helped drive the rebound within the gold market. China skilled a COVID peak in December. In response to the World Gold Council, Chinese language financial actions revived in January. That drove a growth within the gold market.

In response to the China Gold Affiliation, through the 15-day interval from the Chinese language New 12 months day to the Spring Lantern Pageant, Chinese language gold consumption was up by 18% year-on-year.

Gold withdrawals from the Shanghai Gold Change totaled 140 tons in January. That was a modest month-on-month decline of two tons and 25% decrease than January 2022. However the decrease quantity was primarily because of the 2023 Chinese language New 12 months vacation that restricted January to only 16 buying and selling days. That was the fewest since 2012. When put next with earlier Chinese language New 12 months months, January’s withdrawal complete was 12% larger than the 10-year common.

As we’ve reported, the Folks’s Financial institution of China resumed official gold purchases in November. That continued into January, with the Chinese language central financial institution including one other 15 tons to its reserves. Gold now accounts for 3.7% of China’s complete reserves.

The Chinese language central financial institution gathered 1,448 tons of gold between 2002 and 2019, after which immediately went silent. Many speculate that the Chinese language continued so as to add gold to its holdings off the books throughout these silent years.

There has at all times been hypothesis that China holds way more gold than it formally reveals. As Jim Rickards identified on Mises Day by day again in 2015, many individuals speculate that China retains a number of thousand tons of gold “off the books” in a separate entity referred to as the State Administration for International Change (SAFE).

If this obvious rebound within the Chinese language gold market continues into 2023, it would drive general world gold demand larger. Gold demand grew by 18% to 4,741 tons in 2022, the best demand in 11 years.

Loading…

[ad_2]