[ad_1]

After final week’s monetary turmoil, however earlier than the CS/UBS deal, actual charges and inflation breakevens have been down, whereas threat and uncertainty indicators have been up.

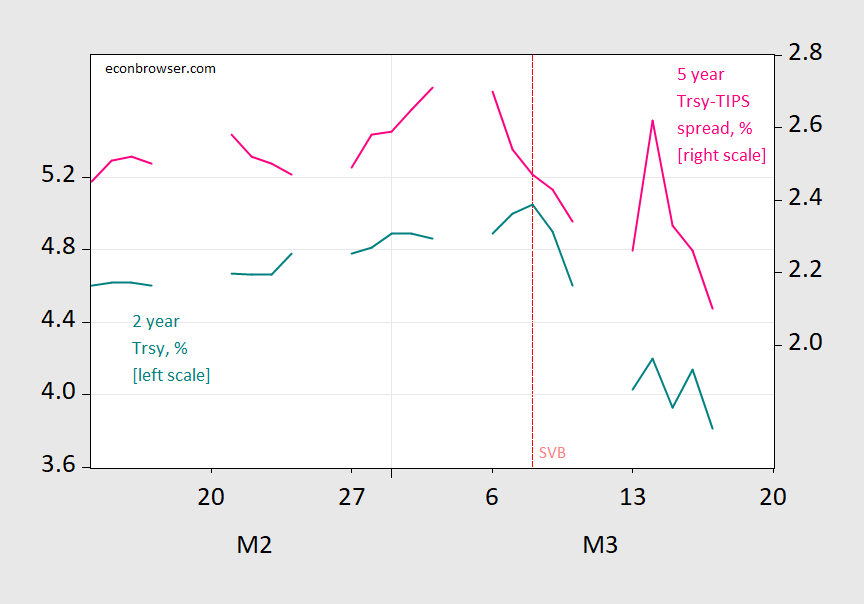

Determine 1: Two 12 months Treasury yield (teal, left scale), and 5 12 months Treasury-TIPS breakeven (pink, proper scale), each in %. Supply: Treasury by way of FRED, and creator’s calculations.

Word that the nominal Treasury yield has fallen as anticipated inflation (ignoring threat and liquidity premia). Word that 5 12 months TIPS have fallen about half a share level because the SVB drama unfolded.

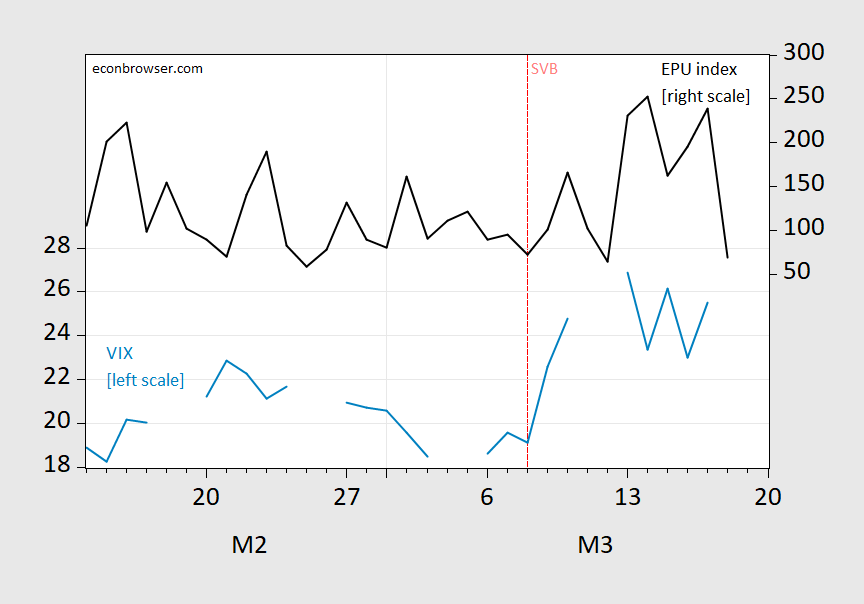

Determine 2: VIX (sky blue, left scale), and Financial Coverage Index (black, proper log scale). Supply: CBOE by way of FRED, policyuncertainty.com.

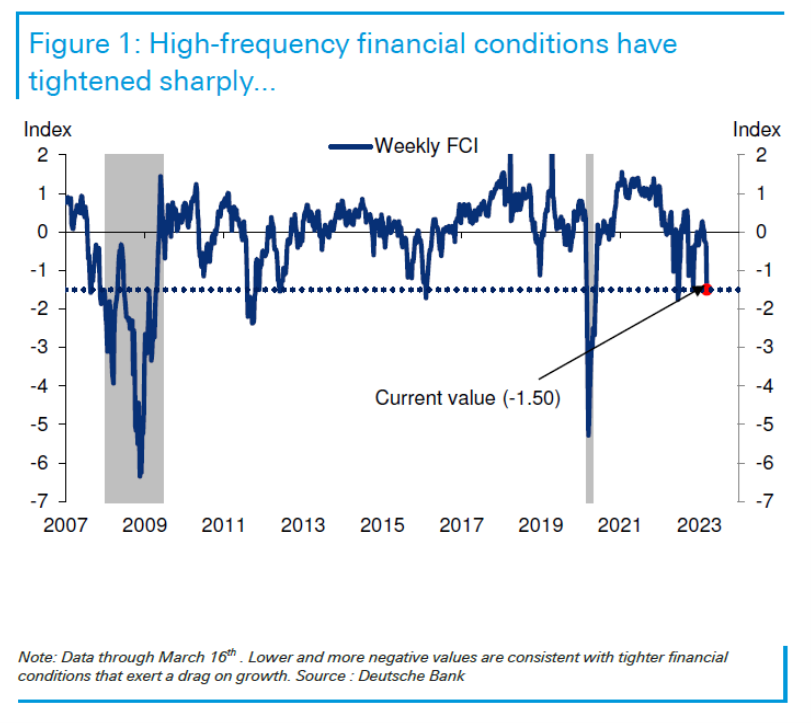

Monetary circumstances have tighted significantly, a lot in order that the market has delivered what the Fed would possibly’ve by funds charge will increase. From DB, Friday, for information by the sixteenth.

Supply: DB, The place’s the stress? 17 March 2023.

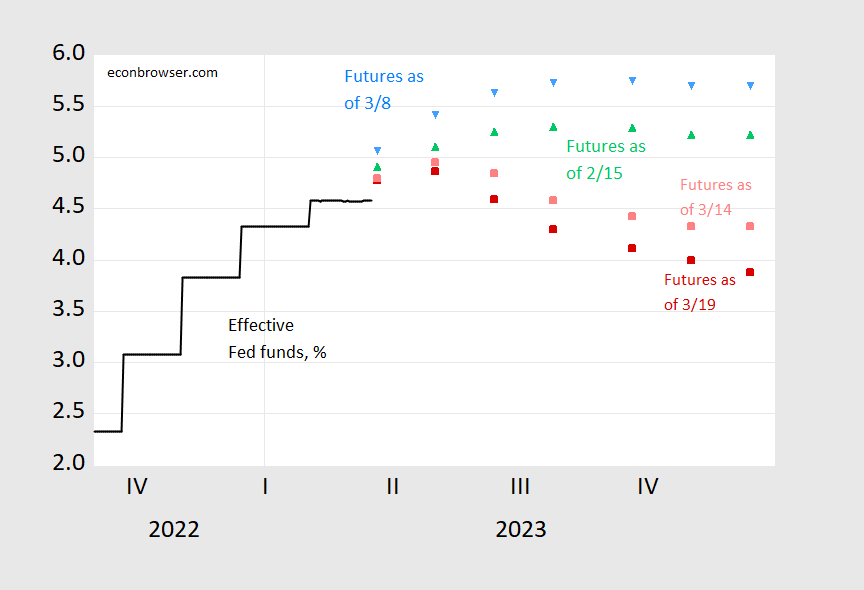

And certainly, the Fed funds path as perceived by the market is now downshifted.

Determine 3: Efficient Fed funds (black), implied Fed funds as of March 19 4:30CT (pink sq.), March 14, 1:30 CT (pink sq.), March 8 (sky blue inverted triangle), and February 15 (inexperienced triangle). Supply: Fed by way of FRED, CME Fedwatch and creator’s calculations.

Implied Fed funds year-end charges now 1.8 ppts decrease than they have been 11 days in the past…

[ad_2]